- 20 Marks

Question

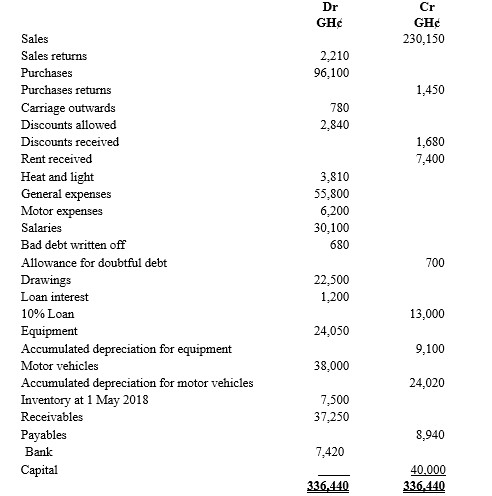

Kofi Badu, a sole trader, extracted the following Trial Balance from the business books as of 30 April 2019:

The following information is also relevant:

i) The closing inventory as at 30 April 2019 was valued at GH¢8,010.

ii) As at 30 April 2019, accrued rent income for the year amounted to GH¢420; heat and light accrued was GH¢260; whilst salaries of GH¢720 was paid in advance.

iii) During the year, Kofi Badu had withdrawn goods costing GH¢720 for his personal use. This had not been recorded in the accounts.

iv) New equipment costing GH¢2,650 was purchased during the year but had been mistakenly included in purchases. This is yet to be corrected.

v) A cheque for GH¢440 received from a customer in full settlement of a debt of GH¢450 has not yet been entered in the accounts.

vi) Allowance for doubtful debt is to be maintained at 2% of receivables.

vii) Depreciation is to be provided for as follows:

- Equipment- 20% per annum using the straight-line method. A full year’s depreciation is provided on all equipment held at 30 April 2019, regardless of the date of purchase.

- Motor vehicles- 40% per annum using the reducing balance method.

Required:

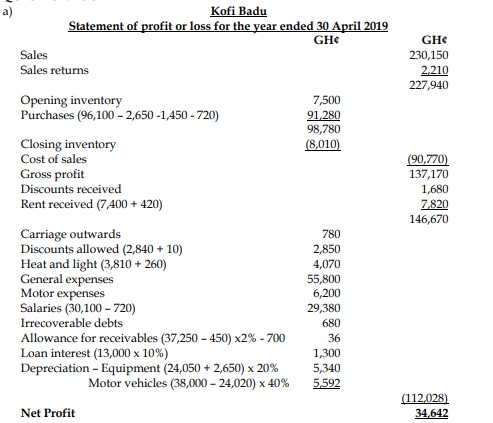

a) Prepare a statement of profit or loss for Kofi Badu for the year ended 30 April 2019.

(12 marks)

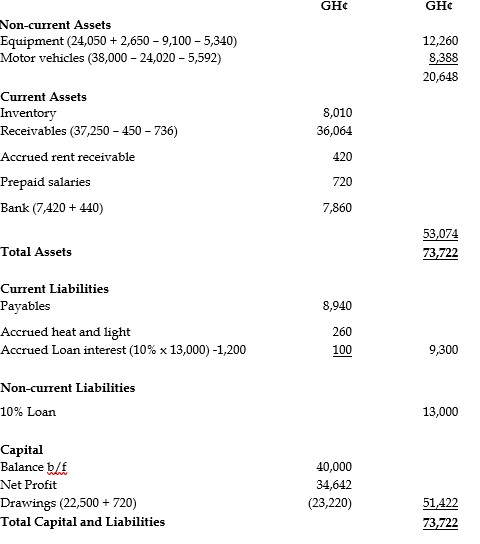

b) Prepare a statement of financial position for Kofi Badu as at 30 April 2019.

Answer

a)

Statement of Profit or Loss for Kofi Badu for the Year Ended 30 April 2019

b)

Statement of Financial Position for Kofi Badu as at 30 April 2019

- Uploader: Theophilus