- 10 Marks

Question

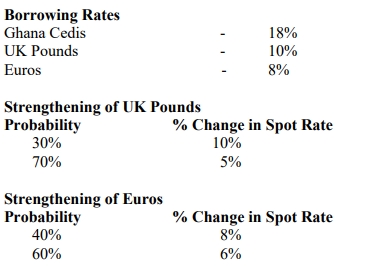

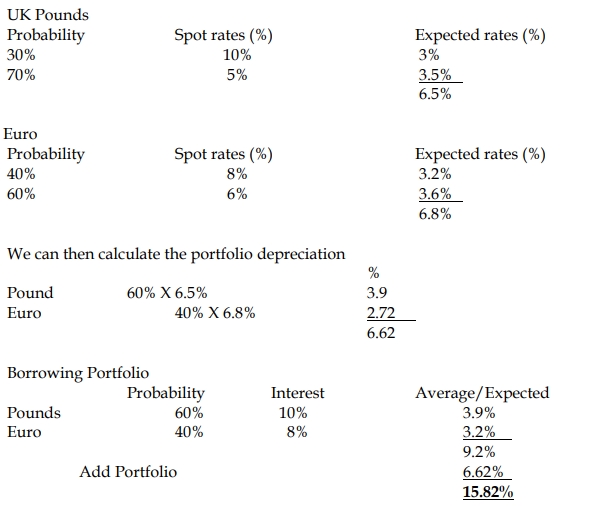

Edi Ltd, based in Accra, Ghana, is a multinational company with two wholly-owned subsidiaries: Gil Plc based in Nigeria and Zep Ltd based in South Africa. Until recently, the Edi group has been doing well, returning a stable level of dividends to its shareholders. The financial performance of the Edi group has dipped in the past two years. In the last quarter of last year, the directors approved the establishment of a central treasury department based at the group’s headquarters in Accra. It is believed that the central treasury function will help boost effectiveness and efficiency in the group’s liquidity management, currency risk management, dividend remittances, and borrowing.

Intragroup Currency Transfers:

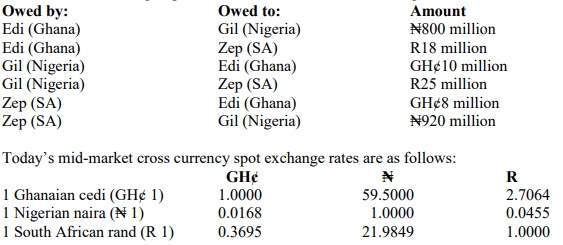

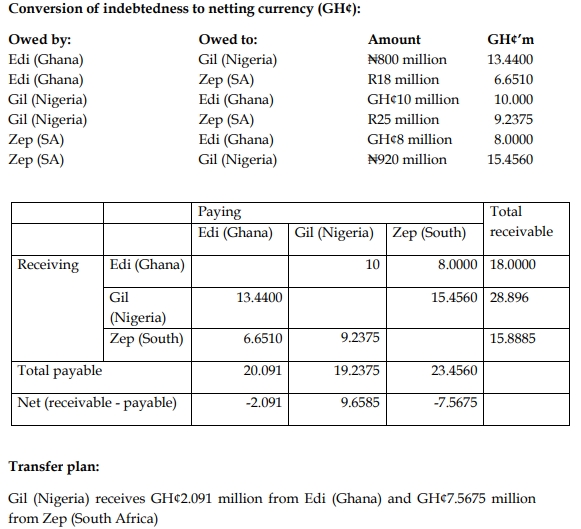

There are a lot of intragroup credit transactions that are often settled independently between the parties involved. This year, the treasury department has been tasked to manage the settlement of intragroup indebtedness through netting to reduce the volume of currency transactions. It has been agreed that all settlements will be made in the Ghanaian cedi at the prevailing spot mid-market exchange rate.

Below is a list of intragroup indebtedness at the end of the first quarter to be settled today:

Required:

i) Suppose the currency netting is implemented. Calculate the intragroup company currency transfers that will be required for settlement by each member of the Edi group.

(6 marks)

ii) Suppose the treasury department is recommending the use of currency futures to hedge net currency exposures. Discuss the advantages and disadvantages of the Edi group using currency options instead of currency futures in hedging net currency exposures.

Answer

i) Intragroup Currency Netting Calculation

Step 1: Convert All Amounts to Ghanaian Cedis (GH¢)

ii) Advantages and Disadvantages of Using Currency Options vs Futures for Hedging

Advantages of Currency Options

- Flexibility: Options provide the flexibility to choose whether to exercise the contract. If exchange rates move favorably, the company can benefit from the upside while limiting its downside risk.

- Limited Risk: With options, the maximum loss is limited to the premium paid, which is not the case with futures where losses can be unlimited.

Disadvantages of Currency Options

- Premium Costs: Options require the payment of an upfront premium, which can be costly and reduce profitability.

- Complexity: Currency options may involve complex pricing and strategies that can be difficult to manage, especially if volatility affects the premiums.

- Topic: The role of the treasury function in multinationals

- Series: MAY 2019

- Uploader: Theophilus