- 6 Marks

Question

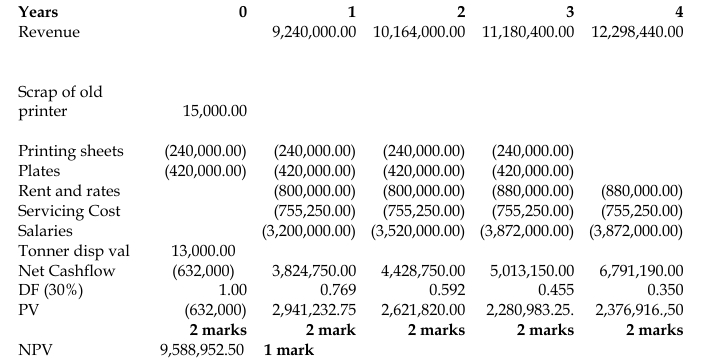

Would you advise the company to continue to take the bank loan to pay for the cost of

inventory purchases within the discount period to enjoy the supplier’s early settlement

discount? Support your answer with relevant computations.

Answer

Financing method

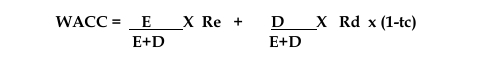

The company should continue utilizing the bank loan to finance inventory purchases within the discount period to benefit from the discount. This recommendation is based on the fact that the annualized cost of the bank loan is 30%, which is lower than the implied annualized interest cost of trade credit, calculated at 37.2%. By opting to borrow and pay early, the company can reduce financing costs by approximately 7.2%, compared to forgoing the discount and using the full credit period.

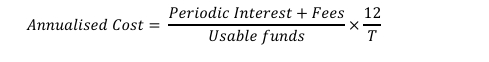

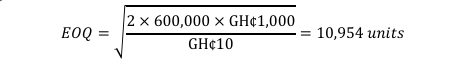

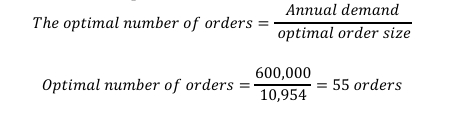

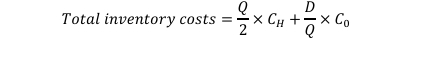

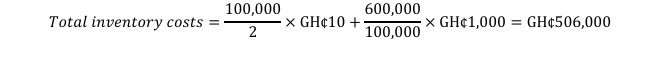

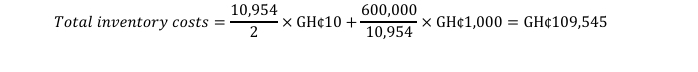

Annualized Cost of the Bank Loan

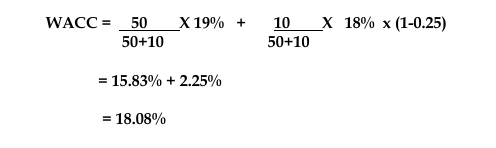

As a form of short-term borrowing, the annualized cost of the bank loan can be calculated as follows:

Assuming the company continues with its current purchase strategy of buying 100,000 units at a purchase price of GH¢120, it would need to borrow GH¢12,000,000. The annualized cost of the loan, therefore, would be 30%:

Periodic Interest = 24% × ¼ × GH¢12,000,000 = GH¢720,000

Processing fee = 1.5% × GH¢12,000,000 = GH¢180,000

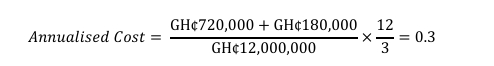

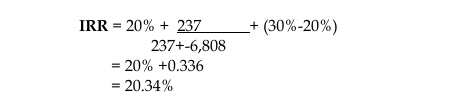

Implied Interest Cost of the Settlement Discount

The cost associated with not taking advantage of the settlement discount, thereby utilizing the full 30-day credit period, is 37.2%:

![]()

Discount = 2% × GH¢12,000,000 = GH¢240,000

T = the effective credit period = 30 – 10 = 20![]()

- Tags: Bank Loan, Early Settlement Discount, Inventory Financing

- Level: Level 2

- Topic: Inventory Management

- Series: MAY 2021

- Uploader: Uploader1

Final Answer:

Final Answer: