- 40 Marks

Question

CASE STUDY: GRACE TELECOM LIMITED

Introduction: Grace Telecom Ltd. is a well-established company providing telecommunications services both nationally and internationally. It offers telephone services, telephone lines and equipment, and private telecommunication networks. Recently, it has expanded into mobile phone services, an expanding global market.

The company has a diverse customer base, including residential users, multinational companies, government agencies, and public sector organizations. Grace Telecom Ltd. handles approximately 100,000 million calls each working day and employs nearly 140 personnel.

Strategic Development: The Chairman of Grace Telecom Ltd., in the latest Annual Report, identified three main growth areas reflecting the evolving telecommunications market. The company aims to:

- Expand its telecommunications business nationally and overseas, acting independently or through partnerships.

- Diversify into television and multi-media services, including telephone shopping and broadcasting.

- Extend joint ventures and strategic alliances already established in West Africa.

The Chairman emphasized the company’s intent to become a world leader in communications by focusing on long-term development, improving customer services, developing high-quality products, and maintaining innovation, flexibility, and market-driven approaches to deliver world-class services at competitive costs.

Financial Information: The following comparative statistics show extracts from the company’s financial performance in the national telecommunications market over the last two years:

| Last year | Previous year |

|---|---|

| Revenue/Turnover (GHS’000) | 16,613 |

| Profit before interest and tax (GHS’000) | 3,323 |

| Capital employed (GHS’000) | 22,150 |

The company estimates its cost of capital to be approximately 18%.

Business Opportunities: The Chief Executive of Grace Telecom Ltd. identified major opportunities in:

- Encouraging greater telephone usage.

- Providing advanced services, including research and development into new technologies.

- Benefiting from the increasing deregulation of global telecommunication services.

An extensive advertising campaign was used to penetrate the residential market further, offering various charging incentives to residential customers.

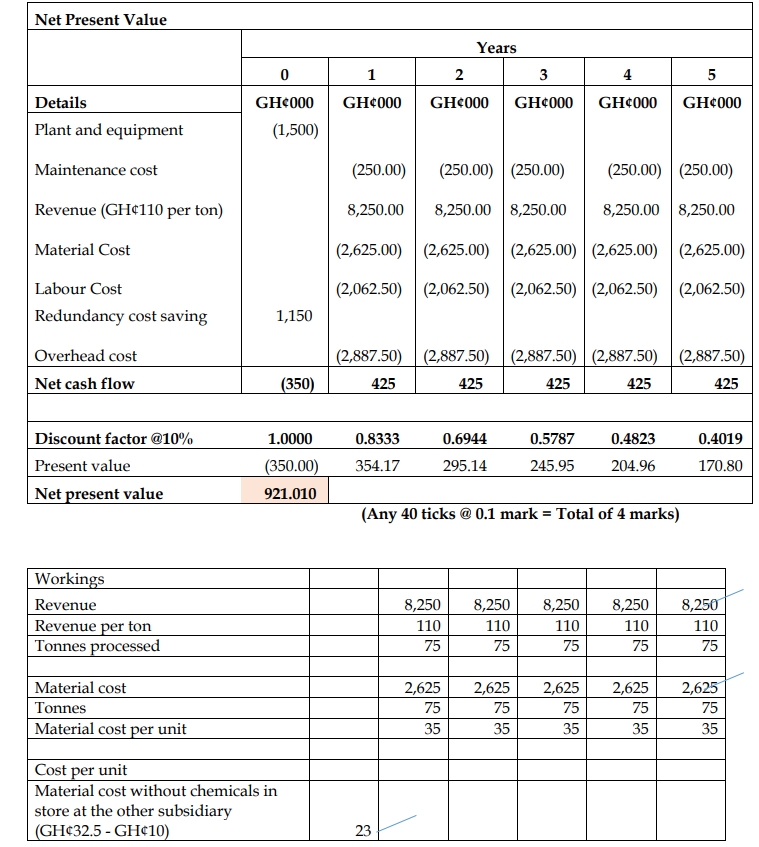

To increase long-term shareholder value, the company is considering investing GHS200 million annually for three years in new technology and quality improvements in its national market. This investment, due to its specialized technical nature, is not expected to have residual value at the end of the three-year period.

Following the investment, the directors believe the company’s rate of profit before interest and tax to turnover in the national telecommunications market will remain constant, at the same level as last year, for the three years of the investment.

Markets and Competition: Grace Telecom Ltd. is experiencing market share erosion and faces strong competition in the mobile phone market. Despite leading its national market with an 85% share, the company has seen reduced demand for residential lines over the past five years due to increased competition.

The market for telecommunications equipment is perceived as static. The planned investment of GHS200 million annually is estimated to increase Grace Telecom Ltd.’s market share to 95%. This improvement is expected to be fully realized in the first year and maintained for the full three-year period. Without further investment, the market share is expected to revert to current levels due to competitive pressures.

Industry Regulation: A government regulatory organization has been established to promote competition and deter anti-competitive behavior. Due to regulatory activities and aggressive pricing strategies, charges to customers are anticipated to remain constant for the full three-year period of new investment.

All cash flows are assumed to occur at the end of the year to which they relate. The cash flows and discount rate are in real terms.

Future Outlook: The business remains under family control, but the board is considering an expansion program, which would require raising GH¢200 million in equity or debt finance. However, there are risks associated with the expansion, such as the declining market for fixed telephone lines. New income is expected from expanding into mobile money transfer services. The company’s key to profit growth lies in generating sales growth, though it faces stiff competition from larger telecom companies.

Grace Telecom Ltd. must carefully consider external factors, including government economic policy. Recent key economic data include:

- Bank base rate reduced from 22% to 20%, with a forecast of a further 0.5% reduction within six months.

- Annual inflation rate reduced to 12% from 14% in the previous quarter and 16% twelve months ago, with no further declines expected in the medium term.

- Personal and corporate tax rates expected to remain unchanged for at least twelve months.

Required:

a) Explain the nature of the political, economic, social, and technological forces which will influence Grace Telecom Ltd. in developing its business and increasing its market share. (8 marks)

b) Apply Ansoff’s Product/Market Growth matrix to assess the extent of the potential market development opportunities available to Grace Telecom Ltd. (12 marks)

c) Explain the relevance of each of the items of economic data listed in the case to Grace Telecom Ltd. (6 marks)

d) Explain whether Grace Telecom Ltd. should continue with its expansion plans. Clearly justify your argument for or against the expansion. (10 marks)

e) Outline FOUR (4) methods whereby Grace Telecom Ltd. can obtain a quotation for its shares on the Ghana Stock Exchange. (4 marks)

Answer

a) Explanation of Political, Economic, Social, and Technological Forces (8 marks):

- Political factors: Grace Telecom Ltd. dominates its national telecommunications market with an 85% share. The company will face political pressure from the government to reduce its dominance by opening up the market to competition and reducing prices for telecom products. The government-appointed industry regulator will closely scrutinize Grace Telecom Ltd., making political forces a major factor in the company’s operations and planning. Additionally, political conditions in international markets where Grace Telecom Ltd. operates must be considered.

- Economic factors: Grace Telecom Ltd. must consider various economic elements, including:

- Shareholder wealth: The company’s shareholders aim for profit maximization and rising share value, especially as the company plans to obtain public funds from the stock exchange.

- Contribution to the national economy: The telecom industry plays a crucial role in economic growth, and Grace Telecom Ltd. has a responsibility to develop new technology and provide reliable services.

- Economies of foreign countries: Economic conditions in each foreign country where Grace Telecom Ltd. operates should be considered, such as foreign currency exchange rates and national economic cycles.

- National economic indicators: Favorable economic indicators, such as reduced interest rates, can help Grace Telecom Ltd. capitalize on cheaper debt capital for its expansion plans.

- Social factors: Grace Telecom Ltd. should understand the social needs of its customers and provide reliable services. The company should portray itself as socially responsible and keep close contact with consumers by offering services for different demographic groups, such as elderly citizens. Additionally, the company should consider the cultural aspects of the different markets in which it operates.

- Technological factors: The telecommunications industry is highly dynamic, and Grace Telecom Ltd. must remain innovative to maintain its competitive advantage. The company should invest in research and development to ensure a constant supply of new products and may need to integrate after-sales support services as a core activity in its value chain, especially as it plans to invest in high technology.

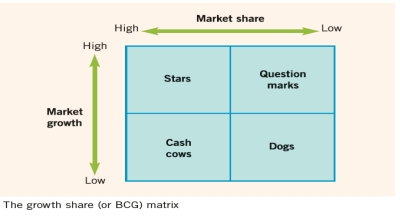

b) Application of Ansoff’s Product/Market Growth Matrix (12 marks):

- Market penetration strategies: Grace Telecom Ltd. currently has 85% of its national market, leaving little room for growth by increasing market share. Most households and businesses already have a conventional telephone line, so products in this category may be at the maturity stage of their life cycle, offering limited growth prospects. Some market growth might be achieved by encouraging existing customers to use the telephone more, but this strategy offers limited potential.

