- 20 Marks

Question

Yevugah has provided you with the following bank statement and bank account details in respect of the month ended 31 January 2018.

Statement Date: 31 January 2018

Account No: 13456892

| Date | Particulars | Debit (GH¢) | Credit (GH¢) | Balance (GH¢) |

|---|---|---|---|---|

| 01-Jan-18 | Balance forward | 55,940 Cr | ||

| 03-Jan-18 | Cheque 596 | 2,500 | 53,440 Cr | |

| 03-Jan-18 | Lodgement | 14,140 | 67,580 Cr | |

| 06-Jan-18 | Cheque 597 | 120 | 67,460 Cr | |

| 06-Jan-18 | Direct debit | 2,020 | 65,440 Cr | |

| 12-Jan-18 | Credit transfer | 4,660 | 70,100 Cr | |

| 13-Jan-18 | Cheque 600 | 1,420 | 68,680 Cr | |

| 14-Jan-18 | Cheque 601 | 12,028 | 56,652 Cr | |

| 16-Jan-18 | Lodgement | 9,000 | 65,652 Cr | |

| 19-Jan-18 | Cheque 599 | 18,004 | 47,648 Cr | |

| 23-Jan-18 | Bank charges for December 2017 | 422 | 47,226 Cr | |

| 25-Jan-18 | Quarterly interest received | 62 | 47,288 Cr | |

| 27-Jan-18 | Dishonoured cheque | 1,600 | 45,688 Cr | |

| 27-Jan-18 | Cheque 598 | 26,090 | 19,598 Cr | |

| 30-Jan-18 | Cheque 603 | 5,048 | 14,550 Cr | |

| 31-Jan-18 | Lodgement | 14,500 | 29,050 Cr | |

| 31-Jan-18 | Standing order: rent first quarter 2018 | 27,000 | 2,050 Cr |

The books and records of Yevugah show the following transactions through the bank account for the month of January 2018:

Required:

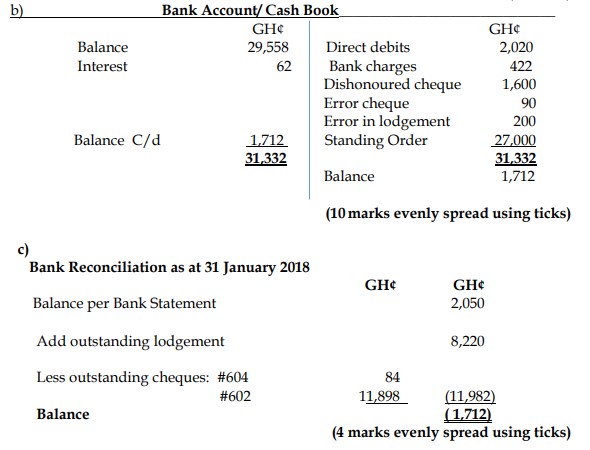

a) Prepare Yevugah’s adjusted cash book including the necessary correcting entries as at 31 January 2018. (The answer format must clearly indicate whether each entry is a debit or credit). (10 marks)

b) Prepare a bank reconciliation as at 31 January 2018. (4 marks)

c) Explain TWO (2) reasons for preparing a bank reconciliation. (6 marks)

Answer

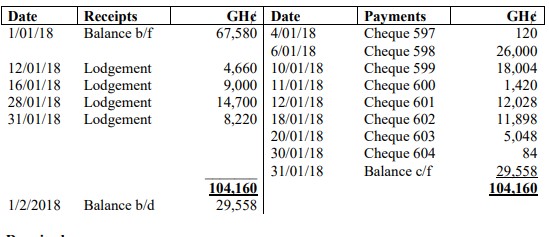

a) Reconciliation of Cash Book and Bank Statement

Opening balance as per bank balance: 55,940

Add outstanding lodgement: 14,140

Less outstanding cheques: (2,500)

Balance as per bank T account: 67,580

c) Reasons for Preparing Bank Reconciliation:

- Identification of Errors: Preparation of regular bank reconciliation will help to identify errors, such as discrepancies between the cash book and the bank statement, which may be due to errors by either the bank or the company.

- Highlighting Unrecorded Transactions: Bank reconciliation helps to identify transactions such as bank charges, direct debits, or dishonoured cheques that may not have been recorded in the cash book until the bank statement is received.

- Tags: Bank Reconciliation, Financial Statements, Suspense Accounts

- Level: Level 1

- Topic: Bank reconciliations

- Series: NOV 2019

- Uploader: Theophilus