- 20 Marks

Question

a) Accounting principles and concepts are of fundamental importance in the preparation of financial statements.

Required:

With the aid of relevant examples, outline your understanding on any FOUR (4) of the following concepts/principles: i) Accruals

ii) Going Concern

iii) Historical Cost

iv) Materiality

v) Break up basis

(10 marks)

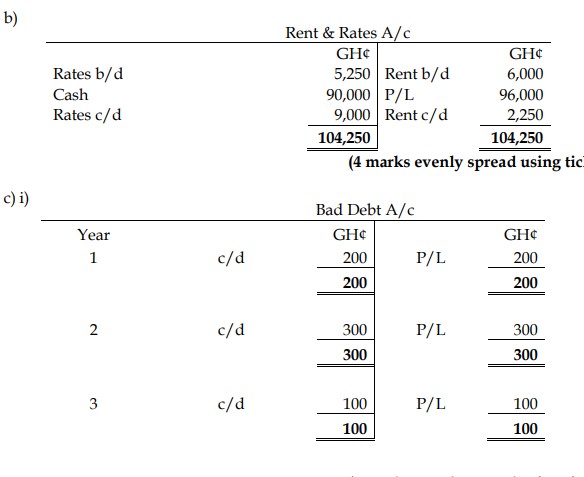

b) Patricia Ltd prepares accounts to 31 December each year. The following transactions relate to Rent and Rates: i) 31 December 2018 three months’ rent owing amounted to GH¢6,000.

ii) 31 December 2018 two months rates prepaid amounted to GH¢5,250.

iii) During the year 2019, cash paid for rent and rates amounted to GH¢90,000

iv) Rent owing as at 31 December 2019 amounts to GH¢9,000

v) Rates prepaid as at 31 December 2019 amounts to GH¢2,250

Required:

Prepare a combined rent and rates account to disclose the amount that is chargeable to the profit or loss account for the year ended 31 December, 2019.

(4 marks)

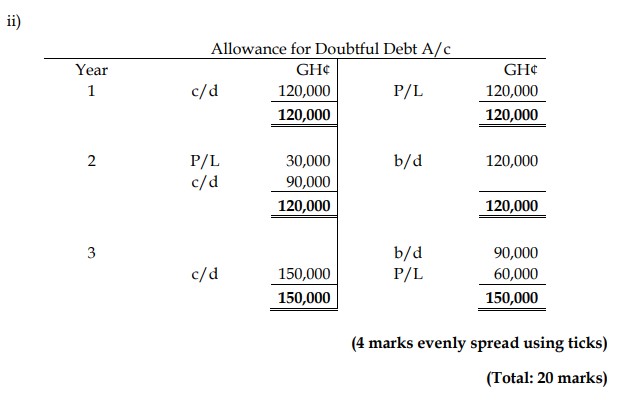

c) The following information was extracted from the books of Maanaa and Co.:

| Year | Bad debts written off (GH¢) | Trade Receivables (GH¢) | Allowance for doubtful debt (%) |

|---|---|---|---|

| 1 | 200,000 | 1,200,000 | 10 |

| 2 | 300,000 | 1,800,000 | 5 |

| 3 | 100,000 | 3,000,000 | 5 |

Required:

Prepare the following accounts for the 3 years to determine the amount chargeable to the Profit or Loss account:

i) Bad debts written off account (2 marks)

ii) Allowance for doubtful debt account (4 marks)

Answer

a)

Accruals

Income is recognized in the financial statements as it is earned, not when the cash is received. Expenditure is recognized as it is incurred, not when it is paid for. When income is incurred over time (e.g., rental/interest income) or expenditures are time-based (e.g., rent payments), the income and expenditure recognized in the income statement should relate to the time period, not to the receipts and payments of cash. For example, the sale of a good is recognized in the financial statements when the rights and rewards of ownership have passed from the seller to the purchaser not when the cash is received.

Going Concern

Financial transactions are usually prepared on the assumption that the business will continue in operational existence for the foreseeable future. This means that the financial statements are drawn up on the assumption that there is no intention or necessity to close down the business. If the financial statements are not prepared on the going concern basis, then they must be prepared on what is known as the break-up basis. The break-up basis reflects the following:

- Some non-current assets may be sold at less than their value on the statement of financial position, whilst a machine may have a use for specific business, it may be scrap or no use to other businesses.

- In contrast, property may be sold for a value in excess of that shown in the statement of financial position based on original cost.

- If the entire inventory is sold at once, then it will not be sold for as much money as if it were sold in the normal way.

- Some receivables may decide not to pay the business if it is known the business is about to go into liquidation.

In most cases, financial statements are prepared on a going concern basis unless there is evidence to the contrary.

Historical Cost

Assets are recorded at historical cost, i.e., what they were bought for. Liabilities are valued at the amount initially received in exchange for the obligation. Thus, the figure shown in the financial statements for an item is the value of the item when the transaction occurred, not its current market value. Historical cost has many drawbacks, a significant one being that the non-current assets of the business tend to be undervalued and therefore the statement of financial position does not show the true value of the business. Historical cost continues to be used, however, for the following reasons: it is simple and cheap to apply, figures used are objective and verifiable, and the lack of a sound and acceptable alternative. An example of the historical cost concept is valuing buildings at a cost price of GH¢100,000 even though the current market value of the buildings is GH¢250,000.

Materiality

Materiality is a threshold quality that is demanded of all information given in the financial statements. When immaterial information is given in the financial statements, the resulting clutter can impair the understandability of the other information provided. An item’s size is judged in the context both of the financial statements as a whole and of the other information available to users that would affect their evaluation of the financial statements. An example of a material item is the value of non-current assets of GH¢250,000 in the financial statement of an entity with total assets of GH¢320,000. The non-current assets are material to the financial statements of the entity.

(4 principles well explained @ 2.5 = 10 marks)

- Tags: Accruals, Allowance for Doubtful Debt, Bad Debts, Break-up Basis, Going Concern, Historical Cost, Materiality, Rates, Rent

- Level: Level 1

- Uploader: Kwame Aikins