- 14 Marks

Question

i) Mr. Malik is a sole trader and carries on business under the name “Malik & Company”. The balance on his cash book at 31 December 2023 did not agree with the balance as per the bank statement, which shows a credit balance of GH¢183,750.

An examination of the cash book and bank statement disclosed the following:

- A deposit of GH¢24,600 made on 29 December 2023 and recorded in the cashbook had been credited by the bank on 1 January 2024.

- Bank charges of GH¢850 have not been entered in the cash book.

- A debit of GH¢2,100 appeared on the bank statement for an unpaid cheque which had been returned marked “out of date”. The cheque was re-dated by his customer and paid into the bank again on 3 January 2024. The earlier transaction was recorded in the cashbook.

- A standing order for payment of an annual subscription amounting to GH¢500 has not been entered in the cash book.

- On 26 December 2023, Mr. Malik had given the cashier a cheque for GH¢5,000 to pay into his personal account at the bank. The cashier deposited it into the business account by mistake.

- On 27 December 2023, a customer had made an online transfer of GH¢24,950 in payment against goods supplied. The advice was received and recorded in the cash book on 2 January 2024.

- On 30 September 2023, Mr. Malik entered into a hire purchase agreement and issued a standing order to the bank to pay a sum of GH¢1,300 on day 10 of each month, commencing from October 2023. No entries have been made in the cash book for these payments.

- A cheque for GH¢18,200 received from Mr. Adoboe had been entered twice in the cash book.

Required:

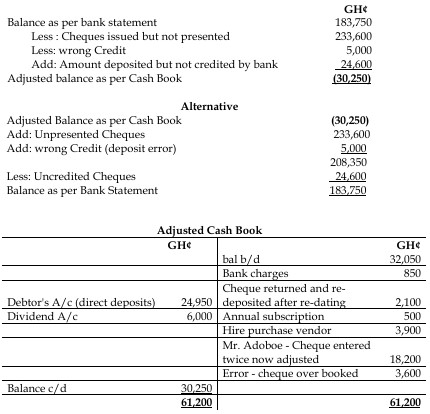

i) Prepare the adjusted cash book for Malik & Company in a format which clearly indicates whether each entry is a debit or credit. (7 marks)

ii) Prepare a reconciliation of the bank statement balance to the adjusted cash book balance. (7 marks)

Answer

a) Malik & Company

Bank Reconciliation Statement as at 31 December, 2023

- Tags: Adjustments, Bank Reconciliation, Cash Book, Errors, Internal Controls

- Level: Level 1

- Topic: Bank reconciliations

- Series: MAR 2024

- Uploader: Theophilus