- 10 Marks

Question

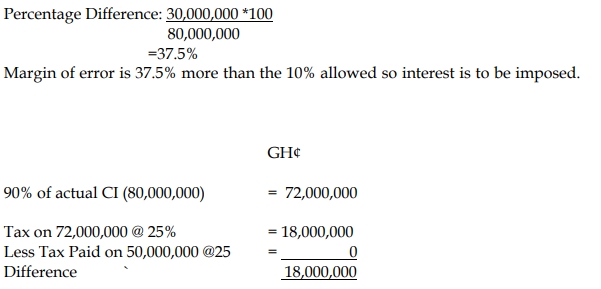

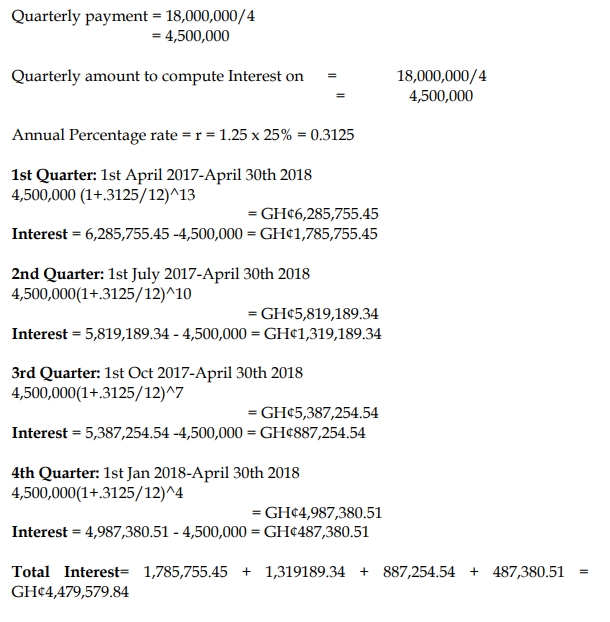

The estimated chargeable income for Vito Ltd for the 2019 year of assessment was GH¢50,000,000, but its actual chargeable income declared at the end of the year was GH¢80,000,000. The company prepares accounts to 31 December each year. The company submitted its returns on 30 April, 2020. The BOG prevailing discount rate is 25%.

Required:

Calculate the interest for underestimation of tax.

Answer

Percentage Difference Calculation:

- Tags: chargeable income, Income Tax, Interest calculation, Underestimation of Tax

- Level: Level 2

- Topic: Income Tax Liabilities

- Series: AUG 2022

- Uploader: Theophilus