To: Managing Director

From: Financial Controller

Subject: Performance Analysis for Shine Ltd – Year Ended 31 December 2016

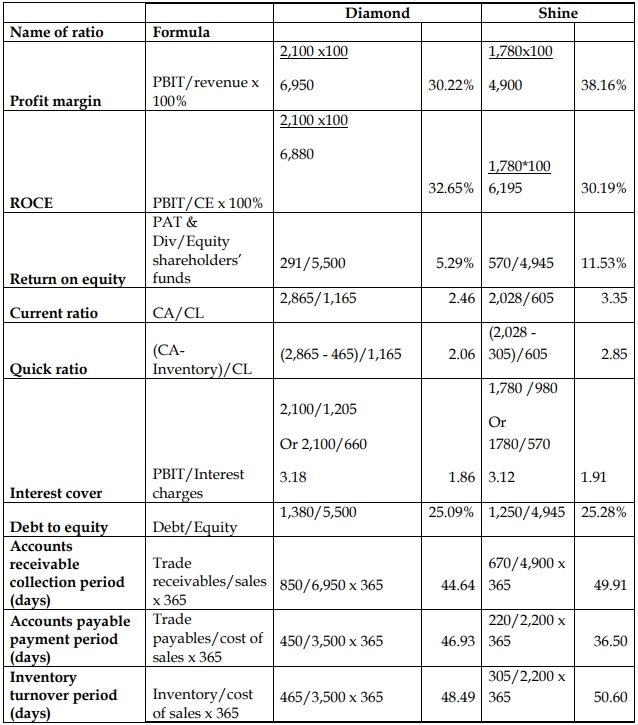

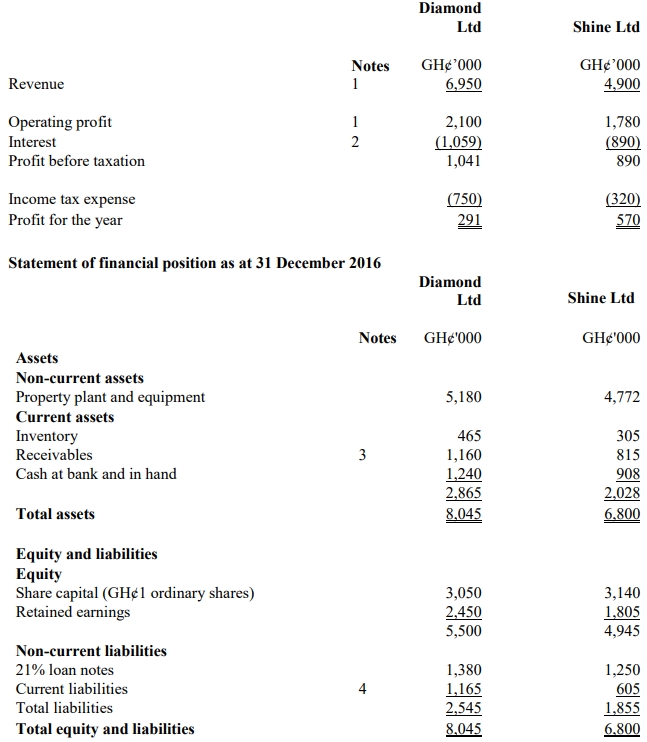

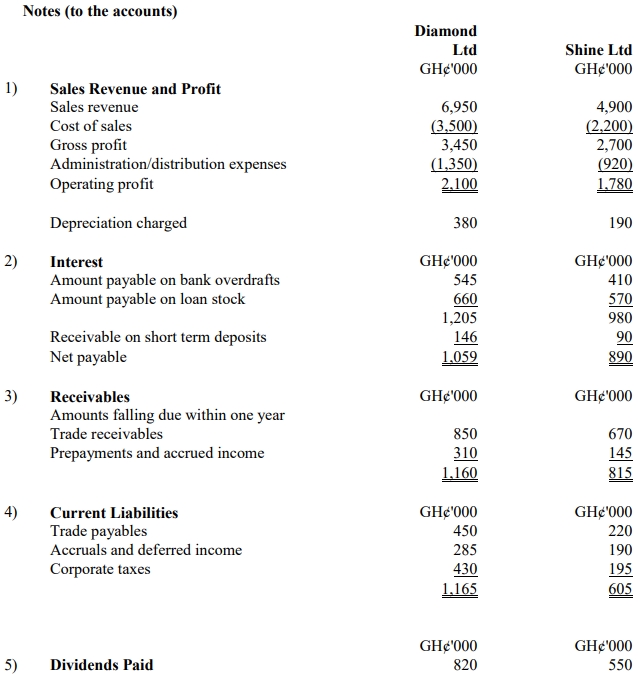

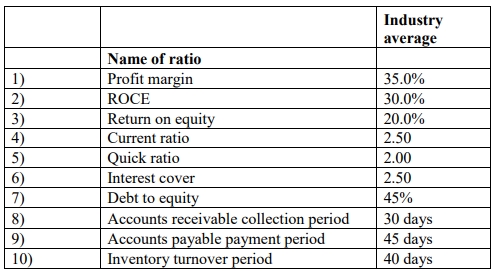

This report provides an analysis of the financial performance of Shine Ltd compared to Diamond Ltd, our key competitor, and the industry averages using the measures of profitability, liquidity, gearing, and efficiency.

1. Profitability

Profit Margin: Shine Ltd has a profit margin of 36.33%, which is significantly higher than Diamond Ltd’s 30.22% and also above the industry average of 35%. This indicates that Shine Ltd is more efficient in converting revenue into profit.

Return on Capital Employed (ROCE): Shine Ltd’s ROCE of 28.74% is slightly lower than Diamond Ltd’s 30.52% and below the industry average of 30%. This suggests that Shine Ltd is not utilizing its capital as effectively as Diamond Ltd in generating returns.

Return on Equity (ROE): Shine Ltd’s ROE of 11.53% is more than double that of Diamond Ltd (5.29%), but it is still significantly lower than the industry average of 20%. This indicates that while Shine Ltd is outperforming Diamond Ltd, there is room for improvement in generating returns for shareholders.

2. Liquidity

Current Ratio: Shine Ltd’s current ratio of 3.35 is better than Diamond Ltd’s 2.46 and higher than the industry average of 2.50. This suggests that Shine Ltd is in a stronger position to cover its short-term obligations.

Quick Ratio: Shine Ltd’s quick ratio of 2.85 is also superior to Diamond Ltd’s 2.06 and the industry average of 2.00. This further reinforces Shine Ltd’s strong liquidity position and its ability to meet immediate liabilities without relying on inventory sales.

3. Gearing

