- 20 Marks

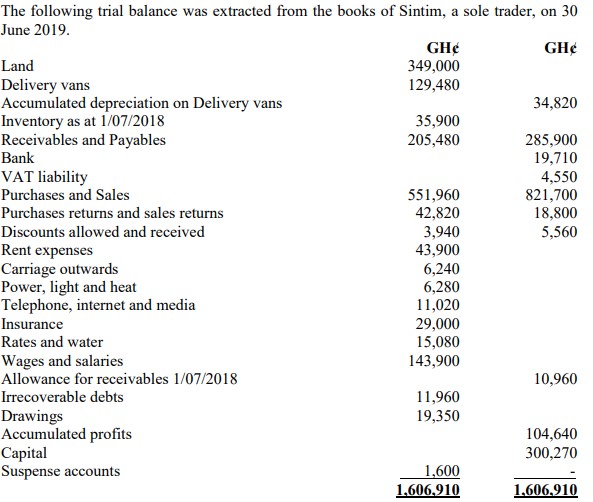

Question

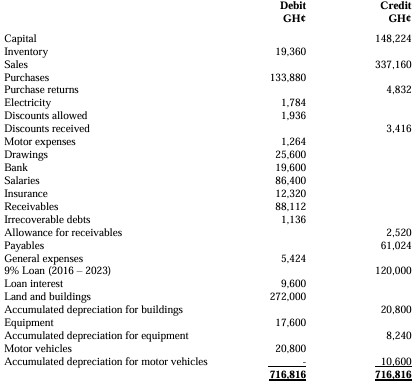

Kontiba Enterprise

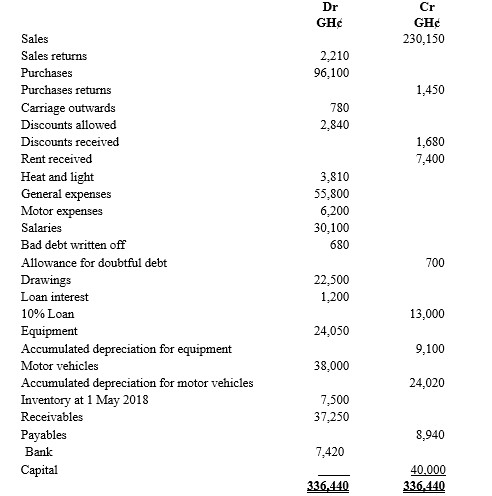

Statement of Profit or Loss for the year ended 30 September 2023

The following information is also available:

1) Only 10 months’ salaries are shown in the Trial Balance. An equal amount is paid for

salaries for each month of the year.

2) As at 30 September 2023, GH¢2,560 had been prepaid for insurance, whilst GH¢328 was

owing for general expenses.

3) GH¢3,680 had been charged to general expenses for the owner’s private holiday.

4) As at 30 September 2023, inventory was valued at GH¢18,000.

5) A customer, owing GH¢4,032 has been declared bankrupt. This amount is to be written

off in full.

6) An allowance for receivables is to be maintained at 3% of the receivables balance.

7) As at 30 September 2023, the business’s land was valued at GH¢80,000. Land is not

depreciated.

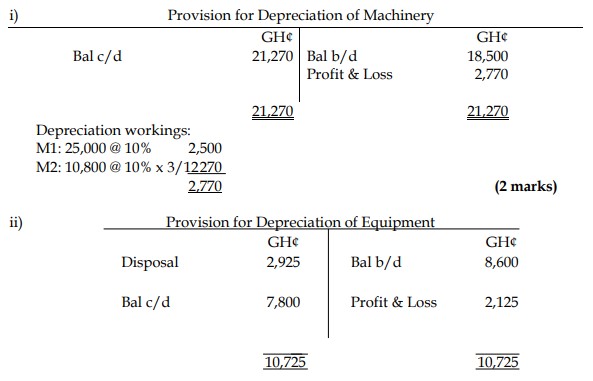

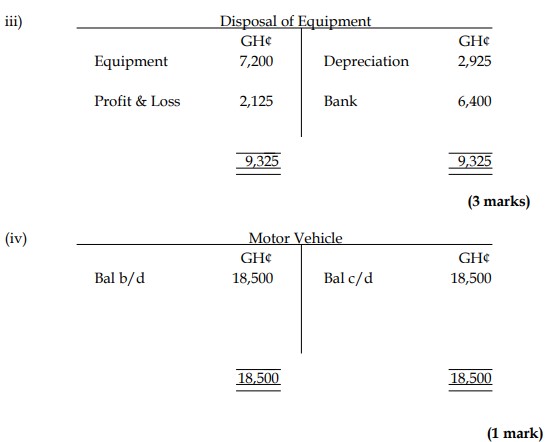

8) Depreciation is to be provided as follows:

Buildings: 4% per annum using the straight line method.

Equipment: 25% per annum using the straight line method.

Page 7 of 20

Motor vehicles: 40% per annum using the reducing balance method.

9) There were no additions or disposals of non-current assets during the financial year.

Required:

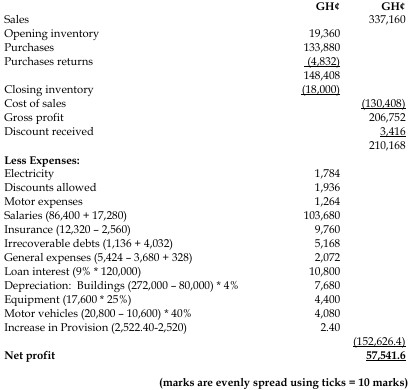

i) Prepare the statement of profit or loss for the year ended 30 September 2023. (10 marks)

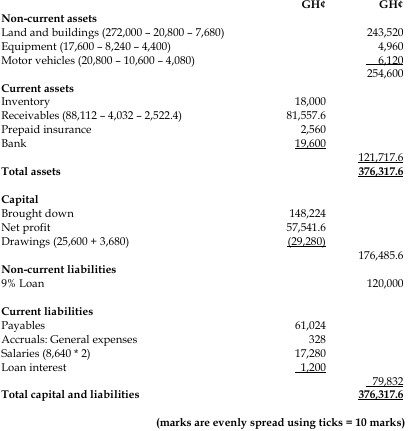

ii) Prepare the statement of financial position as at 30 September 2023. (10 marks)

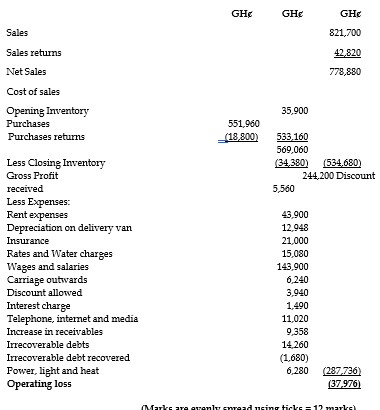

Answer

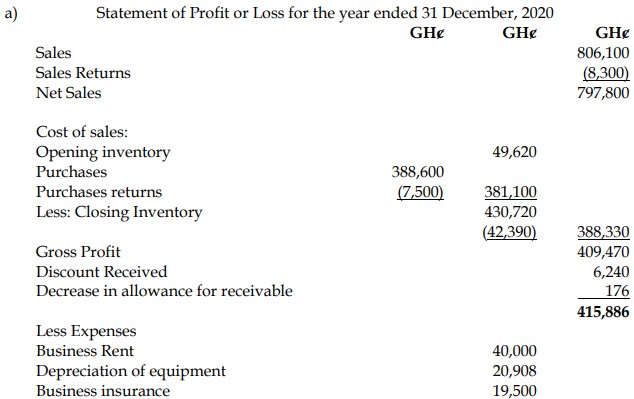

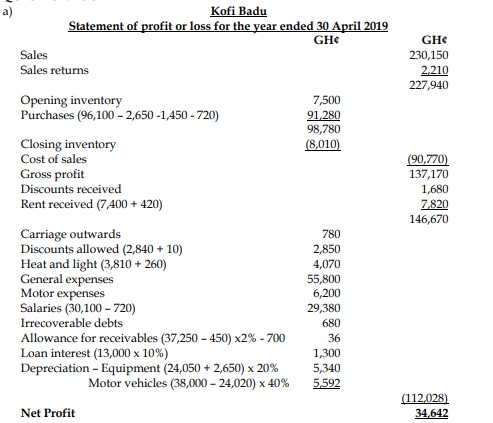

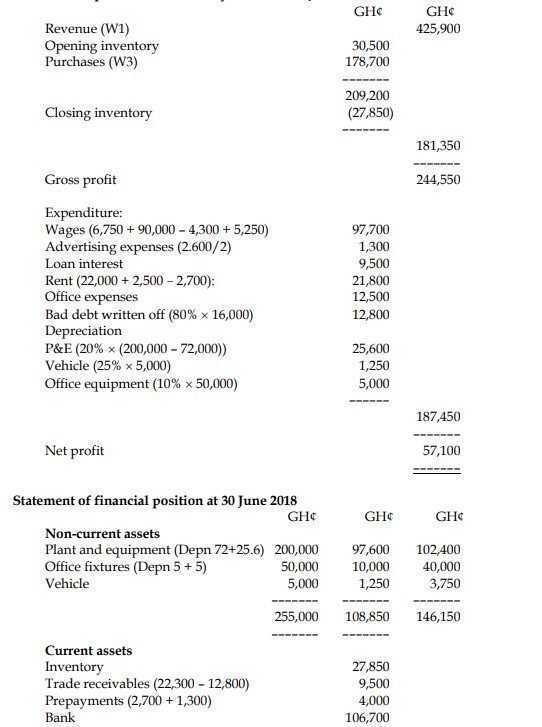

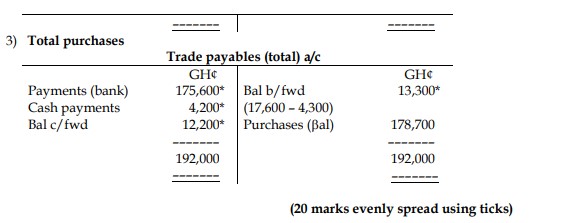

a) Kontiba Enterprise

Statement of Profit or Loss for the year ended 30 September 2023

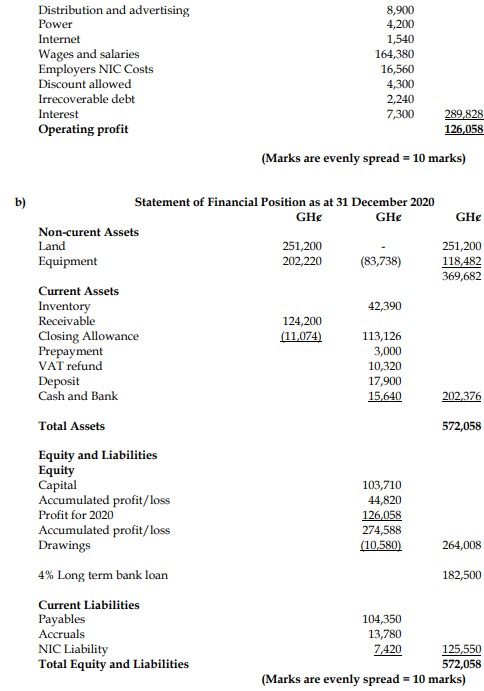

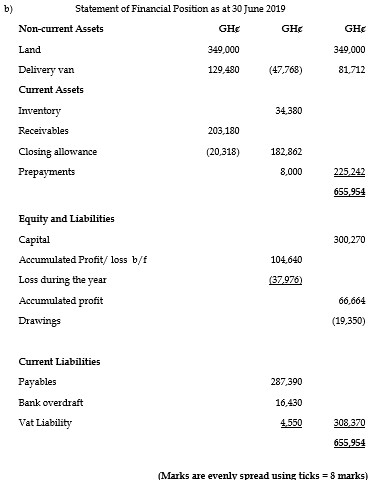

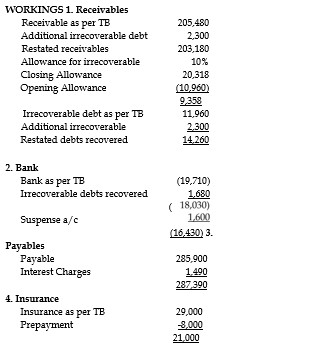

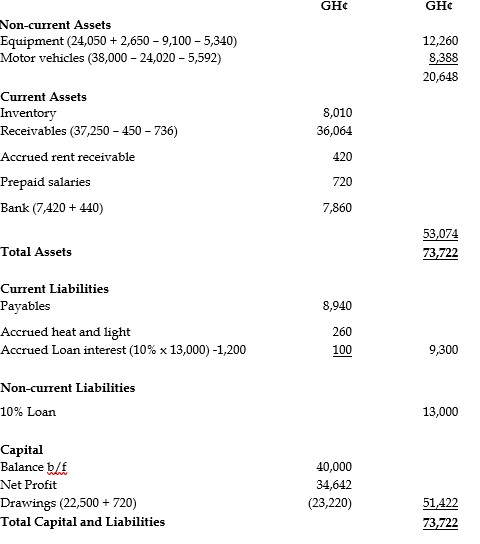

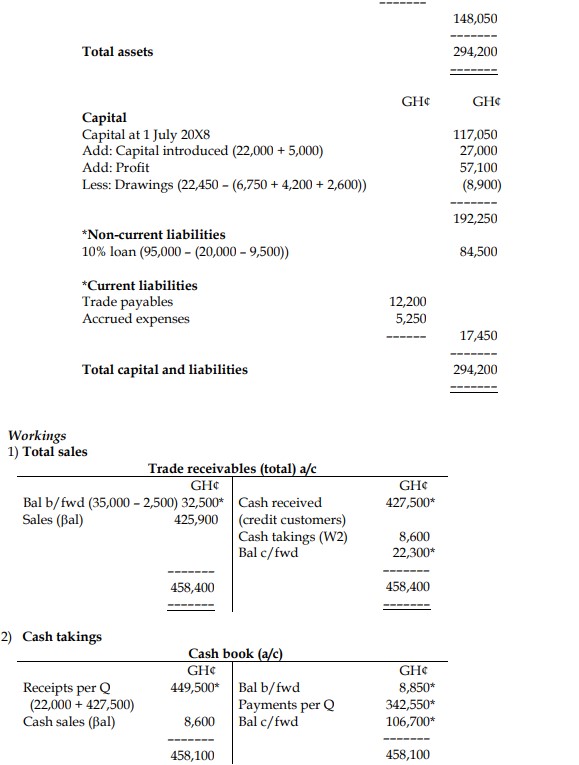

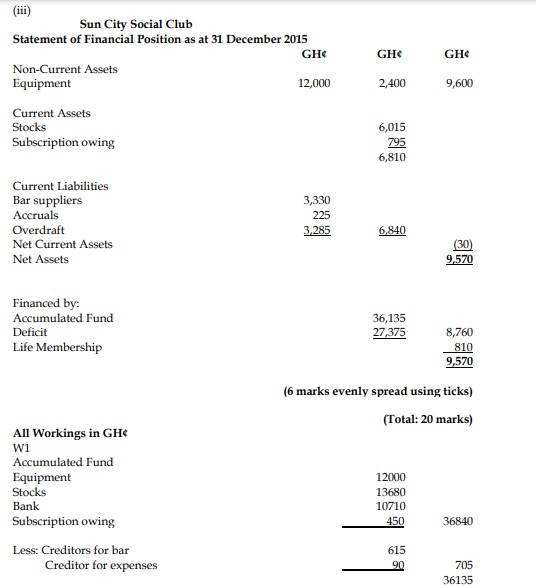

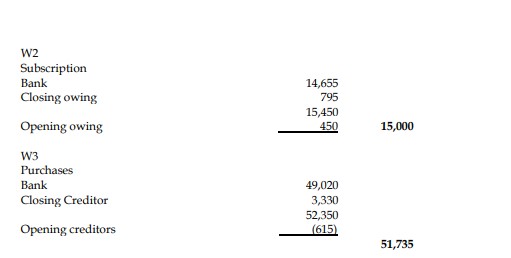

b) Kontiba Enterprise

Statement of Financial Position as at 30 September 2023

- Tags: Adjustments, Balance Sheet, Depreciation, Financial Position, Income Statement, Net Profit

- Level: Level 1

- Uploader: Theophilus