- 20 Marks

Question

The following data has been extracted from the operating records of QQQ Ltd for the last two quarters of the year to 31 December 2020:

| Quarter | 3 | 4 |

|---|---|---|

| Production units | 7,000 | 8,500 |

| Sales units | 5,500 | 9,500 |

| Description | Amount (GH¢) |

|---|---|

| Selling price per unit | 100 |

| Direct material cost per unit | 20 |

| Direct labour cost per unit | 15 |

| Variable overheads per unit | 10 |

- Fixed production overheads are budgeted at GH¢120,000 for a budgeted production of 8,000 units per quarter. These overheads are absorbed on a per unit of production basis.

- Non-production overheads comprised:

- Fixed administration expenses GH¢40,000 per quarter

- Selling and distribution expenses 10% of sales

Required:

a) Prepare a statement of profit or loss for each quarter using the Marginal Costing technique. (10 marks)

b) Prepare a statement of profit or loss for each quarter using the Absorption Costing technique. (10 marks)

Answer

a) Marginal Costing Statement of Profit or Loss for the two Quarters to 31st December 2020

| Quarter | 3 | 4 |

|---|---|---|

| GH¢ | GH¢ | |

| Sales (W1) | 550,000 | 950,000 |

| Variable cost of goods sold: | ||

| Opening Inventory | – | (67,500) |

| Production (W2) | 315,000 | 382,500 |

| Closing Inventory | (67,500) | (22,500) |

| Total Variable Production Cost | 247,500 | 427,500 |

| Non-Production Cost: | ||

| Selling & Dist. Cost | 55,000 | 95,000 |

| Total Variable Cost | (302,500) | (522,500) |

| Contribution | 247,500 | 427,500 |

| Fixed Costs: | ||

| Production | 120,000 | 120,000 |

| Non-production | 40,000 | 40,000 |

| Total Fixed Costs | (160,000) | (160,000) |

| Net profit | 87,500 | 267,500 |

b) Absorption Costing Statement of Profit or Loss for the two Quarters to 31st December 2020

| Quarter | 3 | 4 |

|---|---|---|

| GH¢ | GH¢ | |

| Sales | 550,000 | 950,000 |

| Cost of Sales: | ||

| Opening Inventory | – | (90,000) |

| Production | 420,000 | 510,000 |

| Closing Inventory | (90,000) | (30,000) |

| Total Cost of Sales | 330,000 | 570,000 |

| Gross Profit | 220,000 | 380,000 |

| Expense: | ||

| Selling & Dist. | 55,000 | 95,000 |

| Admin. Expenses | 40,000 | 40,000 |

| Total Expenses | (95,000) | (135,000) |

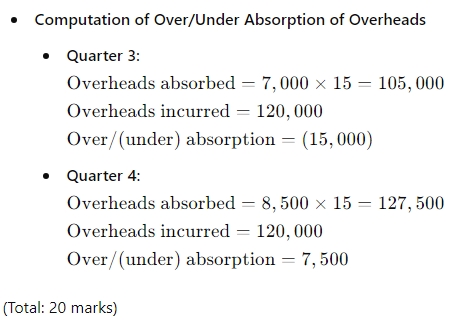

| Over / (Under) Absorption | (15,000) | 7,500 |

| Net Profit | 110,000 | 252,500 |

Workings:

- Computation of Product Cost/unit

- Marginal Costing

- Direct Material Costs: GH¢20

- Direct Labour: GH¢15

- Variable Overheads: GH¢10

- Total Product cost/unit: GH¢45

- Absorption Costing

- Direct Material Costs: GH¢20

- Direct Labour: GH¢15

- Variable Overheads: GH¢10

- Fixed Overheads: GH¢15

- Total Product cost/unit: GH¢60

- Marginal Costing

- Tags: Absorption Costing, Marginal Costing, Profit and Loss Statement

- Level: Level 1

- Topic: Marginal Costing and Absorption Costing

- Series: MAY 2021

- Uploader: Joseph