- 12 Marks

Question

Grammar Limited manufactures product G of which the sales for the year 2015 was ₦25,000,000 at the unit price of ₦40. Production overhead and selling overhead were ₦2.50 and ₦1.50 per unit, respectively. The following additional information are available for the year 2015:

| ₦/unit | |

|---|---|

| Direct material used | 8.50 |

| Direct labour | 7.50 |

| Fixed production overhead | 6.00 |

| Fixed selling overhead | 2.00 |

| Administration overhead | 4.00 |

You are required to calculate:

i. Full production cost per unit and value

ii. Variable cost per unit and value

iii. Contribution per unit and value

iv. Break-even point in value

v. Total non-production cost per unit and value

vi. New break-even point (to the nearest Naira) if additional distribution expenses of ₦1.50/unit was incurred

Answer

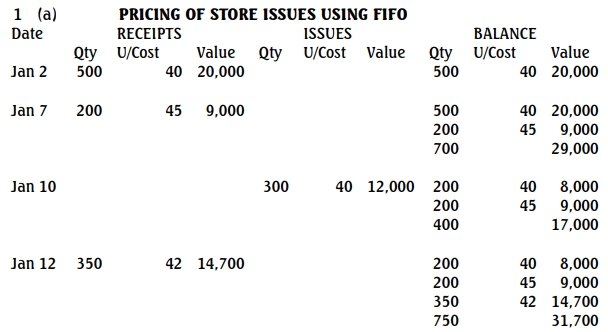

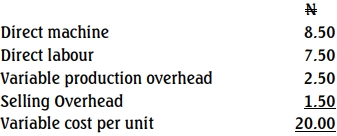

i. Full production cost per unit and value:

Production in units = 25 000 000 / 4 = 625,000 units

ii. Variable cost per unit and value:

Value 625,000 x N20.00 = 12,000,000

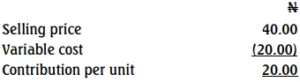

iii. Contribution per unit and value

Value 625,000 x N20.00 = 125,000,000

iv. Break even point in value

![]()

![]() = N15,000,000

= N15,000,000

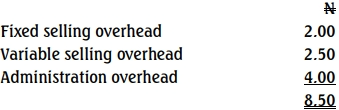

v. Total non-production cost per unit and value

Value 625,000 x N8.50 = N5,312,000

vi. New break-even cost point

= ![]()

= ![]()

= ![]() = N18,243,243

= N18,243,243

- Tags: Absorption Costing, Cost Calculations, Marginal Costing

- Level: Level 1

- Topic: Costing Methods

- Series: MAY 2016

- Uploader: Joseph