- 20 Marks

Question

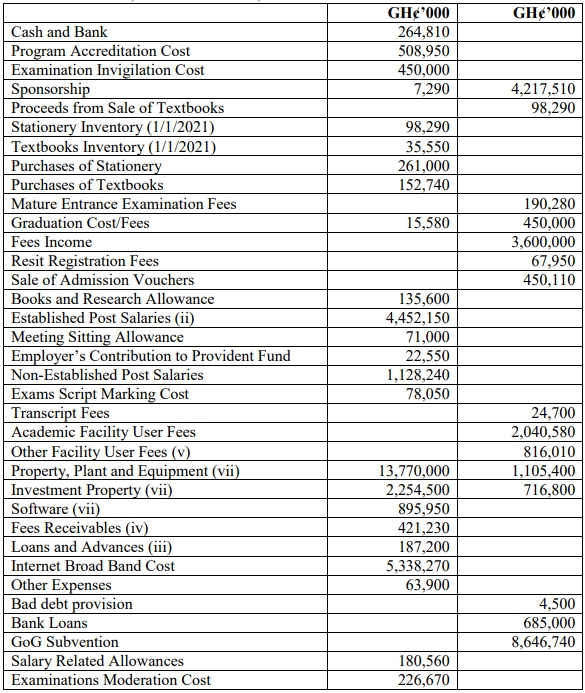

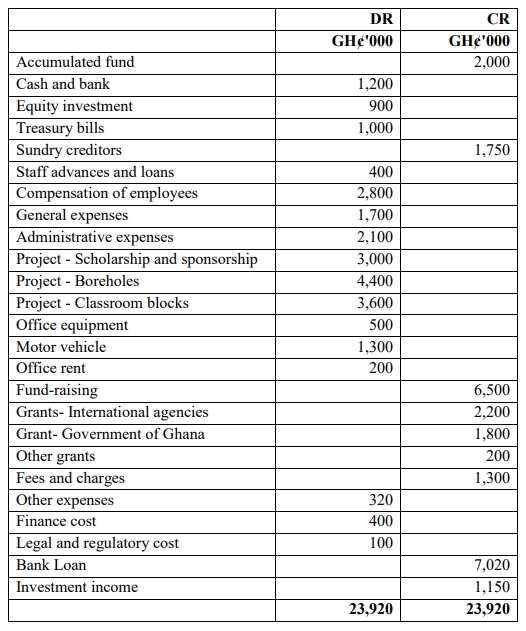

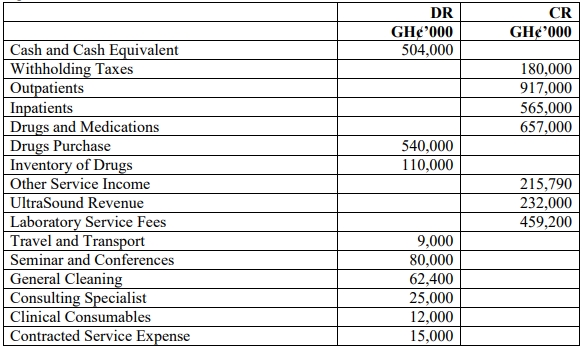

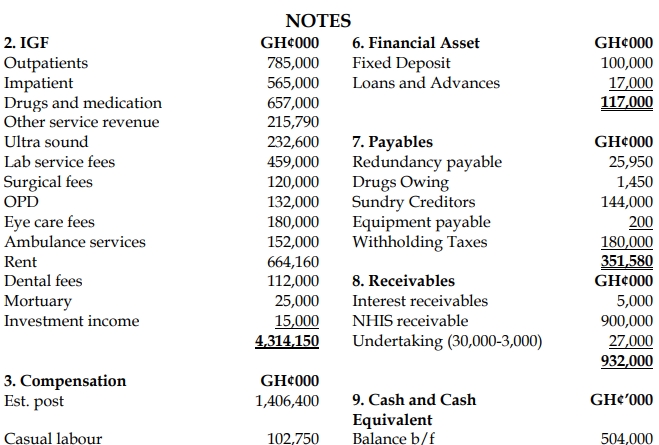

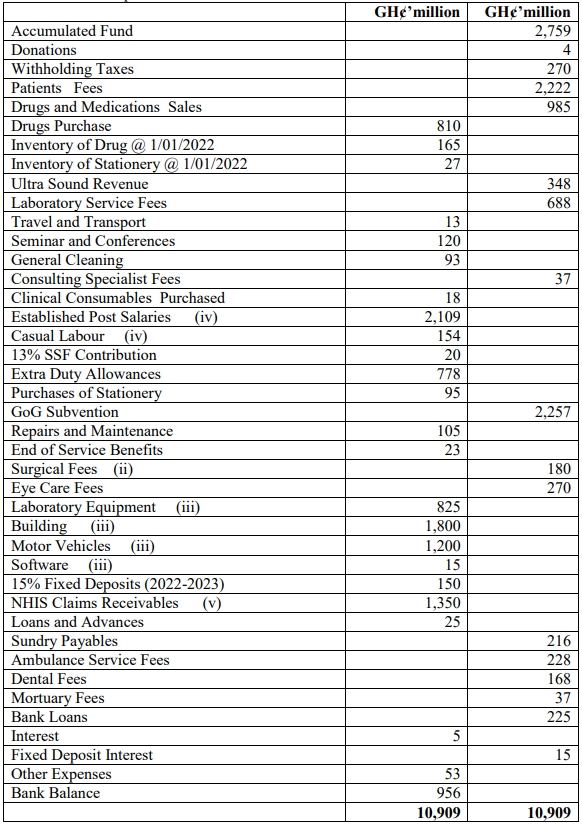

Ayigya Central Hospital is a Public Hospital established in the Ashanti Region, which serves several communities in the Municipalities. Its Trial Balance for the year ended 31 December 2022 is provided below:

