- 20 Marks

Question

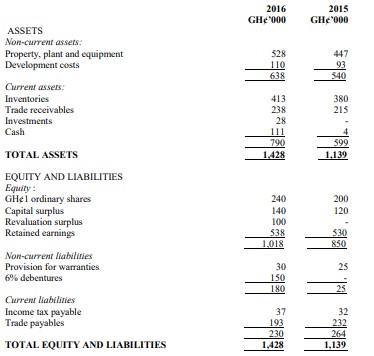

Below are the statement of financial position for Saasa Company Limited at 31 December 2015 and 31 December 2016 and the income statement for the year ended 31 December, 2016.

Income Statement for the year ended 31 December 2016

| GH¢’000 | |

|---|---|

| Revenue | 900 |

| Cost of sales | (550) |

| Gross profit | 350 |

| Expenses | (245) |

| Finance costs | (9) |

| Profit on sale of equipment | 7 |

| Profit before tax | 103 |

| Income tax expense | (30) |

| Profit for the period | 73 |

Additional information

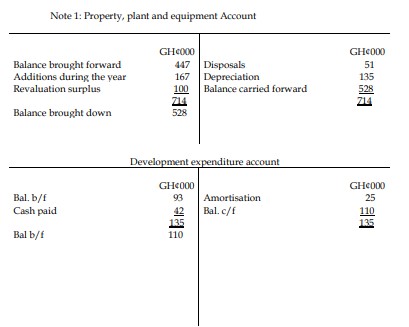

i) Deferred development expenditure amortized during 2016 was GH¢25,000.

ii) Additions to property, plant, and equipment totaling GH¢167,000 were made. Proceeds from the sale of equipment were GH¢58,000, giving rise to a profit of GH¢7,000. No other items of property, plant, and equipment were disposed of during the year.

iii) Finance costs represent interest paid on the new 6% debentures (2016-2022) issued on 1 January 2016.

iv) Current asset investments represent treasury bills acquired. The company deems these to represent cash equivalents.

v) Dividends paid during the year amounted to GH¢65,000.

Required:

Prepare a statement of cash flows for Saasa Company for the year ended 31 December 2016, using the indirect method in accordance with IAS 7: Statement of Cash Flows.

Answer

Saasa Company Ltd – Statement of Cash Flows for the year ended 31 December 2016

| GH¢’000 | GH¢’000 | |

|---|---|---|

| Cash flows from operating activities | ||

| Profit before taxation | 103 | |

| Adjustments for: | ||

| Depreciation | 135 | |

| Amortization | 25 | |

| Interest expense | 9 | |

| Profit on disposal of equipment | (7) | |

| Operating profit before working capital changes | 265 | |

| Increase in trade receivables | (23) | |

| Increase in inventories | (33) | |

| Decrease in trade payables | (39) | |

| Increase in provisions | 5 | |

| Cash generated from operations | 175 | |

| Interest paid | (9) | |

| Income taxes paid | (25) | |

| Net cash from operating activities | 141 | |

| Cash flows from investing activities | ||

| Development expenditure | (42) | |

| Purchase of property, plant, and equipment | (167) | |

| Proceeds from sale of equipment | 58 | (151) |

| Net cash used in investing activities | ||

| Cash flows from financing activities | ||

| Proceeds from issue of shares | 60 | |

| Proceeds from issue of debentures | 150 | |

| Dividends paid | (65) | |

| Net cash from financing activities | 145 | |

| Net increase in cash and cash equivalents | 135 | |

| Cash and cash equivalents at the beginning of the period | 4 | |

| Cash and cash equivalents at end of the period | 139 |

- Topic: IAS 7: Statement of cash flows

- Series: MAY 2017

- Uploader: Theophilus