- 20 Marks

Question

a) Most organisations use time as a basis to reward their employees, hence they pay their staff on a time basis using clock-in devices. Employers are therefore likely to pay for attendance instead of tasks performed. Accountants believe that employees should be rewarded based on tasks, however, not all tasks can easily be rewarded on a time basis.

Required:

i) State THREE (3) factors that should be considered when deciding to use a time-based reward system. (6 marks)

ii) State THREE (3) measures that can be put in place to ensure that employees do not only report for work but execute their tasks as required. (6 marks)

b) State THREE (3) challenges management may face in implementing group bonus schemes. (3 marks)

c) Standard costing among other advantages is used for performance measurement and control reporting.

Required:

Explain how the above uses of standard costing are measured. (5 marks)

Answer

a) i) Factors to consider in deciding to use a time-based reward system:

- Nature of the Job: When the job is difficult to quantify in terms of output, such as creative or intellectual work.

- Quality Over Quantity: When the quality of work is more important than the quantity, ensuring meticulous and error-free output.

- Teamwork Requirement: When tasks are performed by several individuals collaboratively, making it hard to measure individual contributions separately. (Any 3 points @ 2 marks each = 6 marks)

ii) Measures to put in place to ensure employees work effectively:

- Supervision: Regular monitoring and supervision to ensure tasks are being completed as required.

- Task Assignment: Providing additional tasks when previous ones are completed to keep employees engaged and productive.

- Incentives: Offering incentives for high performers to motivate employees to complete their tasks efficiently. (Any 3 points @ 2 marks each = 6 marks)

b) Challenges of implementing group bonus schemes:

- Distribution Issues: Problems in fairly distributing the bonus among group members.

- Identifying High Performers: Difficulty in recognizing individual high performers within the group.

- Task Separation: Challenges in separating tasks to determine individual contributions.

- Demotivation of Hard Workers: Potential demotivation of hardworking employees if lazy workers unduly qualify for bonuses. (Any 3 points @ 1 mark each = 3 marks)

c) Uses of standard costing for performance measurement and control reporting:

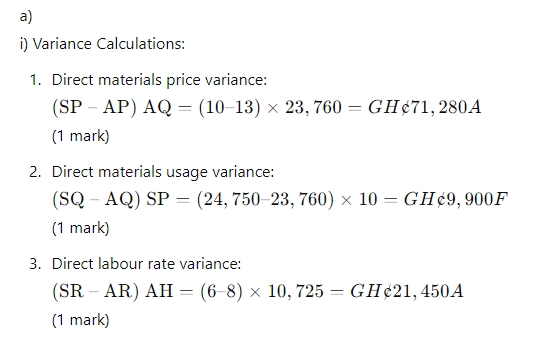

- Performance Measurement: Variances between standard costs (expected costs) and actual costs are measured regularly. These variances help identify areas of good performance or poor performance. Positive variances indicate efficient performance, while negative variances highlight areas needing improvement. (2.5 marks)

- Control Reporting: Variance analysis helps management identify significant deviations from expected performance. If actual results significantly differ from standard costs, management investigates the causes and implements corrective actions to control and improve operations. This ensures that operations are aligned with organizational goals. (2.5 marks)

- Topic: Standard Costing and Variance Analysis

- Series: APR 2022

- Uploader: Joseph