- 20 Marks

Question

The following trial balance was extracted from the books of Nsaa Zolko, a sole trader, on 31 December 2020:

| Account | Debit (GHȼ) | Credit (GHȼ) |

|---|---|---|

| Land | 251,200 | |

| Equipment | 202,220 | |

| Accumulated depreciation on equipment | 62,830 | |

| Inventory | 49,620 | |

| Receivable and Payable | 124,200 | 104,350 |

| Value Added Tax (refund due) | 10,320 | |

| Deposit on rented premises (security deposit) | 17,900 | |

| Bank and Cash balances | 15,640 | |

| Allowance for doubtful debt | 11,250 | |

| Tax Liability | 7,420 | |

| Business Rent | 30,000 | |

| Sales | 804,500 | |

| Purchases | 390,200 | |

| Returns | 8,300 | 7,500 |

| Discount | 4,300 | 6,240 |

| Distribution and Advertising | 8,900 | |

| Power | 4,200 | |

| Communication | 1,540 | |

| Insurance | 22,500 | |

| Wages and Salaries | 164,380 | |

| Employers Social Security contribution | 16,560 | |

| 4% Long term loan | 182,500 | |

| Long term loan interest | 3,520 | |

| Bad debt | 2,240 | |

| Drawings | 10,580 | |

| Retained Earnings | 44,820 | |

| Capital | 103,710 | |

| Suspense | 3,200 | |

| Total | 1,338,320 | 1,338,320 |

Additional Information: i) The inventory count as at 31 December 2020 showed closing inventory value at GHȼ42,390. ii) Nsaa Zolko has agreed an annual rent of GHȼ40,000 with his landlord. iii) Included in insurance above is an amount of GHȼ18,000 paid to insure the equipment. The policy year ends 28 February 2021. iv) Nsaa Zolko has specific concerns over GHȼ5,120 of receivables balance and wishes to set up a specific provision with respect to these balances. The general provision on the remaining receivable balance should be at 5%. v) Depreciation is to be charged as follows:

- Land: No Provision

- Equipment: 15% reducing balance method (Depreciation should be calculated to the nearest whole number). vi) The suspense account balance above relates to sales of GHȼ1,600 which was recorded as purchases in error. The receivables and payables balances are correct.

Required:

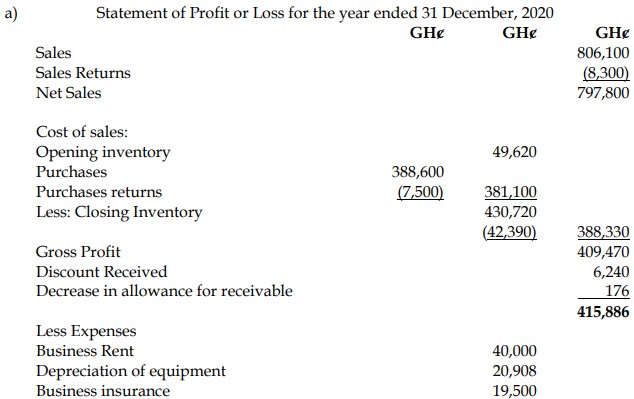

a) Prepare a Statement of Profit or Loss for the year ended 31 December 2020.

(10 marks)

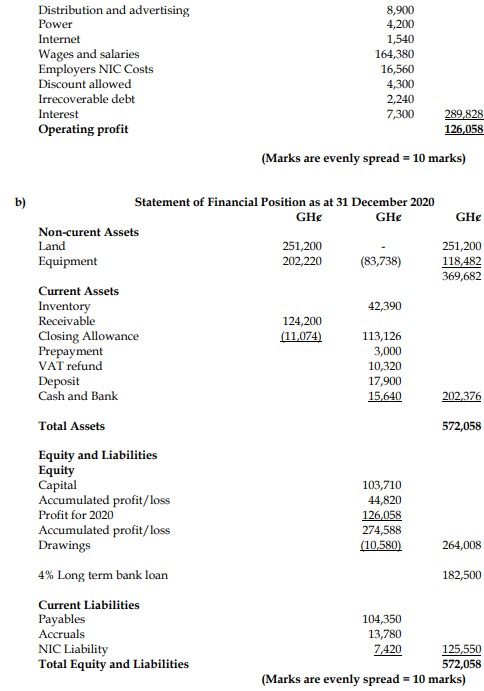

b) Prepare a Statement of Financial Position as at 31 December 2020.

(10 marks)

Answer

- Uploader: Kwame Aikins