- 16 Marks

Question

NASA Ltd commenced business on 1 October 2017, preparing accounts to 31 December each year. Accordingly, the company has the following extracts from its financial records on non-current assets:

Year 2017

- Purchased Office furniture and fittings costing GH¢40,000.

- Purchased office Air conditioners at the cost of GH¢20,000.

- The company bought a land costing GH¢55,000.

- Bought office building at the cost of GH¢700,000.

- Purchased a computer at the cost of GH¢1,500.

- Purchased office Photocopier at the cost of GH¢2,500.

Year 2018

- Purchased a Television Set for the office at the cost of GH¢3,500.

- Bought a 4×4 Vehicle (7-passenger-seater) for an amount of GH¢200,000.

- Purchased a File Cabinet for GH¢2,000.

Year 2019

- Exchanged the vehicle bought in 2018 for four plots of land valued at GH¢200,000.

- Paid for a Trade Mark costing GH¢15,000, which was licensed for ten years.

- Purchased a business that resulted in Goodwill of GH¢100,000. The company decided to amortize the goodwill over 20 years.

Year 2020

- Bought a home-used motor vehicle at the cost of GH¢70,000.

- Purchased office computers for GH¢5,000.

- Purchased Trucks and Trailers for GH¢50,000.

- Sold some of the office furniture for GH¢3,000.

Required:

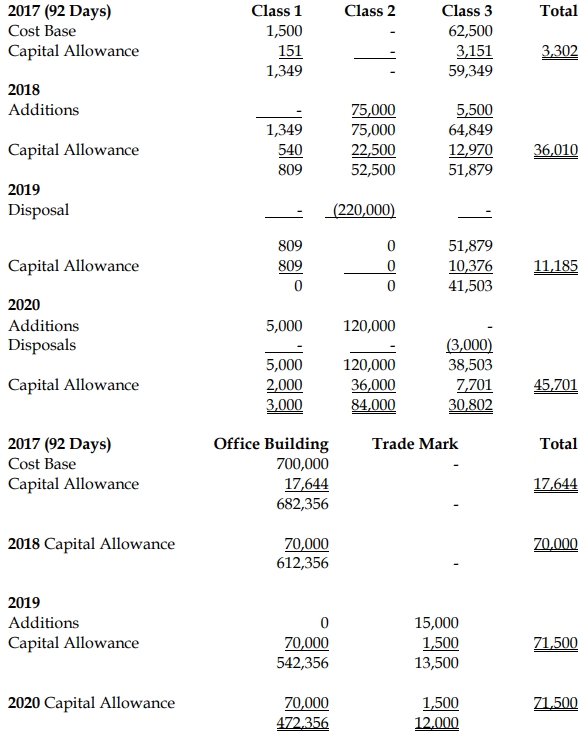

Calculate the amount of capital allowance claimable for 2017, 2018, 2019, and 2020 years of assessment. (16 marks)

Answer

NASA Ltd

Computation of Capital Allowance (Amounts in GH¢)

- Tags: Capital Allowance, Corporate Tax, Depreciation, Non-current Assets, Tax computation

- Level: Level 2

- Topic: Corporate Tax Liabilities

- Series: NOV 2021

- Uploader: Theophilus