- 14 Marks

Question

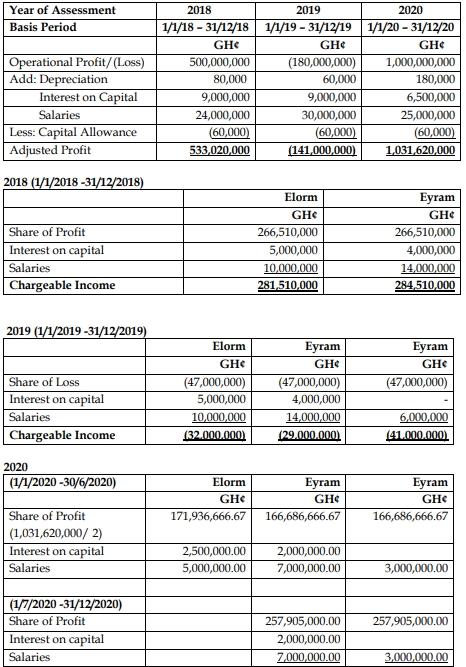

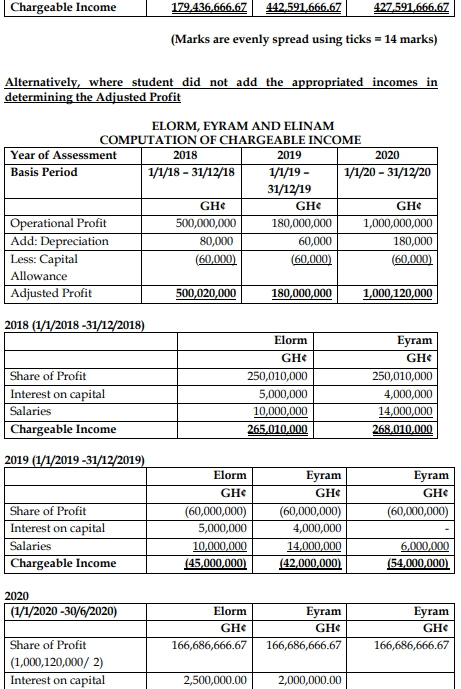

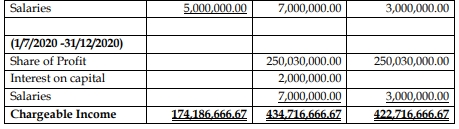

Elorm and Eyram entered into a partnership on 1 January 2018 to produce hair products. They agreed to share profit and losses equally after charging:

- Annual Salaries: Elorm: GH¢10,000,000, Eyram: GH¢14,000,000.

- Interest on capital of 5% p.a. was deducted from the profit.

- Depreciation deducted from the profits for the various years of assessment were GH¢80,000 (2018), GH¢60,000 (2019), and GH¢180,000 (2020).

- Capital contributed by the partners: Elorm: GH¢100,000,000, Eyram: GH¢80,000,000.

- To introduce a new product, they invited Elinam to join the partnership on 1 January 2019. Elinam was to receive a salary of GH¢6,000,000 annually in addition to an equal share of profit. He will not be entitled to interest on his capital of GH¢60,000,000.

- Elorm resigned as a partner on 30 June 2020 after being elected as a Member of Parliament.

- Operational profit/loss of the partnership: GH¢500,000,000 (2018), GH¢(180,000,000) (2019), GH¢1,000,000,000 (2020).

- Capital allowance of GH¢60,000 has been granted by Ghana Revenue Authority for each year of assessment.

Required:

Compute the chargeable income of Elorm, Eyram, and Elinam for the 2018, 2019, and 2020 years of assessment. (14 marks)

Answer

ELORM, EYRAM AND ELINAM

COMPUTATION OF CHARGEABLE INCOME

- Tags: Capital Allowance, chargeable income, Partnership Income

- Level: Level 2

- Topic: Income Tax Liabilities

- Series: AUG 2022

- Uploader: Theophilus