- 20 Marks

Question

Adepa, a limited liability Company, has the following Trial balance as at 31 December 2016:

| Dr (GH¢’000) | Cr (GH¢’000) | |

|---|---|---|

| Cash at bank | 100 | |

| Inventory at January, 2016 | 2,400 | |

| Administrative expenses | 2,206 | |

| Distribution costs | 650 | |

| Non-current assets at cost: | ||

| – Buildings | 10,000 | |

| – Plant and equipment | 1,400 | |

| – Motor vehicles | 320 | |

| Suspense | 1,500 | |

| Accumulated depreciation: | ||

| – Buildings | 4,000 | |

| – Plant and equipment | 480 | |

| – Motor vehicles | 120 | |

| Retained earnings | 560 | |

| Trade receivables | 876 | |

| Purchases | 4,200 | |

| Dividend paid | 200 | |

| Sales revenue | 11,752 | |

| Sales tax payable | 1,390 | |

| Trade payables | 1,050 | |

| Capital surplus | 500 | |

| GH¢ 1 ordinary shares | 1,000 | |

| Totals | 22,352 | 22,352 |

The following additional information is relevant:

- Inventory at 31 December, 2016 was valued at GH¢1,600,000. While doing the inventory count, errors in the previous year’s inventory count were discovered. The inventory brought forward at the beginning of the year should have been GH¢2,200,000 not GH¢2,400,000 as stated above.

- Depreciation is to be provided as follows:

- Buildings at 5% straight line, charged to administrative expenses

- Plant and equipment at 20% on the reducing balance basis, charged to cost of sales

- Motor vehicles at 25% on the reducing balance basis, charged to distribution costs.

- No final dividend is being proposed.

- A customer has gone bankrupt owing GH¢76,000. This debt is not expected to be recovered and an adjustment should be made. 5% provision for bad debt is to be made.

- 1 million new ordinary shares were issued at GH¢1.50 on 1 December 2016. The proceeds have been left in a suspense account.

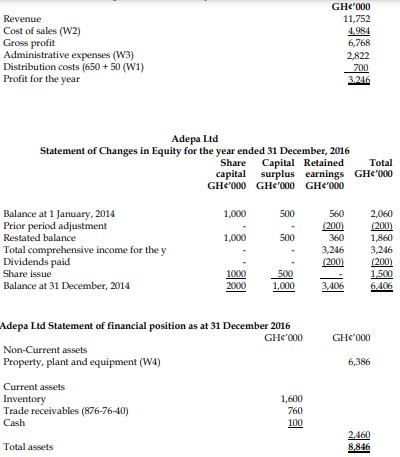

Required: a) Prepare an Income Statement for Adepa Ltd for the year ended 31 December, 2016. (10 marks)

b) Prepare a Statement of Financial Position as at 31 December, 2016. (10 marks)

Answer

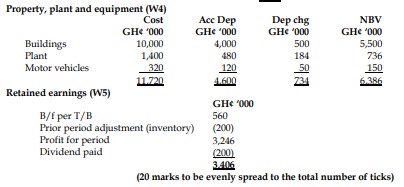

Workings:

Depreciation (W1):

- Buildings: GH¢ 10,000 x 5% = GH¢ 500

- Plant: (GH¢ 1,400 – GH¢ 480) x 20% = GH¢ 184

- Motor vehicles: (GH¢ 320 – GH¢ 120) x 25% = GH¢ 50

Cost of sales (W2):

- Opening inventory: GH¢ 2,200

- Purchases: GH¢ 4,200

- Depreciation – Plant: GH¢ 184

- Closing inventory: GH¢ (1,600)

- Total: GH¢ 4,984

Administrative expenses (W3):

- Per T/B: GH¢ 2,206

- Depreciation – Buildings: GH¢ 500

- Irrecoverable debt: GH¢ 76

- Receivable allowance: (GH¢ 876 – GH¢ 76) x 5% = GH¢ 40

- Total: GH¢ 2,822

- Tags: Adjustments, Financial Statements, Limited Liability Company, Trial Balance

- Level: Level 1

- Uploader: Theophilus