- 7 Marks

Question

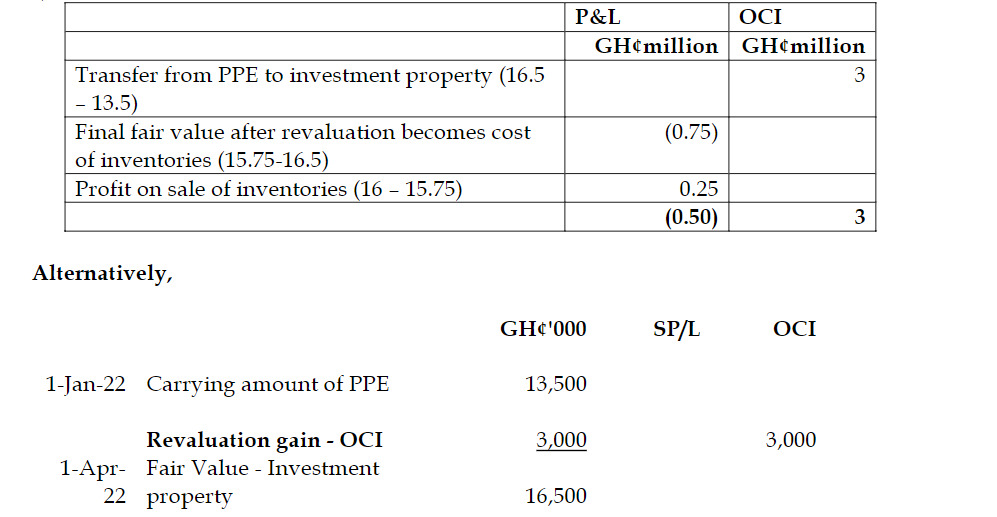

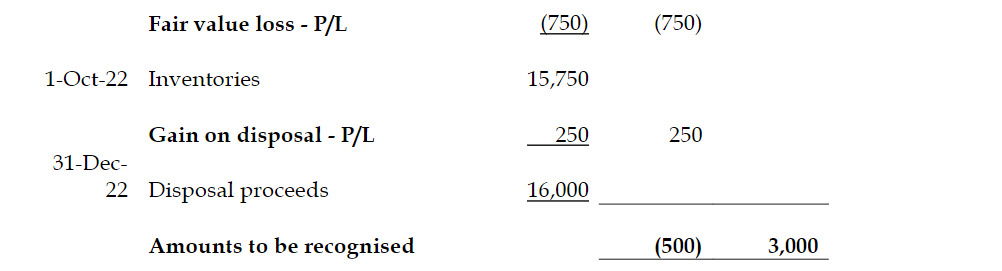

Wenchi Ltd (Wenchi) is a real estate development company. On January 1, 2022, Wenchi’s office building had a net carrying value of GH¢13.5 million. The property became vacant on April 1, 2022, and was leased to a third party. On October 1, 2022, the property was added to inventory for sale after the lease expired. The property was sold in December 2022 for GH¢16 million.

Required:

In accordance with IFRS, determine the amounts to be recognized in profit or loss and other comprWenchi Ltd (Wenchi) is a real estate development company which has been operating for several years. On January 1, 2022, the office building of Wenchi had a net carrying value of GH¢13.5 million. The cost model was used to value the property. No depreciation had been incurred because the expected residual value was more than the cost due to a buoyant real estate market.

The property became vacant as a result of relocating the company’s operations, and on April 1, 2022, a third party (Dormaa Ltd) was given a six-month short lease to occupy it. The property’s fair value at the time it was leased out was GH¢16.5 million.

Wenchi made the choice to add the property to its inventories of properties for sale in the regular course of business once the lease expired. The property was valued at GH¢15.75 million at 1 October 2022. The property was sold in December 2022 for GH¢16 million.

Required:

In accordance with IFRS, determine the amounts to be recognized in profit or loss and in other comprehensive income in respect of the property for the year ended 31 December 2022.ehensive income in respect of the property for the year ended 31 December 2022.

Answer

c)

(7 marks)

- Uploader: Cheoli