Additional information:

- Inventory as at 31 December 2022 consists of Drugs and Stationery amounting to GH¢50 million and GH¢20 million respectively.

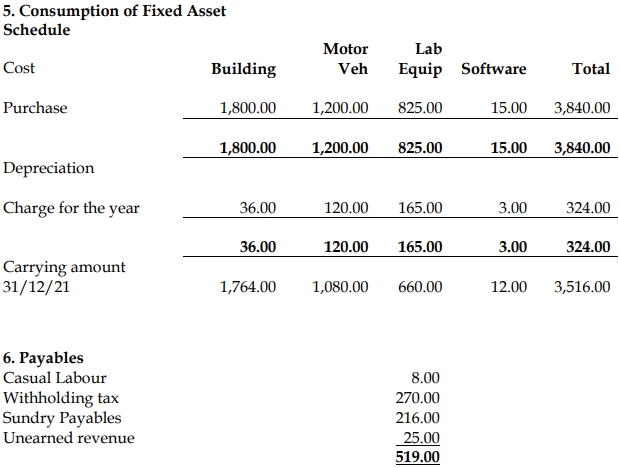

- Four patients who paid GH¢25 million to the Hospital intending to undertake heart surgery are scheduled to have their surgery done in February 2023. This amount is included in Surgical Fees.

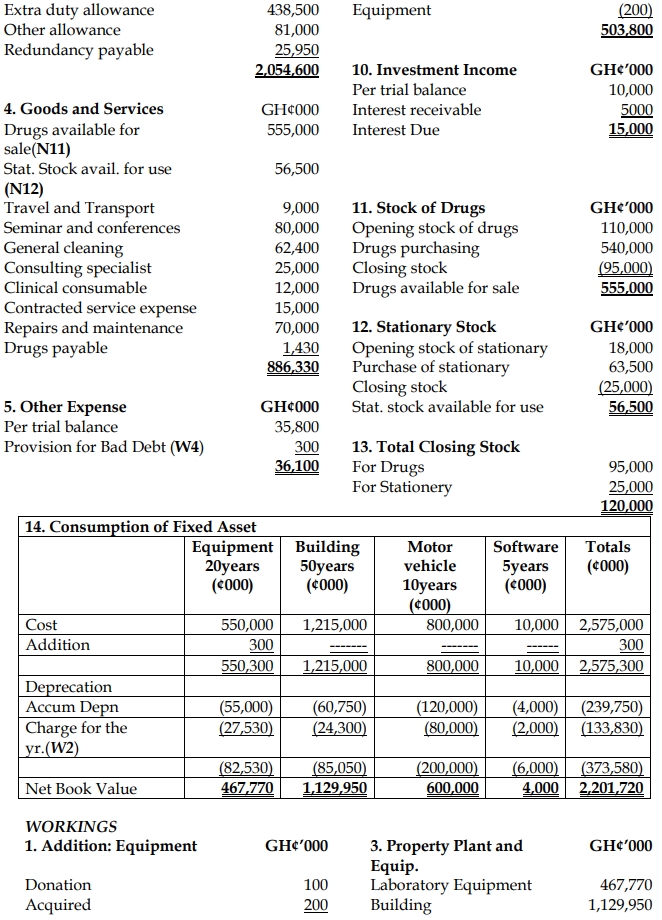

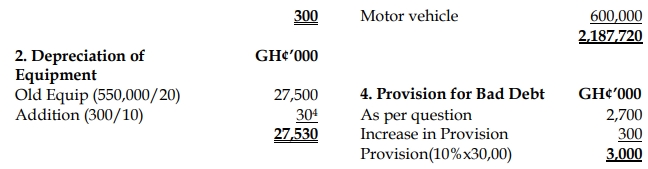

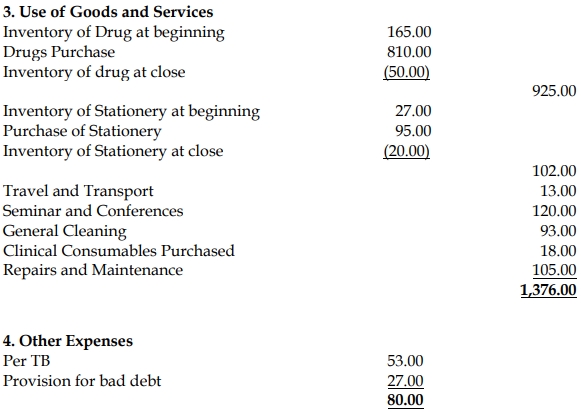

- The fixed assets in the trial balance were acquired at the beginning of the year. It is the policy of the Hospital to provide for the consumption of fixed assets using the straight-line method:

- Asset: Laboratory Equipment, Building, Motor Vehicles, Software

- Useful life: 5 years, 50 years, 10 years, 5 years respectively

- Salaries and other emoluments outstanding relating to casual labor during the year amounted to GH¢8 million.

- Provision for Bad Debt relates to NHIS Claims Receivables in the Trial balance. The Provision for Bad Debt is 2%.

Required:

