- 20 Marks

Question

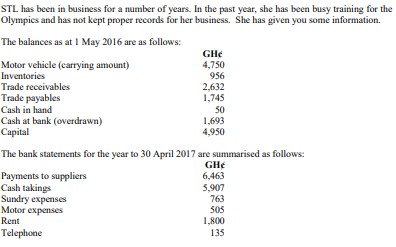

STL has been in business for a number of years. In the past year, she has been busy training for the Olympics and has not kept proper records for her business. She has given you some information.

The balances as at 1 May 2016 are as follows:

The balance on the bank statement at 30 April 2017 was GH¢1,144. There were no timing differences.

You are given the following additional information:

i) Closing inventory is valued at GH¢1,324.

ii) STL took goods which had a cost of GH¢96 and would have been sold for GH¢124 for her own personal use.

iii) A telephone bill was received on 7 July 2017 for GH¢75, this related to the quarter ended 30 June 2017.

iv) Rent includes GH¢1,000 paid on 1 January 2017 for the year to 31 December 2017.

v) STL takes GH¢60 every week out of the takings before banking them. She also spends GH¢20 every week on petrol for the company van.

vi) Depreciation is to be charged at 15% reducing balance.

vii) Closing trade receivables and payables were GH¢2,072 and GH¢967 respectively. However, one customer, Caroline, has vanished and her debt of GH¢575 is not likely to be paid.

viii) STL always keeps a cash float of GH¢50.

ix) STL makes sales to cash and credit customers. Customers taking credit always pay by cheque or bank transfer.

Required:

a) Prepare the statement of profit or loss for STL for the year ended 30 April 2017. (12 marks)

b) Prepare the statement of financial position for STL as at 30 April 2017. (8 marks)

Answer

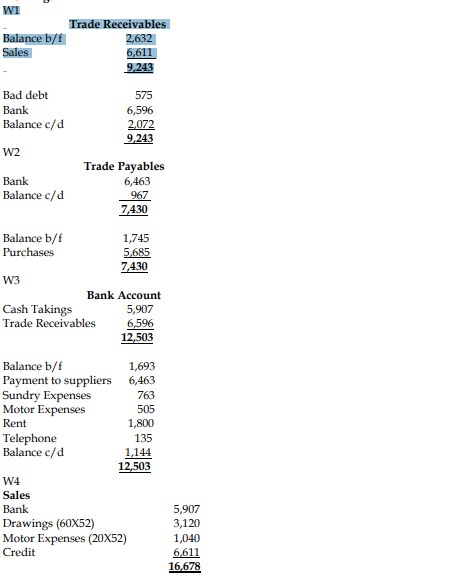

a) STL – Statement of Profit or Loss for the year ended 30 April 2017

| Item | GH¢’000 | GH¢’000 |

|---|---|---|

| Sales (W5) | 16,678 | |

| Less: Cost of Sales | ||

| Opening Inventory | 956 | |

| Purchases (W2) | 5,685 | |

| Drawings | (96) | |

| 6,545 | ||

| Less: Closing Stock | (1,324) | 5,221 |

| Gross Profit | 11,457 | |

| Less Expenses | ||

| Telephone (135+25) | 160 | |

| Rent (1,800 – 667) | 1,133 | |

| Motor Expenses | 1,545 | |

| Sundry Expenses | 763 | |

| Bad Debts | 575 | |

| Depreciation (W5) | 4,889 | |

| Net Profit | 713 | 6,568 |

b) STL – Statement of Financial Position as at 30 April 2017

| GH¢’000 | GH¢’000 | |

|---|---|---|

| Non-Current Assets | ||

| Motor Van | 4,037 | |

| Current Assets | ||

| Inventory | 1,324 | |

| Trade Receivables | 2,072 | |

| Prepayment | 667 | |

| Bank | 1,144 | |

| Cash | 50 | 5,257 |

| Total Assets | 9,294 | |

| Capital and Liabilities | ||

| Capital | 4,950 | |

| Add: Profit | 6,568 | |

| 11,518 | ||

| Less: Drawings (W6) | (3,216) | 8,302 |

| Current Liabilities | ||

| Trade Payables | 967 | |

| Accrual | 25 | 992 |

| Total Capital and Liabilities | 9,294 |

Workings:

W5

Depreciation

Motor Van 4,750 * .15

= 713

W6

Drawings

Cash Takings 3,120 + Goods 96 = 3,216

- Uploader: Theophilus