- 20 Marks

Question

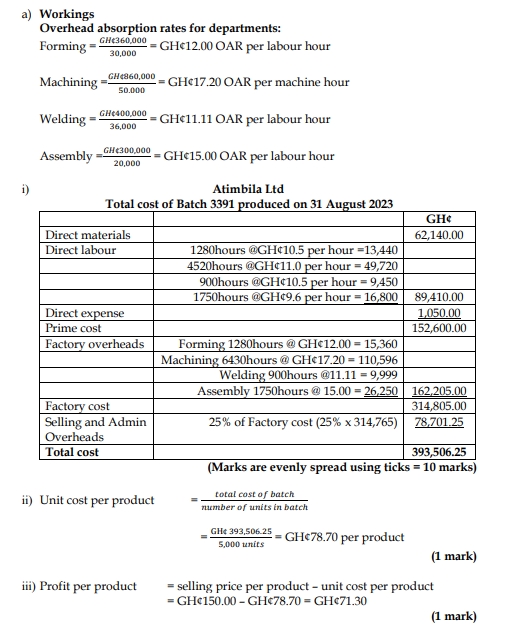

a) Atimbila Ltd manufactures a product that goes through various workshops. The following budgeted overheads for the year 2023, based on normal activity levels, have been provided:

| Workshop | Budgeted Overheads (GH¢) | Overhead Absorption Base |

|---|---|---|

| Forming | 360,000 | 30,000 labour hours |

| Machining | 860,000 | 50,000 machine hours |

| Welding | 400,000 | 36,000 labour hours |

| Assembly | 300,000 | 20,000 labour hours |

Selling and administrative overheads are 25% of factory cost.

An order for 5,000 units of the product (Batch 3391) incurred the following costs on 31 August 2023:

- Materials: GH¢62,140

- Labour:

- 1,280 hours forming shop at GH¢10.50 per hour

- 4,520 hours machining shop at GH¢11 per hour

- 900 hours welding shop at GH¢10.50 per hour

- 1,750 hours assembly shop at GH¢9.60 per hour

- An amount of GH¢1,050 was paid for the hire of a special X-ray equipment for testing the welds. The time booking in the machine shop was 6,430 machine hours. Selling price was GH¢150 per product.

Required:

i) Compute the total cost of the batch. (10 marks)

ii) Calculate the unit cost per product. (1 mark)

iii) Determine the profit per product. (1 mark)

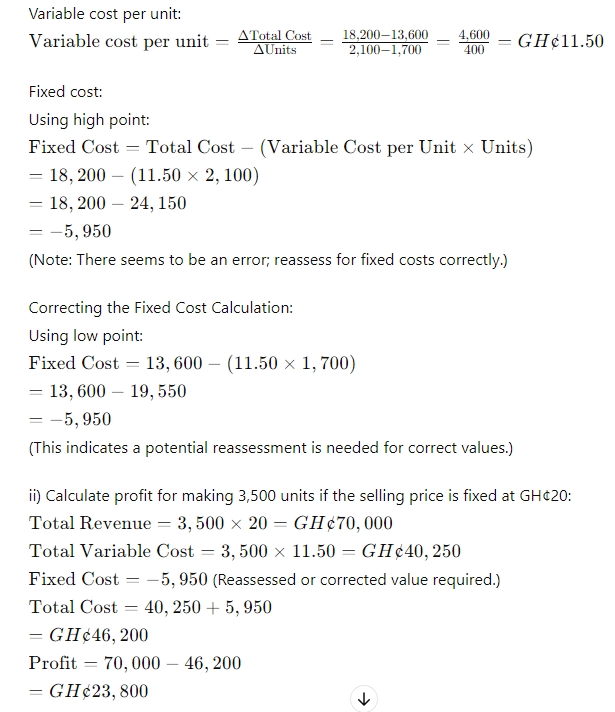

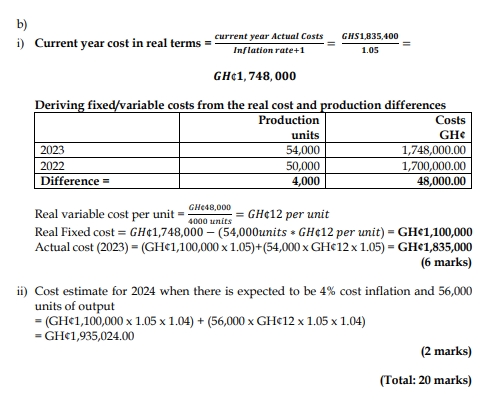

b) The following cost and production data relates to the operations of Mawuga Ltd over a two-year period:

| Year | Production (units) | Total Costs (GH¢) |

|---|---|---|

| 2022 | 50,000 | 1,700,000 |

| 2023 | 54,000 | 1,835,400 |

Between 2022 and 2023, there has been a 5% cost inflation.

Required:

i) Calculate the real fixed and variable costs. (6 marks)

ii) Estimate what the total costs will be in 2024 if it is expected that there will be 4% cost inflation and output will be 56,000 units. (2 marks)

Answer

- Tags: Batch Costing, Cost Estimation, Overhead Absorption, Real Fixed Costs, Variable Costs

- Level: Level 1

- Topic: Cost and Cost Behaviour

- Series: MAR 2024

- Uploader: Joseph