Interest Cover: Shine Ltd’s interest cover ratio is 2.00, which is similar to Diamond Ltd’s 1.98 and marginally below the industry average of 2.50. This indicates that Shine Ltd’s ability to meet interest payments is comparable to that of Diamond Ltd, but both are below industry standards, suggesting potential pressure in covering interest expenses.

Debt to Equity Ratio: Shine Ltd’s debt to equity ratio of 25.28% is similar to Diamond Ltd’s 25.09% and much lower than the industry average of 45%. This indicates that Shine Ltd has a lower reliance on debt financing compared to the industry, which reduces financial risk.

4. Efficiency

Accounts Receivable Collection Period: Shine Ltd takes 49.91 days to collect receivables, which is longer than Diamond Ltd’s 44.64 days and the industry average of 30 days. This indicates that Shine Ltd is slower in collecting payments from customers, which could negatively impact cash flow.

Accounts Payable Payment Period: Shine Ltd takes 36.50 days to pay its suppliers, which is shorter than Diamond Ltd’s 46.93 days and the industry average of 45 days. This indicates that Shine Ltd is paying its suppliers faster than its competitor and the industry norm, which may affect its working capital management.

Inventory Turnover Period: Shine Ltd’s inventory turnover period is 50.60 days, slightly longer than Diamond Ltd’s 48.49 days and the industry average of 40 days. This indicates that Shine Ltd is holding inventory for a longer period, which could increase storage costs or risk of obsolescence.

Conclusion

Overall, Shine Ltd is performing well in terms of profitability and liquidity, outperforming Diamond Ltd and meeting or exceeding industry averages in several areas. However, there are concerns with the company’s efficiency, particularly in managing receivables and inventory. There is also a need to improve interest cover to reduce financial risk. Addressing these areas could further enhance Shine Ltd’s competitive position and financial health.

Signed:

Financial Controller

Required:

Required: