- 20 Marks

Question

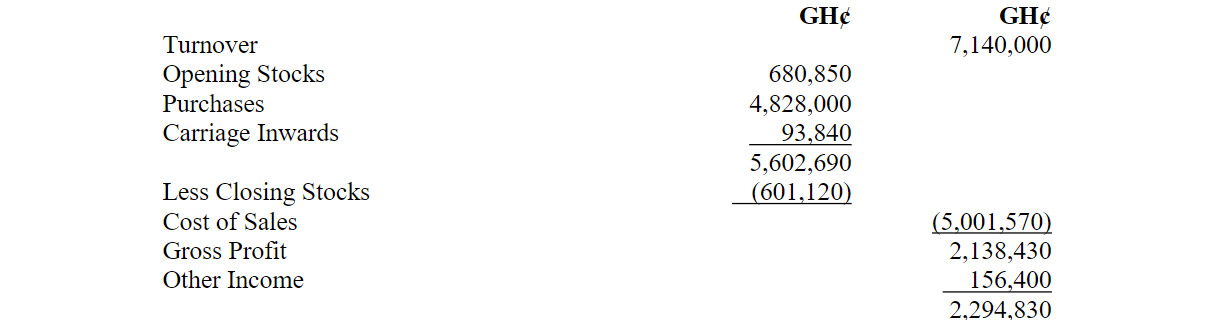

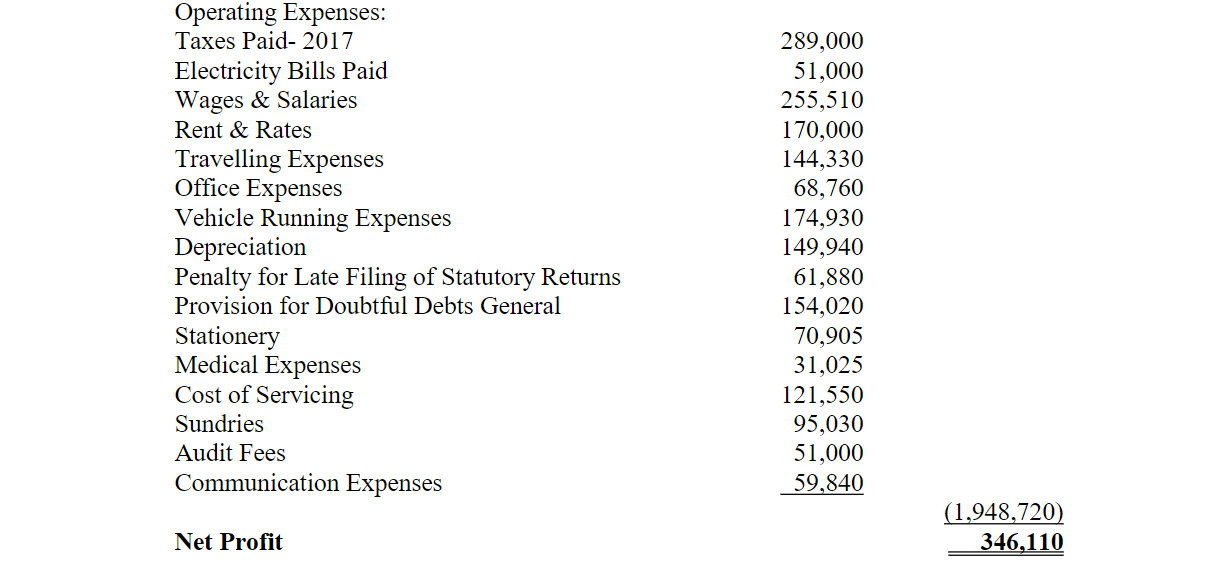

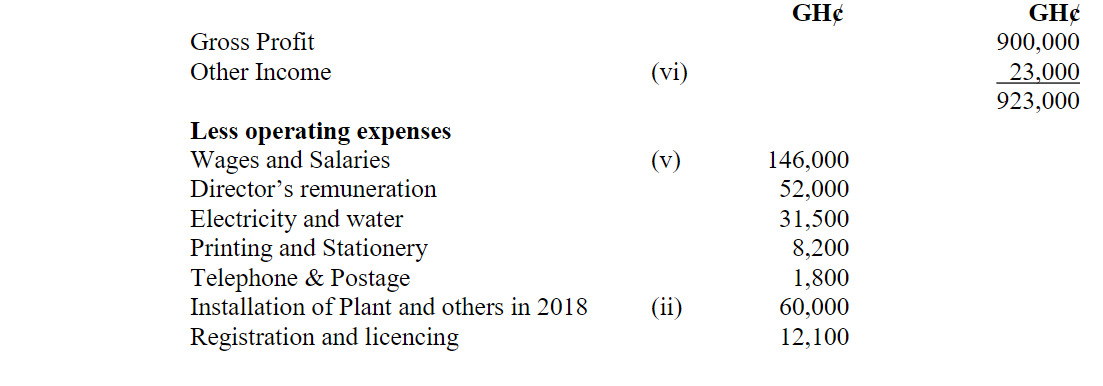

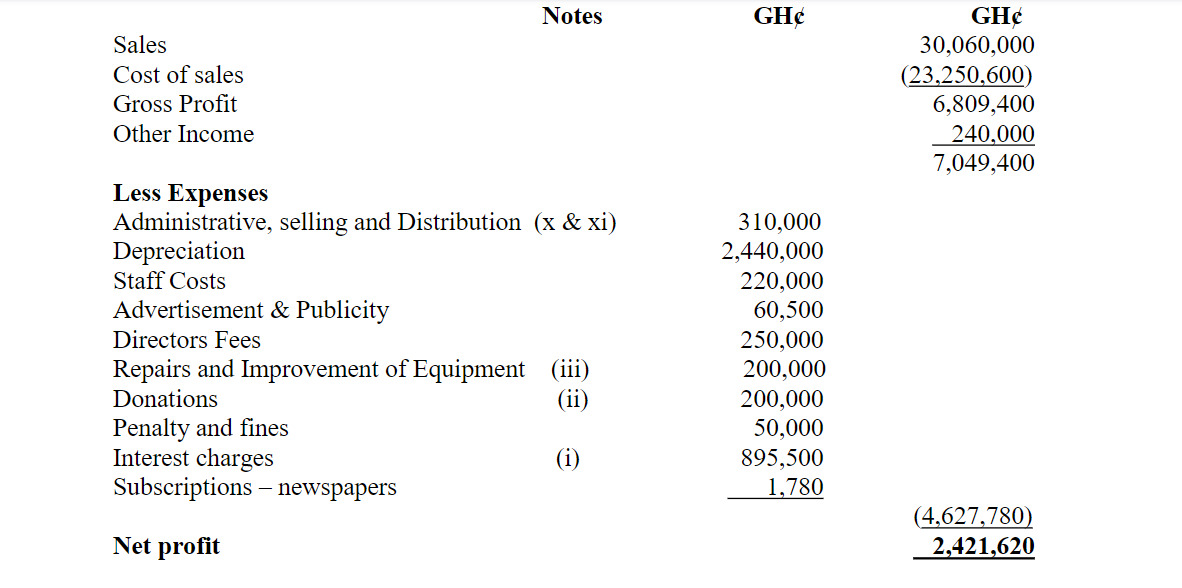

The following extract relates to the financial data of Therry Ltd, a company resident in Ghana with a basis period from January to December each year. Therry Ltd has submitted its tax returns to GRA for the 2020 year of assessment:

The following additional information is available:

Interest Charges:

a. Interest on loan for MD’s personal housing project GH¢500,000

b. Foreign exchange loss on loan GH¢320,500

c. Bank charges GH¢75,000

Donations:

a. Osu Children Home GH¢10,000

b. Pastor (Azigi Church) GH¢30,000

c. Labone Senior High School GH¢20,000

d. National Disaster Management Organisation GH¢50,000

e. Political Parties Fundraising GH¢90,000

An amount of GH¢200,000 disclosed in the accounts was paid for repairs and improvements of an old machine bought three years ago. It is hoped that the performance of the machine will be enhanced after the improvements.

Creditors of the company agreed to cancel an amount of GH¢120,000 standing as part of the credit balance as incentive to the company. This has not been taken into account by the company in its tax returns to GRA.

An amount of GH¢300,000 being cost price of goods was issued to a related party outside Ghana at cost. The margin on the goods waived was sighted as GH¢40,000 in a correspondence with the related party.

Tax paid on account was GH¢20,000.

The company booked capital allowance unutilised certified by GRA from 2019 year of assessment as GH¢300,000.

Capital allowance agreed with GRA after taking into account all relevant issues was GH¢1,050,000 for 2020 year of assessment.

The machine (Pool 3 asset) had a written down value of GH¢4,000,000 as at 1 January 2020.

An allowable bad debt included in the selling and distribution expenses for 2019 amounted to GH¢100,000. The company recovered the amount in 2020 but no transaction was recorded in 2020.

Therry Ltd disposed off one of its capital assets for GH¢250,000 to the Managing Director. It cost the company GH¢300,000 to acquire the asset some years ago. An investigation revealed that the market value of the asset at the time of the sale was GH¢350,000. The company has already included the loss of the sale of the asset in administration expenses.

Required:

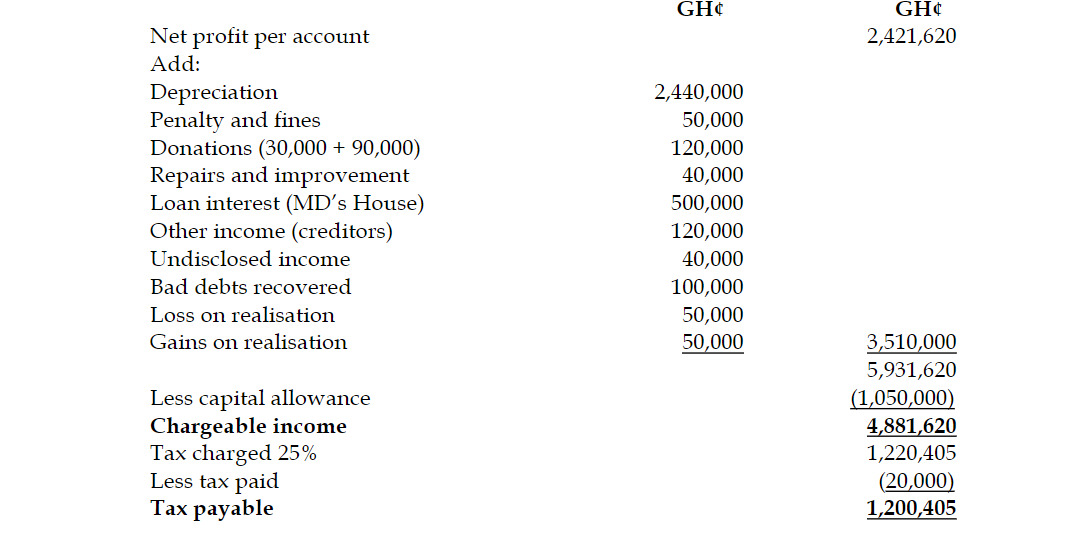

Determine the tax payable for the 2020 year of assessment. (20 marks)

Answer

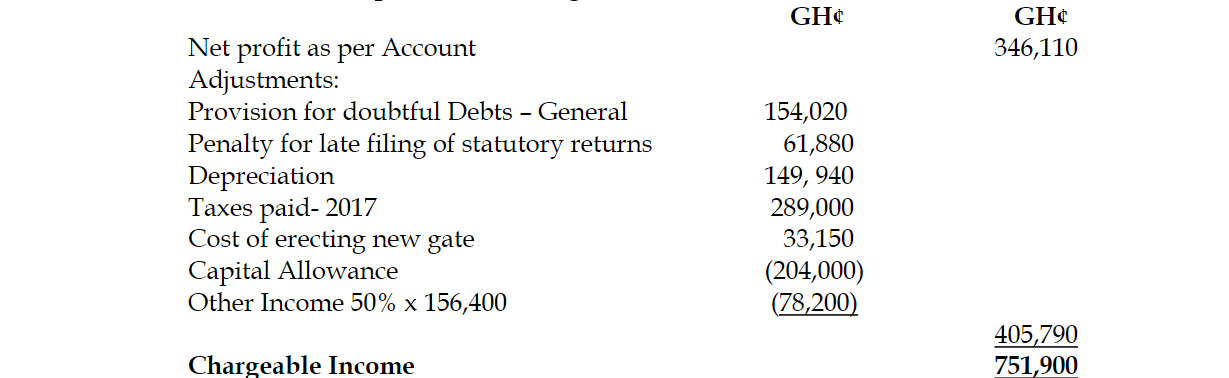

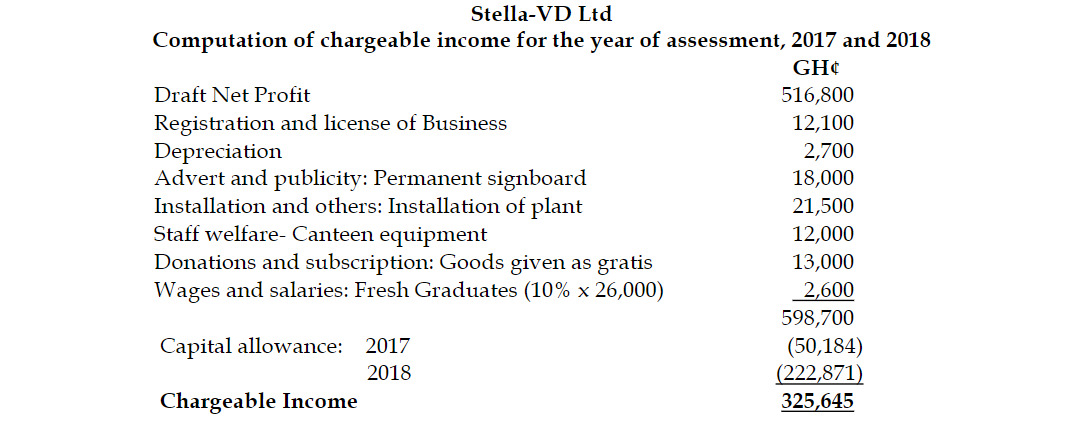

Therry Ltd

Determination of tax payable for the 2020-year of assessment

Basis period: 01/01/2020 to 31/12/2020

Repairs and improvements:

Pool 3 asset Written down value at 01/01/2020 = GH¢4,000,000

Depreciation allowance (20%) = GH¢800,000

Written down value at 31/12/2020 = GH¢3,200,000

Allowable repairs and improvements (5% x GH¢3,200,000) = GH¢160,000

Disallowed repairs and improvements = GH¢200,000 – GH¢160,000 = GH¢40,000

Gain/Loss on realisation of capital asset:

Consideration received = GH¢350,000

Cost of asset = GH¢300,000

Gain on realisation = GH¢50,000

- Topic: Corporate Tax Liabilities, Tax Computation for Companies

- Series: APR 2022

- Uploader: Cheoli