- 6 Marks

Question

The accountant of Abeiku Ltd has prepared a trial balance but found that the total of debit balances is GH¢691,680 and the total of credit balances is GH¢689,720.

On investigation, the following errors were discovered in the book-keeping:

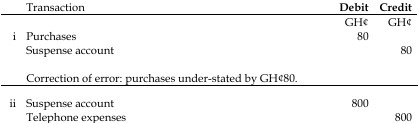

- Total purchases were recorded at GH¢80 below their correct value, although the total value of trade payables was correctly recorded.

- Total telephone expenses were recorded at GH¢800 above their correct amount, although the total value of the amounts payable was correctly recorded.

- Purchase returns of GH¢440 were recorded as a debit entry in the sales returns account, but the correct entry had been made in the trade payables control account.

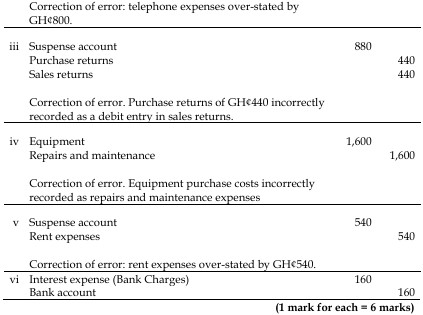

- Equipment costing GH¢1,600 had been recorded as a debit entry in the repairs and maintenance account.

- Rental expenses of GH¢4,392 were entered incorrectly as GH¢4,932 in the expense account but were entered correctly in the bank account in the ledger.

- Bank charges of GH¢160 have been omitted entirely from the ledger.

Required:

i) Prepare journal entries for the correction of the errors. (6 marks)

Answer

b) Abeiku Limited Journal Entries:

- Tags: Adjustments, Bank Reconciliation, Cash Book, Errors

- Level: Level 1

- Topic: Bank reconciliations

- Series: MAR 2024

- Uploader: Theophilus