- 20 Marks

Question

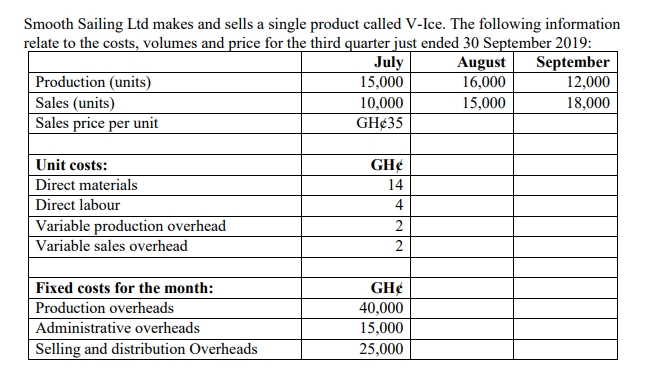

Additional information:

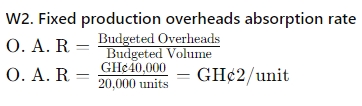

Fixed production overheads are budgeted to be GH¢40,000 per month for a budgeted monthly

production of 20,000 units. Production overheads are absorbed on a unit of production basis.

Required:

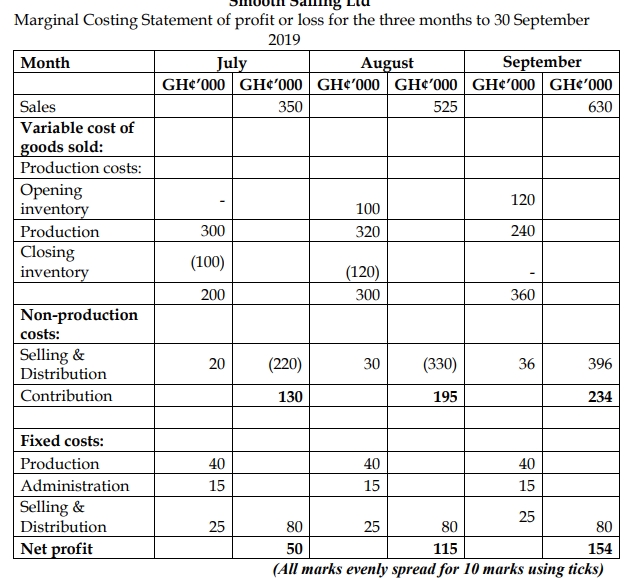

a) Using marginal costing principles, prepare a statement of profit or loss for the THREE (3)

months to September 2019. (10 marks)

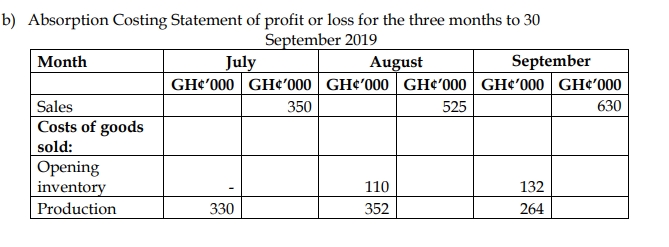

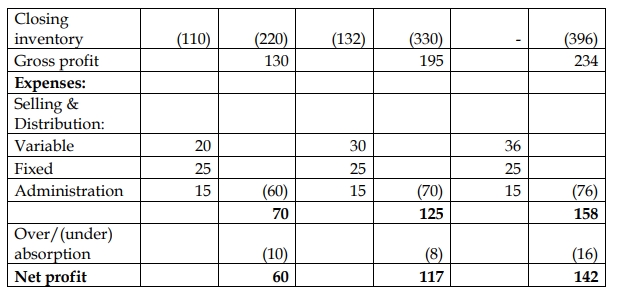

b) Using absorption costing principles, prepare a statement of profit or loss for the THREE (3)

months to September 2019. (10 marks)

Answer

Workings (W):

W1. Computation of product cost per unit

| Marginal Costing | Absorption Costing | |

|---|---|---|

| Direct material | GH¢14 | GH¢14 |

| Direct labour | GH¢4 | GH¢4 |

| Variable overheads | GH¢2 | GH¢2 |

| Fixed overheads (W2) | – | GH¢2 |

| Total cost per unit | GH¢20 | GH¢22 |

W3. Over/ (Under) Absorption

| Month | July | August | September |

|---|---|---|---|

| GH¢’000 | GH¢’000 | GH¢’000 | |

| Overheads absorbed | 30,000 | 32,000 | 24,000 |

| Overheads incurred | 40,000 | 40,000 | 40,000 |

| Over/(under) absorption | (10,000) | (8,000) | (16,000) |

| (All marks evenly spread for 10 marks using ticks) |

- Tags: Absorption Costing, Marginal Costing, Profit or Loss Statement

- Level: Level 1

- Topic: Marginal Costing and Absorption Costing

- Series: MAY 2020

- Uploader: Joseph