- 10 Marks

Question

Lukay is a wholesaler who is into the distribution of soft drinks. Lukay has been in operation for some time now, and the following transactions in relation to sales occurred in the first 3 years:

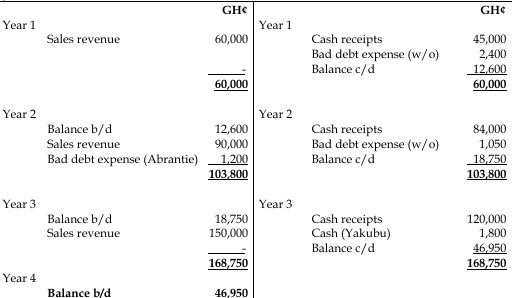

Year 1

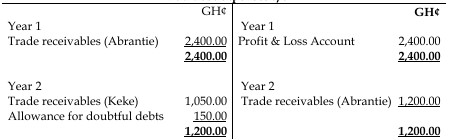

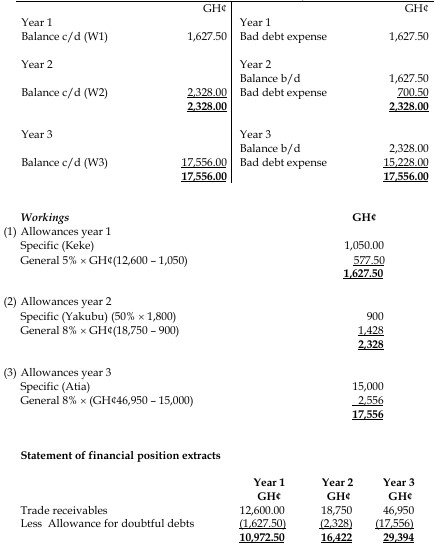

Lukay made credit sales of GH¢60,000 and received GH¢45,000 from his credit customers. At the end of the year, she decided to write off Abrantie’s debt of GH¢2,400, made a specific allowance for Keke’s debt totaling GH¢1,050, and created a general allowance of 5% of the remaining trade receivables balance.

Year 2

During the second year of trading, Lukay made credit sales of GH¢90,000 and received cash of GH¢84,000, including GH¢1,200 from Abrantie. He decided to write off Keke’s debt and create a specific allowance against 50% of Yakubu’s total debt of GH¢1,800. He decided that his general allowance should now be 8% of the remaining trade receivables balance.

Year 3

Lukay made credit sales of GH¢150,000 and received cash of GH¢120,000. Additionally, he also received a cheque from Yakubu for GH¢1,800. At the year-end, he decided to create a specific allowance against Atia’s debt of GH¢15,000 and maintained his general allowance at 8%.

Required:

For each of the above years, show the trade receivables account, bad debt expense account, and allowance for doubtful debts account, and the statement of financial position extract as at each year-end. (10 marks)

Answer

Trade Receivables Account

Tutorial Notes:

- Recovery of Written-Off Debts: If Abrantie’s receipt was not included in the GH¢280,000 but recorded as a receipt from a non-active customer, it should be credited directly to the bad debt expense account as a recovery.

- Allowance Adjustment: There’s no need to adjust Keke’s write-off against the allowance account, even if it was previously provided for. The previously made allowance is “released” to the expense account since it’s no longer needed.

- Provision vs. Write-Off: Since Yakubu’s debt was only provided against and not written off, a “reinstatement” adjustment would be incorrect.

Bad debt expenses a/c

Allowance for doubtful debts a/c

- Tags: Allowance for Doubtful Debts, Bad Debts, Sales Revenue, Trade receivables

- Level: Level 1

- Topic: Bad and doubtful debt

- Series: MAR 2024

- Uploader: Theophilus