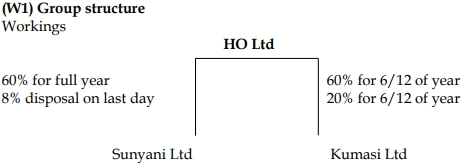

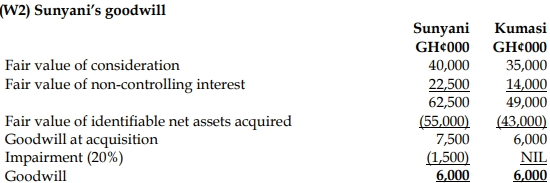

On 1 October 2016, HO acquired 60% of the equity interest of Sunyani, a public limited company in Ghana. The purchase consideration is made up of cash of GH¢40 million and the fair value of the identifiable net assets acquired was GH¢55 million at that date. The fair value of the non-controlling interest (NCI) in Sunyani was GH¢22.5 million on 1 October 2016.

HO wishes to use the ‘full goodwill’ method for all acquisitions. The share capital and retained earnings of Sunyani were GH¢12.5 million and GH¢32.5 million respectively, and other components of equity were GH¢3 million at the date of acquisition. The excess of the fair value of the identifiable net assets at acquisition is due to non-depreciable land. Goodwill has been tested for impairment annually and as at 30 September 2017 had reduced in value by 20%. However, at 30 September 2018, the impairment of goodwill had reversed and goodwill was valued at GH¢1 million above its original value. This upward change in value has already been included in the draft financial statements of HO below prior to the preparation of the group accounts.

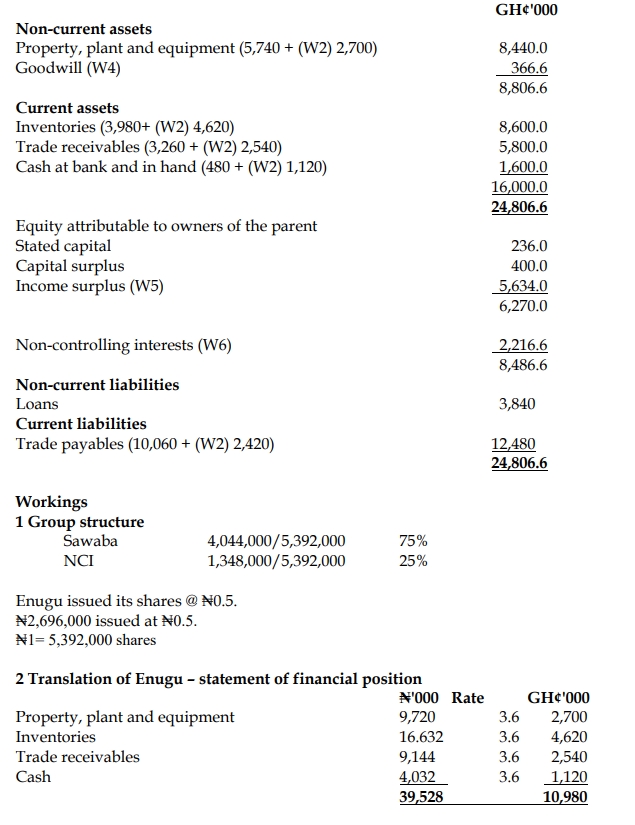

HO group:

Draft statements of profit or loss and other comprehensive income for the year ended 30 September 2018

|

HO (GH¢’000) |

Sunyani (GH¢’000) |

Kumasi (GH¢’000) |

| Revenue |

200,000 |

57,500 |

35,000 |

| Cost of sales |

(156,000) |

(32,500) |

(18,000) |

| Gross profit |

44,000 |

25,000 |

17,000 |

| Other income |

10,500 |

3,500 |

1,000 |

| Administrative costs |

(7,500) |

(4,500) |

(6,000) |

| Other expenses |

(17,500) |

(9,500) |

(4,000) |

| Operating profit |

29,500 |

14,500 |

8,000 |

| Finance costs |

(2,500) |

(1,500) |

(2,000) |

| Finance income |

3,000 |

2,500 |

4,000 |

| Profit before tax |

30,000 |

15,500 |

10,000 |

| Income tax expense |

(9,500) |

(4,500) |

(2,500) |

| Profit for the year |

20,500 |

11,000 |

7,500 |

| Other comprehensive income – revaluation surplus |

5,000 |

– |

– |

| Total comprehensive income for year |

25,500 |

11,000 |

7,500 |

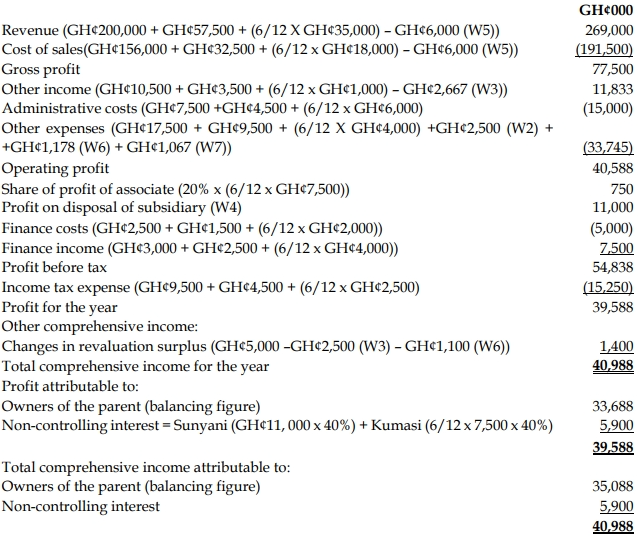

The following information is relevant:

i) HO disposed of an 8% equity interest in Sunyani on 30 September, 2018 for a cash consideration of GH¢9 million and had accounted for the gain or loss in other income. The carrying value of the net assets of Sunyani Ltd at 30 September, 2018 was GH¢60 million before any adjustments on consolidation. HO accounts for investments in subsidiaries using IFRS 9 financial instruments and has made an election to show gains and losses in other comprehensive income. The carrying value of the investment in Sunyani was GH¢45 million at 30 September 2017 and GH¢47.5 million at 30 September, 2018 before the disposal of the equity interest.

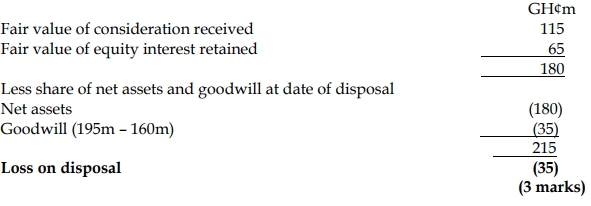

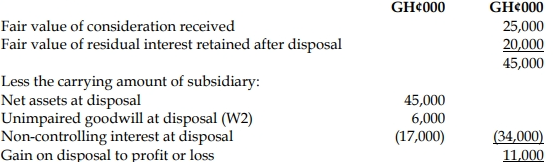

ii) HO acquired 60% of the equity interest of Kumasi Ltd, a limited liability company also in Ghana on 30 September, 2016. The purchase consideration was cash of GH¢35 million. Kumasi’s identifiable net assets were fair valued at GH¢43 million and the non-controlling interest had a fair value of GH¢14 million at that date. On 1 April 2018, HO disposed off a 40% equity interest in Kumasi for a consideration of GH¢25 million. Kumasi’s identifiable net assets were GH¢45 million and the value of the non-controlling interest was GH¢17 million at the date of disposal. The remaining equity interest was fair valued at GH¢20 million. After the disposal, HO exerts significant influence. Any increase in net assets since acquisition has been reported in profit or loss and the carrying value of the investment in Kumasi had not changed since acquisition. Goodwill had been tested for impairment and found that no impairment was required. No entries had been made in the financial statements of HO for this transaction other than for cash received.

iii) HO sold inventory to Sunyani for GH¢6 million at fair value. HO made a loss on the transaction of GH¢1 million and Sunyani still holds GH¢4 million in inventory at the year end.

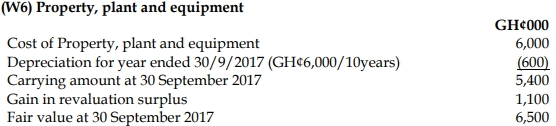

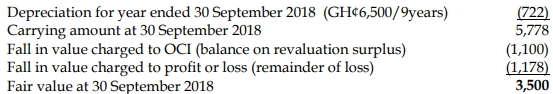

iv) On 1 October 2016, HO purchased an item of property, plant and equipment for GH¢6 million and this is being depreciated using the straight line basis over 10 years with a nil residual value. At 30 September 2017, the asset was revalued to GH¢6.5 million but at 30 September 2018, the value of the asset had fallen to GH¢3.5 million. HO uses the revaluation model to value its non-current assets. The effect of the revaluation at 30 September 2018 had not been taken into account in total comprehensive income but depreciation for the year had been charged.

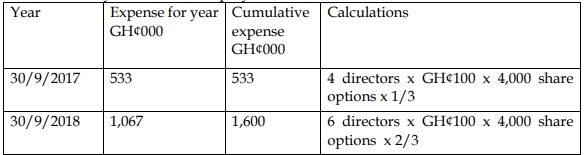

v) On 1 October 2016, HO made an award of 4,000 share options to each of its seven directors. The condition attached to the award was that the directors must remain employed by HO for three years. The fair value of each option at the grant date was GH¢100 and the fair value of each option at 30 September 2018 was GH¢110. At 30 September 2017, it was estimated that three directors would leave before the end of three years. Due to an economic downturn, the estimate of directors who were going to leave was revised to one director at 30 September 2018. The expense for the year as regards the share options had not been included in profit or loss for the current year and no director had left by 30 September 2018.

Required:

Prepare a consolidated statement of profit or loss and other comprehensive income for the year ended 30 September 2018 for the HO group.