- 20 Marks

Question

Mr. Antitom (physically challenged) was employed as a Chief Accountant of Nangode Ltd on 1 April 2020 on an annual basic salary of GH¢60,000 x 10,000 – GH¢100,000. He was entitled to the following monthly allowances and benefits:

Allowances & Benefits Monthly Amount (GH¢)

Responsibility Allowance 4,400

Professional Allowance 6,600

House Help Allowance 8,200

Utilities 4,200

Overtime Allowance 6,000

Provision of furnished accommodation by the employer for which he paid 5% of his basic salary.

Provision of vehicle and fuel by the employer for both official and private use.

Bonus payment amounting to 25% of his basic salary.

He contributed 5.5% of his basic salary to the Mandatory Pension Scheme and an additional 10% to a Voluntary Pension Scheme approved by the National Pension Regulatory Authority.

Married with 3 children, 2 in approved Senior High Schools in Ghana, 1 at the University of South Africa.

Earned interest of GH¢4,000 on a savings account with Kilma Bank.

Received a net dividend of GH¢20,480 from an investment with Enoga Securities.

Required:

Compute the chargeable income of Mr. Antitom for the 2022 year of assessment.

(20 marks)

Answer

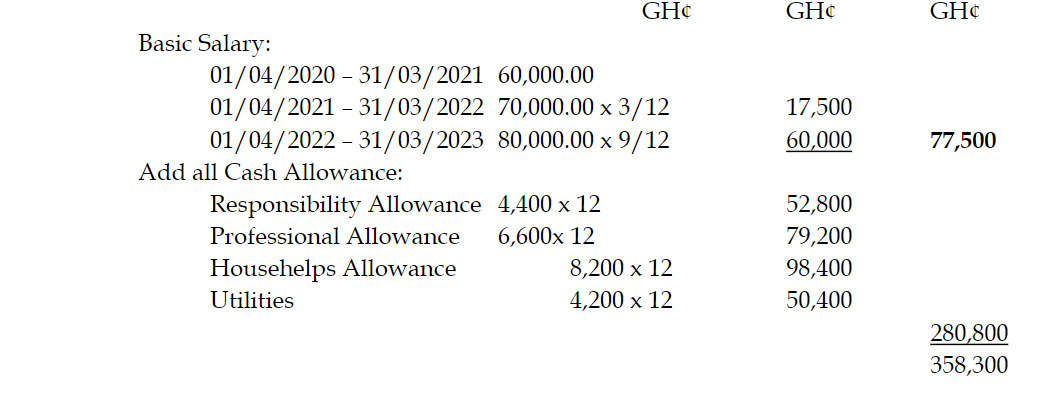

Antitom Computation Of Chargeable Income Year Of Assessment: 2022

Basis Period: January to December, 2022

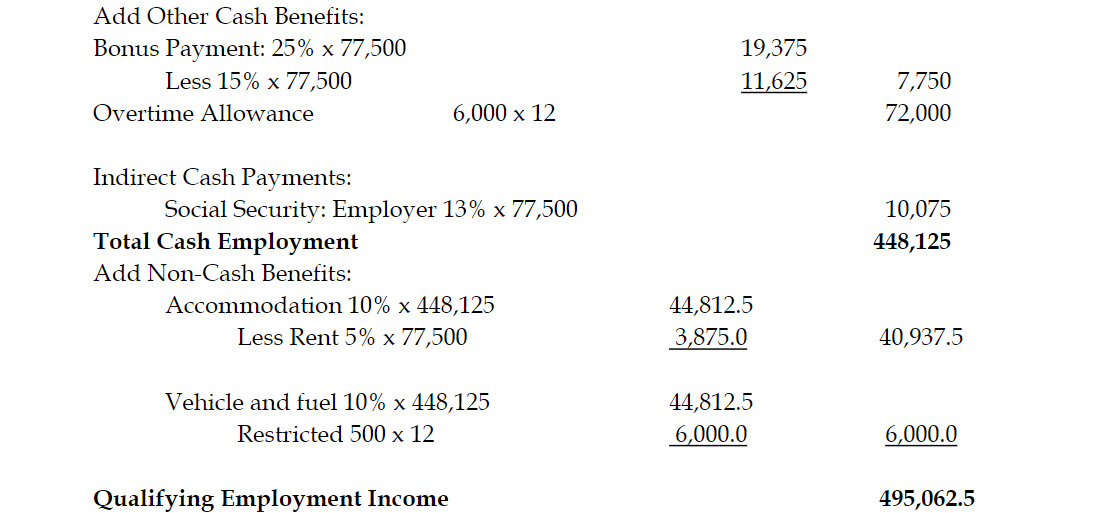

Add Other Cash Benefits:

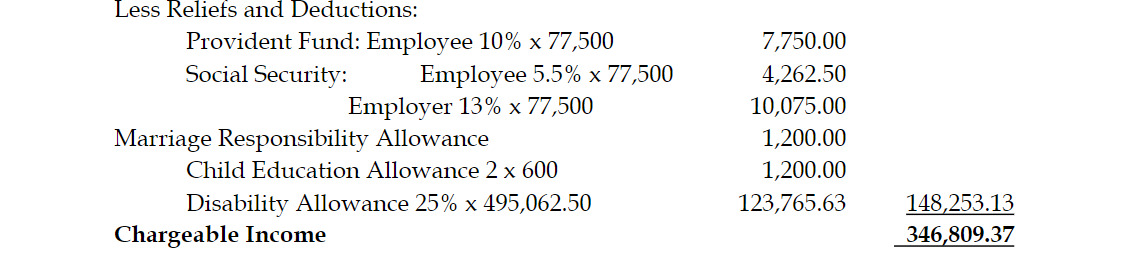

Less Reliefs and Deductions:

Note: Candidates who considered the non-taxation of interest and dividend income correctly were awarded marks.

(20 marks evenly spread using ticks)

- Topic: Taxation of Employment Income

- Series: NOV 2023

- Uploader: Cheoli