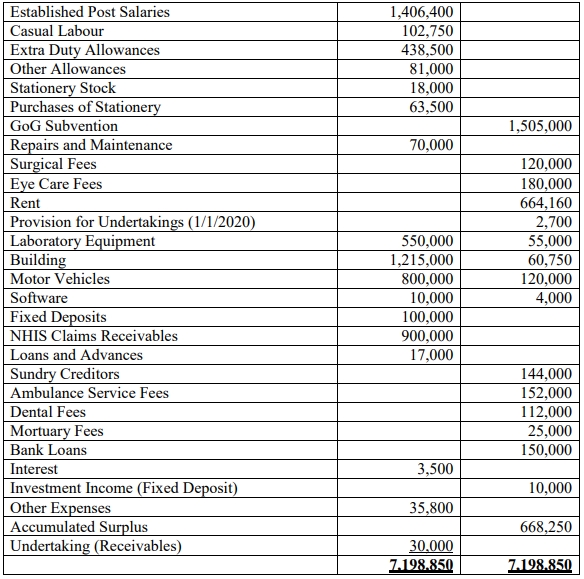

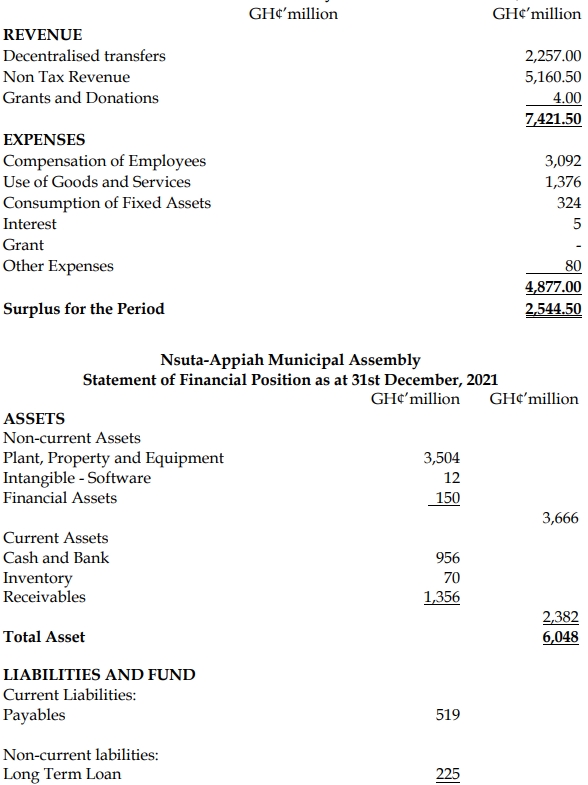

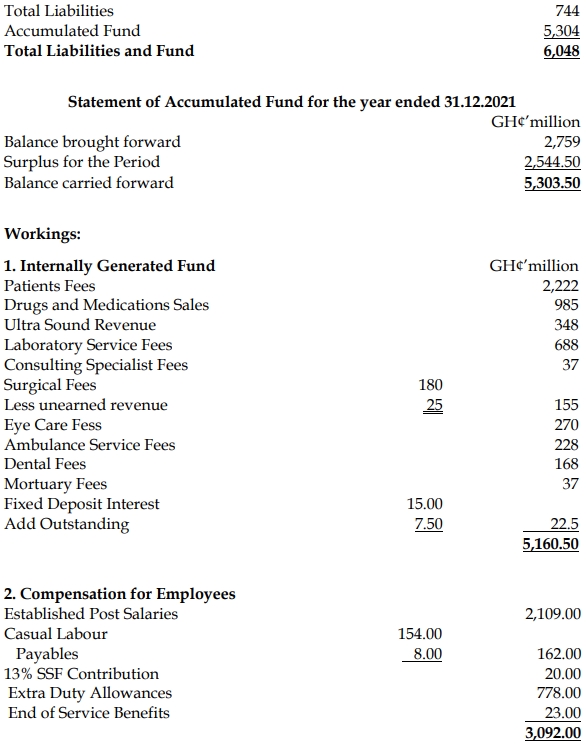

a) Prepare a Statement of Financial Performance for Ayigya Central Hospital for the year ended December 31, 2022. (10 marks)

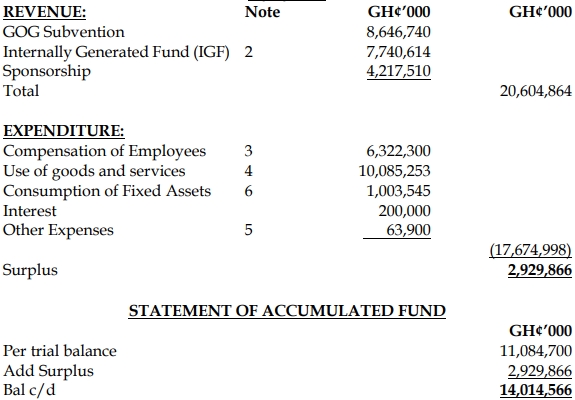

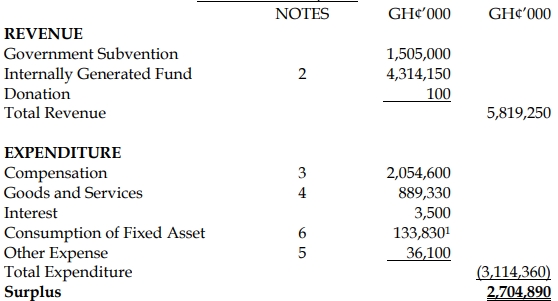

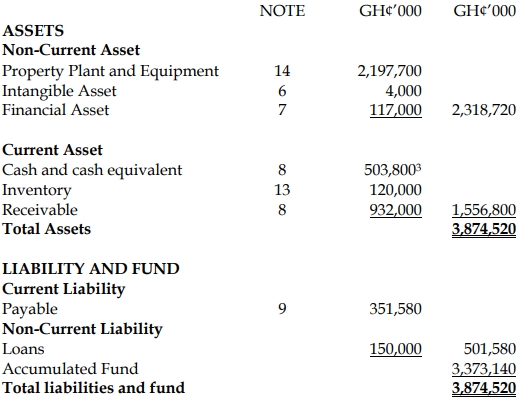

b) Prepare a Statement of Financial Position for Ayigya Central Hospital as at December 31, 2022. (10 marks)

Answer

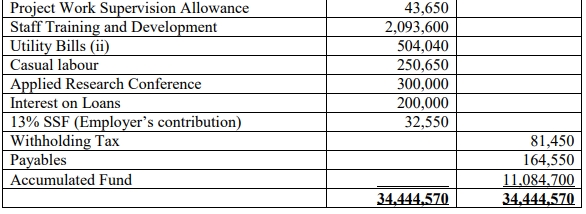

Statement of Financial Performance for Ayigya Central Hospital for the year ended December 31, 2022

- Uploader: Theophilus