- 20 Marks

Question

a) In periods of difficult global financial environment, raising of capital is a challenge necessitating the need for prudent and best use of scarce capital for projects.

Required:

i) Explain the term capital rationing. (2 marks)

ii) Distinguish between soft capital rationing and hard capital rationing giving an example each. (3 marks)

b) Akonta Ghana Ltd has excess funds of GH¢200 million and is looking for attractive investment opportunities that will yield a return of 15% per annum or better to deploy the funds. An extract from a Feasibility report submitted by a team of investment and project experts is as follows:

| Project | Initial Investment Required (GH¢) | Constant Annual Cash Inflow (GH¢) | Project Life (Years) |

|---|---|---|---|

| A | 80,000,000 | 36,000,000 | 4 |

| B | 40,000,000 | 23,000,000 | 3 |

| C | 78,000,000 | 30,000,000 | 5 |

| D | 40,000,000 | 20,000,000 | 4 |

| E | 40,000,000 | 22,000,000 | 3 |

The cash flows per project are constant for the life span of each project and each project is divisible for the purpose of capital allocation.

Required:

i) Calculate the Net Present Values (NPVs) of each project. (7 marks)

ii) Rank the projects using Profitability Index and allocate the GH¢200 million among the projects. (3 marks)

c) There are many sources of debt finance available to a company which has viable and profitable investment opportunities to utilise the funds. It is, however, very important for the Finance Manager to do a thorough work before deciding the type and source of debt finance to tap into.

Required:

Explain THREE (3) factors a Finance Manager should consider when deciding the type of debt finance to raise. (5 marks)

Answer

a)

i) Capital Rationing

Capital rationing refers to the allocation of scarce or restricted capital among acceptable projects based on the most profitable and efficient use of the capital. For example, if a company has a total available capital of GH¢1 million to invest among competing profitable projects whose total capital investment required exceeds GH¢1 million, the company will have to allocate or ration the capital in order of best values or profitability. (2 marks)

ii) Soft and Hard Capital Rationing

- Soft Capital Rationing is the situation where the constraint on raising and using capital is internally driven by policies and decisions. For example, a company with past poor return on investment compared to initial projections may implement internal tightening of capital allocations and raising of returns expectation on projects.

- Hard Capital Rationing occurs when a company faces constraints in raising capital due to external factors such as market conditions or investor reluctance. An example would be a company unable to raise additional funds through equity due to unfavorable stock market conditions.

(1.5 marks each = 3 marks)

b)

i) Net Present Value (NPV) Calculations

| Project | Initial Investment Outlay (GH¢) | Constant Annual Cash flows (GH¢) | Annuity Discount Factor @ 15% | Present Value (GH¢) | Net Present Value (GH¢) |

|---|---|---|---|---|---|

| A | 80,000,000 | 36,000,000 | 2.855 | 102,780,000 | 22,780,000 |

| B | 40,000,000 | 23,000,000 | 2.283 | 52,509,000 | 12,509,000 |

| C | 78,000,000 | 30,000,000 | 3.352 | 100,560,000 | 22,560,000 |

| D | 40,000,000 | 20,000,000 | 2.855 | 57,100,000 | 17,100,000 |

| E | 40,000,000 | 22,000,000 | 2.283 | 50,226,000 | 10,226,000 |

(7 marks)

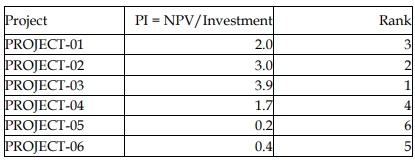

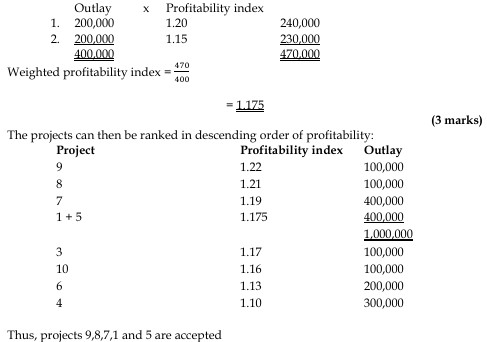

ii) Profitability Index Ranking and Allocation

| Project | Initial Investment Outlay (GH¢) | Present Value (GH¢) | Profitability Index (PI) | Rank | Amount Allocated (GH¢) |

|---|---|---|---|---|---|

| D | 40,000,000 | 57,100,000 | 1.43 | 1 | 40,000,000 |

| B | 40,000,000 | 52,509,000 | 1.31 | 2 | 40,000,000 |

| C | 78,000,000 | 100,560,000 | 1.29 | 3 | 78,000,000 |

| A | 80,000,000 | 102,780,000 | 1.28 | 4 | 42,000,000 |

| E | 40,000,000 | 50,226,000 | 1.26 | 5 | 0 |

Total Allocated: GH¢200,000,000

(3 marks)

c) Factors to Consider When Deciding the Type of Debt Finance

- Cost: This includes the interest rate, issuance costs, and any other fees associated with the debt. The cost of debt finance can significantly affect the viability and profitability of the projects being financed. The tax implications and the basis of interest rates (fixed vs. variable) are also critical considerations.

- Purpose and Maturity: The purpose of the finance will determine the maturity of the debt. Long-term investments like capital expenditure should be financed with long-term debt, while working capital requirements should be financed with short-term debt instruments like overdrafts.

- Gearing Level/Financial Risk: The company’s existing level of debt relative to equity (gearing) and the associated financial risk must be evaluated. High gearing may limit the company’s ability to raise additional debt and may expose the company to higher financial risk.

- Flexibility: The terms and conditions and covenants that go with the facility

should be reviewed and ensure that they friendly and will not squeeze the

company unfavourably. Ability to restructure and renegotiate during difficult

times should be considered - Control: Will the new source lead to dilution of control of existing shareholder

and will they be happy? Will any debt put a lot of restrictions on shareholder and

dividend payment and will they be happy? All should be considered and

analysed. Will the debt providers exercise a; lot of control and interference in the

management? - Security/Collateral: Providing collateral or security for the debt is also crucial and

should be carefully considered. The bigger and longer the debt tenor the more the

requirement to provide security or Collateral.

(5 marks)

- Uploader: Joseph