- 20 Marks

Question

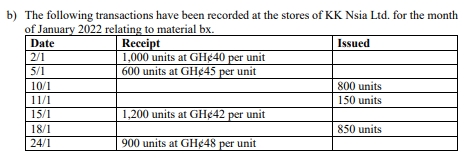

a) The following data has been extracted from the books of ABC Ltd for the month of October 2023.

| Date | Description |

|---|---|

| 2/10/2023 | Bought 200 units @ GH₵100 per unit |

| 5/10/2023 | Bought 150 units @ GH₵120 per unit |

| 8/10/2023 | Issued 120 units |

| 12/10/2023 | Bought 100 units @ GH₵90 per unit |

| 20/10/2023 | Issued 140 units |

| 24/10/2023 | Bought 300 units @ GH₵150 per unit |

| 28/10/2023 | Issued 210 units |

Required:

Using the FIFO method, calculate the value of the closing inventory. (10 marks)

b) Identify FOUR (4) pieces of information that can be seen on an invoice. (5 marks)

c) Preka body lotion is a product produced from the combination of two materials: prekese and kakaduro. Preka body lotion has a standard direct material cost as follows:

| Material | Quantity (kg) | Cost per kg (GH₵) | Total Cost (GH₵) |

|---|---|---|---|

| Prekese | 6 | 15 | 90 |

| Kakaduro | 10 | 10 | 100 |

During period one, 1,000 units of Preka body lotion were manufactured, using 11,700 kilograms of prekese and 10,000 kilograms of kakaduro, costing GH₵98,600 and GH₵78,000 respectively.

Required:

Calculate the following variances for prekese and kakaduro:

i) The direct material price variance (2.5 marks)

ii) The direct material usage variance (2.5 marks)

Answer

a) ABC Ltd – Calculation of Closing Inventory Using FIFO Method

| Date | Receipt/Issued | Balance |

|---|---|---|

| 2/10/2023 | 200 @ GH₵100 | 200 @ GH₵100 = GH₵20,000 |

| 5/10/2023 | 150 @ GH₵120 | 200 @ GH₵100 = GH₵20,000 |

| 150 @ GH₵120 = GH₵18,000 | ||

| Total = GH₵38,000 | ||

| 8/10/2023 | Issued 120 @ GH₵100 | 80 @ GH₵100 = GH₵8,000 |

| 150 @ GH₵120 = GH₵18,000 | ||

| Total = GH₵26,000 | ||

| 12/10/2023 | 100 @ GH₵90 | 80 @ GH₵100 = GH₵8,000 |

| 150 @ GH₵120 = GH₵18,000 | ||

| 100 @ GH₵90 = GH₵9,000 | ||

| Total = GH₵35,000 | ||

| 20/10/2023 | Issued 140 | 80 @ GH₵100 = GH₵8,000 |

| 60 @ GH₵120 | 90 @ GH₵120 = GH₵10,800 | |

| 100 @ GH₵90 = GH₵9,000 | ||

| Total = GH₵19,800 | ||

| 24/10/2023 | 300 @ GH₵150 | 90 @ GH₵120 = GH₵10,800 |

| 100 @ GH₵90 = GH₵9,000 | ||

| 300 @ GH₵150 = GH₵45,000 | ||

| Total = GH₵64,800 | ||

| 28/10/2023 | Issued 210 | 20 @ GH₵150 |

| 280 @ GH₵150 = GH₵42,000 | ||

| Total = GH₵42,000 |

Closing Inventory:

- 280 units @ GH₵150 per unit = GH₵42,000

(10 marks)

b) Information That Can Be Seen on an Invoice:

- Payment Due Date: The date by which the payment is expected.

- Unique Invoice Number: A specific number that identifies the invoice.

- Description of Products/Services Sold: Details of what has been purchased.

- Quantity and Price of Each Product/Service: The amount and cost per unit of the items listed. (4 points @ 1.25 marks each = 5 marks)

c)

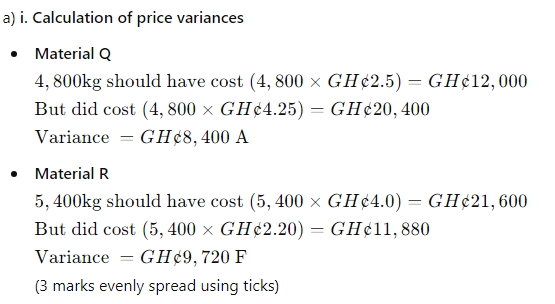

i) Direct Material Price Variance

| Material | Calculation | Variance (Favorable/Adverse) |

|---|---|---|

| Prekese | (11,700 kg × GH₵15) – GH₵98,600 | GH₵76,900 Favorable (F) |

| Kakaduro | (10,000 kg × GH₵10) – GH₵78,000 | GH₵22,000 Favorable (F) |

Prekese Price Variance:

- 11,700 kg should have cost GH₵175,500, but did cost GH₵98,600

- Variance = GH₵76,900 Favorable (F)

Kakaduro Price Variance:

- 10,000 kg should have cost GH₵100,000, but did cost GH₵78,000

- Variance = GH₵22,000 Favorable (F)

(2.5 marks)

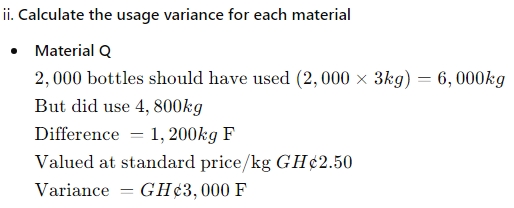

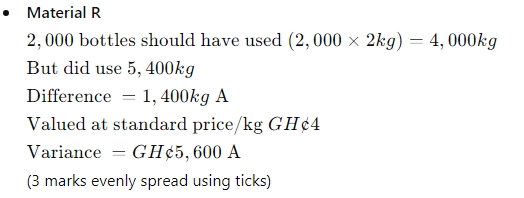

ii) Direct Material Usage Variance

| Material | Calculation | Variance (Favorable/Adverse) |

|---|---|---|

| Prekese | (1,000 units × 6 kg) – 11,700 kg = 5,700 kg | GH₵85,500 Adverse (A) |

| Kakaduro | (1,000 units × 10 kg) – 10,000 kg = 0 kg | No Variance |

Prekese Usage Variance:

- 1,000 units should have used 6,000 kg, but did use 11,700 kg

- Variance = 5,700 kg × GH₵15 = GH₵85,500 Adverse (A)

Kakaduro Usage Variance:

- 1,000 units should have used 10,000 kg, but did use 10,000 kg

- Variance = 0 kg (No Variance)

(2.5 marks)

- Tags: FIFO, Inventory Valuation, Material Price Variance, Material Usage Variance

- Level: Level 1

- Uploader: Joseph