- 20 Marks

Question

Mr. Mala, the proprietor of a small bookshop, has requested you to prepare his accounts. He did not keep complete records of account. From his passbook, notebook, bank statements, and oral information obtained during a meeting with him, you put together the following figures for the year ended December 31, 2015:

| Item | January 1, 2015 (N’000) | December 31, 2015 (N’000) |

|---|---|---|

| Cash in hand | 400 | 890 |

| Bank overdraft | 18,000 | 14,000 |

| Furniture & Fittings | 2,000 | 2,000 |

| Delivery van | 3,600 | 3,600 |

| Inventories | 20,400 | 22,400 |

| Trade receivables | 12,400 | 9,800 |

| Trade payables | 9,120 | 8,400 |

| Bills payables | 2,210 | 2,200 |

| Bills receivables | 3,100 | 3,200 |

During the year, Mr. Mala used part of the inventories for domestic affairs which was agreed at N1,200,000. He drew cash for private expenses at frequent intervals. He estimated his drawing in cash at N2,800,000 for the year.

He also agreed with the following suggestions:

- To write off irrecoverable debts of N300,000 owed by a customer who died in May 2015.

- To charge a notional rent of N1,000,000 per annum for the shop premises owned by him.

- To allow 15 percent per annum depreciation on furniture and fittings and 20 percent per annum on the delivery van.

Required:

a. Ascertain Mr. Mala’s bookshop’s profit or loss for the year ended December 31, 2015. (8 Marks)

b. Prepare the statement of financial position of the bookshop at December 31, 2015. (12 Marks)

Answer

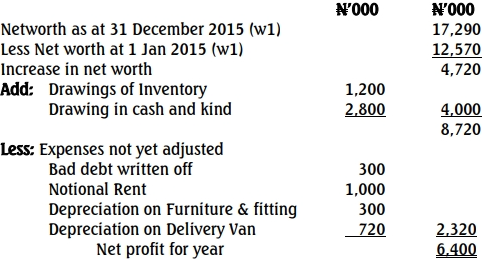

(a) Estimate of Mala’s profit for the year ended 31 December 2015

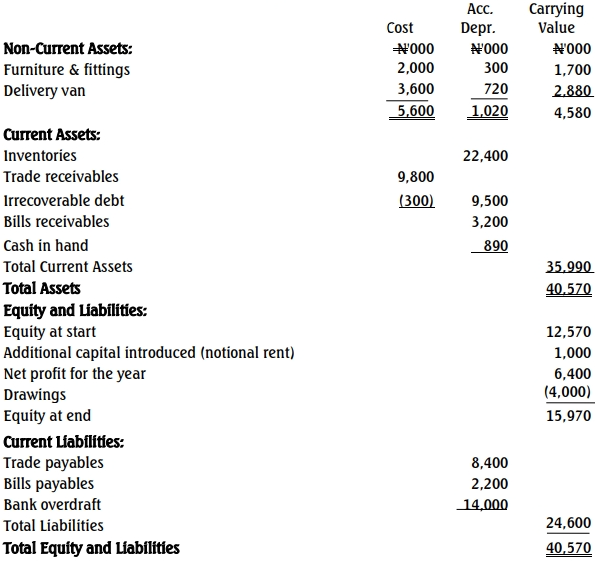

(b) Statement of financial position as at December 31, 2015

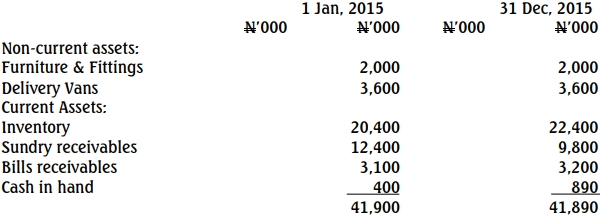

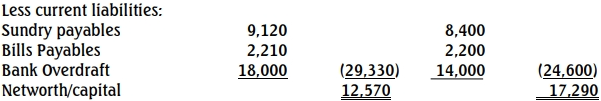

WORKING NOTES

W1 Calc. of Net Worth/Capital as at

- Topic: Accounting from Incomplete Records

- Series: MAY 2016

- Uploader: Joseph