- 10 Marks

Question

Odapagyan Foods Ltd is borrowing GH¢500,000 to finance a project involving an expansion of its existing factory. It has obtained an offer from Sika Bank. The terms of the loan facility are as follows:

- Annual interest rate: 22%

- Duration: 2 years

- Interest method: compound interest with quarterly compounding

- Payment plan: equal installments at the end of each quarter

Required:

i) Compute the quarterly installment.

(3 marks)

ii) Prepare a loan amortization schedule to show the periodic interest charges, installment payments, principal payments, and balance of the loan at the end of each quarter.

(7 marks)

Answer

i) Calculation of Quarterly Installment:

The present value of the payments, PVAn = Loan principal = GH¢500,000

Annual interest, i = 22%

Frequency, m = 4

Term (in years), t = 2

Number of periods, n = Term x Frequency = 2 x 4 = 8

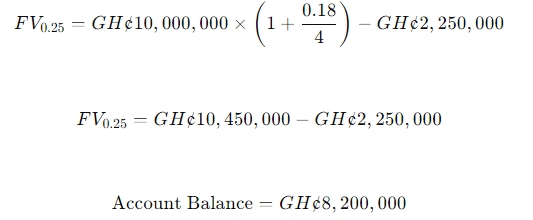

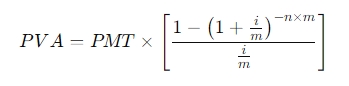

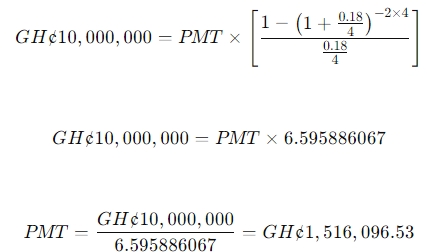

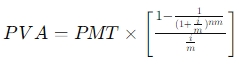

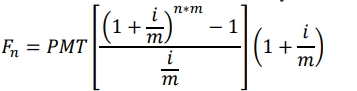

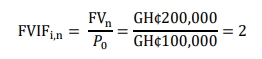

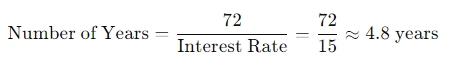

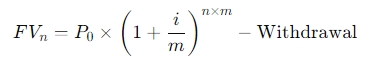

The formula for the present value of an annuity (PVA) is:

Plugging in the values:

Thus, the quarterly installment is GH¢78,932.01.

(3 marks)

ii) Amortization Schedule:

| Period | Interest (GH¢) | Installment (GH¢) | Principal Repayment (GH¢) | Outstanding Balance (GH¢) |

|---|---|---|---|---|

| 0 | – | – | – | 500,000.00 |

| 1 | 27,500.00 | 78,932.01 | 51,432.01 | 448,567.99 |

| 2 | 24,671.24 | 78,932.01 | 54,260.77 | 394,307.23 |

| 3 | 21,686.90 | 78,932.01 | 57,245.11 | 337,062.12 |

| 4 | 18,538.42 | 78,932.01 | 60,393.59 | 276,668.53 |

| 5 | 15,216.77 | 78,932.01 | 63,715.24 | 212,953.29 |

| 6 | 11,712.43 | 78,932.01 | 67,219.57 | 145,733.72 |

| 7 | 8,015.35 | 78,932.01 | 70,916.65 | 74,817.07 |

| 8 | 4,114.94 | 78,932.01 | 74,817.07 | – |

(7 marks)

- Topic: Simple interest and compound interest

- Series: MAY 2020

- Uploader: Theophilus

Where:

Where: