- 20 Marks

Question

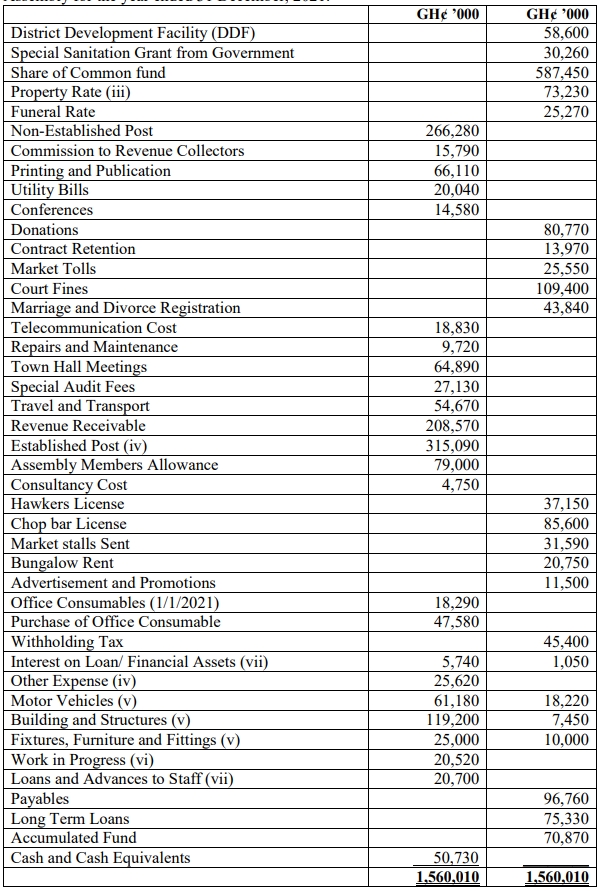

a) The following details relate to Eminaa District Assembly for the year 2018.

| Details | GH¢’000 |

|---|---|

| Dividend Received | 93,250 |

| Central Government Salaries | 12,000,000 |

| Basic Rates | 370,900 |

| Districts Development Facility | 15,000,600 |

| Rent from Land and Building | 6,120,800 |

| Established Posts | 1,140,700 |

| Other Expenditure | 600,000 |

| Non-Established Posts | 580,000 |

| Allowances | 390,470 |

| Court Fees | 240,000 |

| Inventory and Consumables | 800,000 |

| Sanitation Fees | 370,000 |

| General Cleaning | 350,000 |

| Common Fund | 2,930,000 |

| Social Benefit | 840,300 |

| Equity Investment Acquired | 420,000 |

| Infrastructure, Plant, and Equipment | 980,000 |

| Work-In-Progress | 490,000 |

| Loans Received | 2,330,000 |

| Interest Expense | 200,000 |

| Advances to Staff | 660,000 |

| Royalties | 430,000 |

| Consultancies cost | 470,000 |

| Training and Workshop cost | 275,000 |

| Transport and Travelling cost | 620,000 |

| Consumption of Fixed Assets | 960,000 |

| Special Services | 820,000 |

| Utilities | 630,000 |

| Market Tolls | 870,000 |

| Permit Fees | 990,000 |

| Fines and Penalties | 330,000 |

| Development Bonds Issued | 1,300,000 |

| Hostel License | 630,920 |

| Business Income | 2,300,600 |

| Chop Bar License | 300,400 |

| Proceeds from Sale of Equity | 990,320 |

| Accumulated Fund (1/1/2018) | 370,600 |

| Herbalist License | 530,370 |

| Cash and Cash Equivalent @ (1/1/2018) | 12,300,240 |

| Stool Land Revenue | 600,000 |

| Lorry Park Fees | 720,400 |

| Market Store Rent | 300,750 |

| Recoveries | 194,000 |

| Loan Repayment | 143,000 |

| Property Rate | 820,900 |

Additional Information:

- Eminaa District Assembly adopts the accrual basis of accounting in the preparation of its financial statements.

- Established Post salaries outstanding as at 31/12/2018 were GH¢180,000,000.

- Inventory at 31/12/2018 was GH¢170,000,000.

Required:

Prepare for Eminaa District Assembly:

- Statement of Financial Performance for the year ended 31/12/2018.

(7 marks)

b) Prepare a statement of cash flow for Eminaa District Assembly for the year ended 31/12/2018. (8 marks)

c) Subject to IPSAS 6: Consolidated and Separate Financial Statements, a Controlling Entity that presents Consolidated Financial Statements shall disclose certain basic information.

Explain FIVE (5) basic information that an institution preparing Consolidated Financial Statements needs to disclose. (5 marks)

Answer

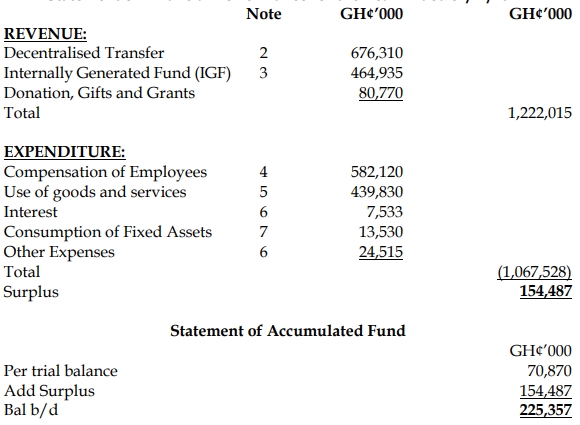

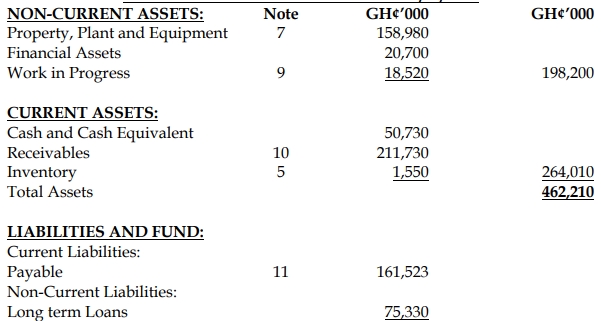

a) Statement of Financial Performance:

EMINAA DISTRICT ASSEMBLY

STATEMENT OF FINANCIAL PERFORMANCE FOR THE YEAR ENDED 31ST DECEMBER 2018

| Revenue | GH¢’000 |

|---|---|

| Decentralized Transfers | 30,530,600 |

| Internally Generated Funds (IGF) | 14,888,920 |

| Total Revenue | 45,419,520 |

| Expenditure | GH¢’000 |

|---|---|

| Compensation of Employees | 2,291,170 |

| Goods and Services | 3,520,000 |

| Consumption of Fixed Capital | 960,000 |

| Interest | 200,000 |

| Social Benefits | 840,300 |

| Other Expenditure | 600,000 |

| Total Expenditure | 8,411,470 |

| Net Operating Result – Surplus | 37,008,050 |

Notes:

- Decentralized Transfers:

- Government of Ghana Salaries: GH¢12,000,000

- District Development Facility: GH¢15,000,600

- Common Fund: GH¢2,930,000

- Stool Land Revenue: GH¢600,000

- Total: GH¢30,530,600

- Internally Generated Funds (IGF):

- Basic Rates: GH¢370,900

- Rent from Land and Building: GH¢6,120,800

- Court Fees: GH¢240,000

- Royalties: GH¢430,000

- Market Tolls: GH¢870,000

- Market Store Rent: GH¢300,750

- Permit Fees: GH¢990,000

- Fines and Penalties: GH¢330,000

- Hostel License: GH¢630,920

- Business Income: GH¢2,300,600

- Chop Bar License: GH¢300,400

- Dividend Received: GH¢93,250

- Herbalist License: GH¢530,370

- Property Rate: GH¢820,900

- Sanitation Fees: GH¢370,000

- Lorry Park Fees: GH¢720,400

- Total: GH¢14,888,920

- Compensation of Employees:

- Established Posts: GH¢1,320,700 (including GH¢180,000 outstanding)

- Non-Established Posts: GH¢580,000

- Allowances: GH¢390,470

- Total: GH¢2,291,170

- Goods and Services:

- Inventory and Consumables: GH¢630,000 (GH¢800,000 – GH¢170,000)

- General Cleaning: GH¢350,000

- Consultancies Cost: GH¢470,000

- Training and Workshop Cost: GH¢275,000

- Transport and Travelling Cost: GH¢620,000

- Special Services: GH¢820,000

- Utilities: GH¢630,000

- Total: GH¢3,520,000

b) Statement of Cash Flow:

ELMINA DISTRICT ASSEMBLY

STATEMENT OF CASH FLOW FOR THE YEAR ENDED DECEMBER 31, 2018

| Description | Amount (GH¢’000) | Amount (GH¢’000) |

|---|---|---|

| Cash Flow from Operating Activities | ||

| Inflows | ||

| Decentralised transfer | 30,530,600 | |

| Internally generated fund | 14,888,920 | |

| Total Inflows | 45,419,520 | |

| Outflows | ||

| Compensation of employees | 2,111,170 | |

| Goods and services | 3,690,000 | |

| Interest | 200,000 | |

| Social Benefits | 840,300 | |

| Other expenditure | 600,000 | |

| Total Outflows | 7,441,470 | |

| Net cash flow from operating activities | 37,978,050 | |

| Net Cash Flow from Investing Activities | ||

| Equity investment acquired | (420,000) | |

| Infrastructure, plant and equipment | (980,000) | |

| Work-in-progress | (490,000) | |

| Advanced to staff | (660,000) | |

| Sale of equity | 990,320 | |

| Recoveries | 194,000 | |

| Net Cash Flow from Investing Activities | (1,365,680) | |

| Cash Flow from Financing Activities | ||

| Development bonds issued | 1,300,000 | |

| Loans received | 2,330,000 | |

| Loan repayment | (143,000) | |

| Net Cash Flow from Financing Activities | 3,487,000 | |

| Net increase in Cash and Cash equivalent | 40,099,370 | |

| Cash and cash equivalent (1/1/2018) | 12,300,240 | |

| Cash and cash equivalent (31/12/2018) | 52,399,610 |

c) Basic Disclosures in Consolidated Financial Statements:

The following disclosures shall be made in consolidated financial statements:

- A list of significant controlled entities: This includes a summary of entities over which control is exercised.

- The fact that a controlled entity is not consolidated: As required by IPSAS 6, reasons for not consolidating a controlled entity should be disclosed.

- Summarized financial information of controlled entities not consolidated: This includes details such as total assets, liabilities, revenues, and surplus or deficit for unconsolidated entities.

- The name and explanation for control: Any controlled entity where the controlling entity holds 50% or less ownership interest should be disclosed with reasons for control.

- Significant restrictions on the ability of controlled entities: Any limitations on transferring funds to the controlling entity in the form of cash dividends or similar distributions should be disclosed.

- Uploader: Joseph