- 10 Marks

Question

The government of Ghana has been borrowing in the international financial market by issuing “Eurobonds” to finance projects in Ghana. There has been a keen debate on the borrowing by the government.

Required:

i) As a Finance Officer, explain what Eurobond is all about. (3 marks)

ii) Identify THREE advantages that have been cited for the government using Eurobonds. (3 marks)

iii) Evaluate FOUR problems associated with the use of international borrowing, especially Eurobonds in Ghana. (4 marks)

Answer

i) Explanation of Eurobond:

A Eurobond is a bond that is issued in a currency other than the home currency of the country or market in which it is issued. These bonds are often used by governments or corporations to raise funds in international capital markets. Eurobonds are usually bearer bonds, meaning they are unregistered, and their ownership is determined by possession. This makes them attractive to global investors seeking anonymity and liquidity. Eurobonds can be denominated in any currency, and they are often issued by international syndicates of financial institutions. They provide issuers access to a broader pool of investors than domestic bonds.

(3 marks)

ii) Advantages of Using Eurobonds:

- Access to International Capital:

By issuing Eurobonds, the government of Ghana can access a much larger pool of international investors and raise funds at potentially lower interest rates compared to borrowing from local markets. - Favorable Regulatory Conditions:

Eurobonds are not subject to the taxes and regulations of a single country, making them attractive for issuers who wish to avoid the complexities of domestic borrowing laws and regulations. - Currency Matching:

Eurobonds allow governments to issue bonds in foreign currencies, which can be useful when matching foreign currency revenues to debt payments, reducing currency mismatch risks.

(Any 3 points for 3 marks)

iii) Problems Associated with International Borrowing (Eurobonds):

- Currency Risk:

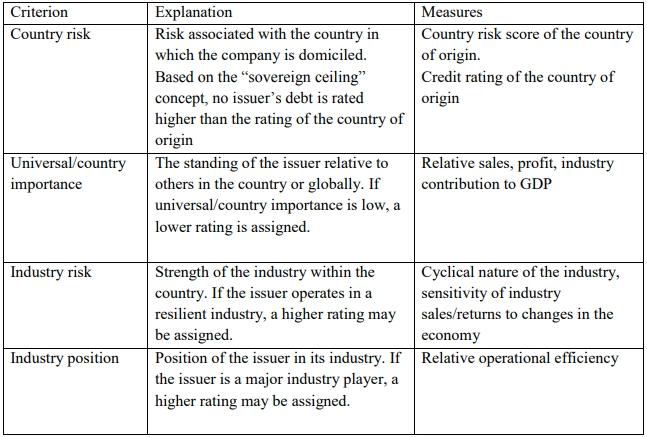

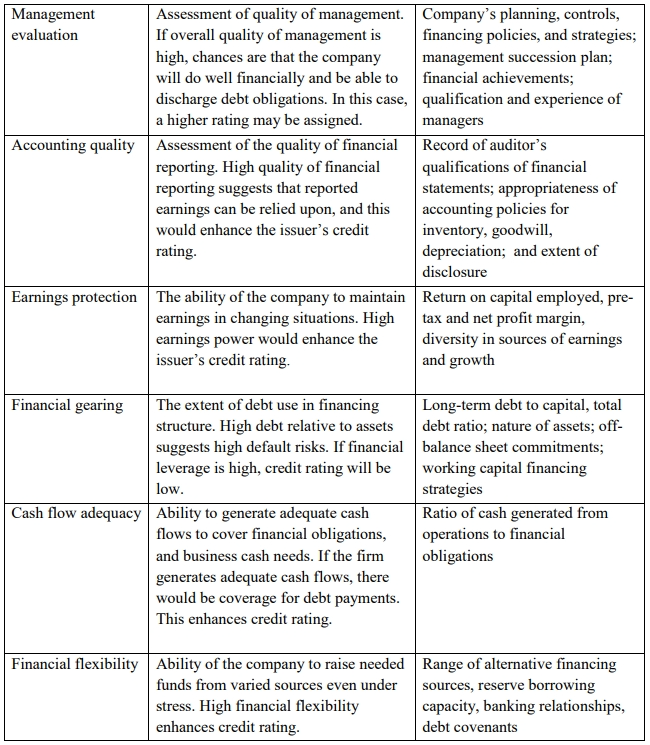

When a country like Ghana issues Eurobonds in a foreign currency, it faces significant currency risk. If the Ghanaian cedi depreciates against the currency in which the bond is issued, the cost of repaying the bond will increase, placing a heavy burden on government finances. - High Interest Costs:

Borrowing through Eurobonds can result in higher interest payments if the bonds are issued at higher rates due to the perceived risk of lending to Ghana. This can increase the government’s debt servicing costs over time. - Credit Rating Risk:

The ability to issue Eurobonds depends heavily on Ghana’s credit rating. If Ghana’s credit rating deteriorates, it may face higher interest rates or even find itself unable to access international markets in the future. - Vulnerability to Global Market Fluctuations:

International borrowing exposes Ghana to global economic and financial market volatility. Events such as global financial crises or rising interest rates in developed markets can increase borrowing costs or limit access to new debt issuance.

(Any 4 points for 4 marks)

- Tags: Eurobonds, Government Finance, International borrowing, Risk Management

- Level: Level 3

- Topic: Sources of finance and cost of capital

- Series: MAY 2017

- Uploader: Dotse