- Product development strategy: This strategy involves introducing new products into existing markets. Grace Telecom Ltd. has already achieved a good track record for new product development and should continue investing in research and development to maintain its momentum. There is significant opportunity in the industry for this strategy, such as further developments in mobile phone and internet technology.

- Market development strategy: Grace Telecom Ltd. has pursued a successful strategy of expanding into foreign markets with existing products. The company currently operates in North America, Europe, India, and the Far East. The Chairman mentioned developing countries, such as those in Africa, where the company has operations. Market development in these regions presents a significant growth opportunity.

- Diversification strategy: This involves introducing new products to new markets and is considered a high-risk strategy. Grace Telecom Ltd. is a large, profitable company with an innovative culture. The company should carefully evaluate the risks of any diversification strategy, but if opportunities exist, they should be considered. For example, digital television technology could be a potential area for diversification.

The company should pursue all four strategies, with an emphasis on product development and market development, as these strategies exploit the company’s strengths in research and development and growth in foreign markets.

c) Relevance of Economic Data (6 marks):

i) Reduction in bank base rate:

- Change in borrowing costs: A fall in interest rates will make borrowing cheaper, reducing the cost of raising finance for expansion plans. This reduction in the cost of capital could increase the NPV of the company’s investment proposals.

- Level of demand: A fall in interest rates could increase the overall level of demand within the economy, although the impact on Grace Telecom Ltd.’s products, which are relatively inelastic, may be limited.

- Economic confidence: Lower interest rates may boost general economic confidence and encourage expansion, although this may not significantly affect the demand for low-value basic products offered by Grace Telecom Ltd.

ii) Effect of present and forecast rates of inflation:

- Interest rates: Low inflation rates suggest that interest rates are unlikely to rise, maintaining favorable borrowing conditions.

- Costs of purchases: The cost of inputs for Grace Telecom Ltd. should remain stable due to low inflation. Wage rates may also be less affected.

- Price increases: In a low-inflation environment, it is challenging to increase prices without losing business. Grace Telecom Ltd., which offers low-value products, may find it difficult to raise prices, reducing its competitive advantage.

iii) Effects of stable tax rates:

- Consumer demand: Stable personal tax rates are unlikely to significantly affect demand for Grace Telecom Ltd.’s products, which are inelastic.

- Tax relief: Stability in tax rates allows for confident financial planning, particularly concerning tax relief available to the company and individual equity investors.

d) Argument for or against Grace Telecom Ltd.’s Expansion Plans (10 marks):

Arguments in favor of expansion:

- Need to increase sales: Grace Telecom Ltd. needs to increase sales to trade profitably. Given the low recent sales growth, despite new product additions, opening new outlets may be the only way to significantly boost sales.

- Bulk order discounts: Expanding the business will increase purchase volumes, potentially improving buying power with suppliers and allowing the company to take advantage of bulk order discounts. This could positively impact gross margins and profitability.

- Wider geographical spread: A broader geographical presence will reduce vulnerability to local events, such as rising unemployment or new competitors.

- Economies of scale: Expansion could lead to economies of scale, such as more efficient use of regional management resources.

Arguments against expansion:

- Nature of products: Expansion may not address the fundamental weakness of the business, which lies in its focus on low-value products with strong price competition. There is limited growth potential, and other factors, such as the convenience of larger stores, work against the business.

- Risk of political pressure: Expanding further could subject Grace Telecom Ltd. to greater political pressure due to its large market share (already 85%), potentially leading to increased regulation and costs.

- Competitive pressures: Strong price competition due to low inflation and competition from the supermarket sector is likely to continue, limiting the benefits of expansion.

Conclusion: Grace Telecom Ltd. should carefully consider the expansion, as it may not significantly increase margins and profitability. The company might explore alternative strategies, such as offering higher-value products or entering markets with better opportunities for price-based competition.

e) Methods for Obtaining a Quotation on the Ghana Stock Exchange (4 marks):

- Offer for sale: This involves offering securities already in issue or for which the company has agreed to subscribe to the public through an issuing house or broker.

- Offer for subscription: This method involves offering new securities to the public for the first time.

- Rights issue: This is an issue of shares at a special price by the company to existing shareholders in proportion to their holdings.

- Bonus/Capitalization issue: This involves issuing additional shares to shareholders instead of paying a dividend, in proportion to shares already held.

- Placing: This refers to selling or obtaining subscription for securities privately by an issuing house or broker through the market and their own clients.

- Introduction: This describes an application where no marketing arrangements are required because the securities to be listed are already widely held, ensuring adequate marketability.

- Topic: Analysing the external environment

- Series: NOV 2015

- Uploader: Theophilus

|

|