- 20 Marks

Question

a) On 4 April 2020, Kofi Ntam received his bank statements for the month ended 31 March 2020. The bank statement showed a balance of GH¢417,400 (overdraft) as at 31 March, whilst the cash book showed a balance of GH¢525,990 (credit) as at that date. Upon examination of the cash book and the bank statement, the following were discovered:

- Bank charges of GH¢2,010 had not been recorded in the cash book.

- Kofi Ntam exceeded his overdraft limit during the month of March. The bank had therefore charged a penalty of GH¢2,500. This has not been recorded in the cash book.

- A sum of GH¢12,500 had been wrongly credited to Kofi Ntam’s bank account by the bank.

- A cheque for GH¢12,300 had been returned by the bank as dishonored. As the cheque had been dishonored, the bank charged Kofi Ntam GH¢150. This has not reflected in the cash book.

- Cash receipts of GH¢37,400 were posted as cash payment of GH¢47,300 in the cash book.

- On 21 March, Kofi Ntam deposited an amount of GH¢6,500 into his personal bank account. This was deposited to the business bank account in error by the bank.

- Standing orders and direct debits of GH¢11,150 had not been posted to the cash book.

- Customers had deposited GH¢21,700 directly to the bank account. This has not been recorded in the cash book.

- Receipts of GH¢51,200 deposited to the bank account on 31 March 2020, had not been credited by the bank.

- The following cheques, drawn on the bank account, had not been presented to the for payment as at 31 March 2020:

| Cheque Number | Date Cheque was Written | Amount (GH¢) |

|---|---|---|

| No. 45280 | 11 March 2020 | 8,400 |

| No. 45350 | 28 March 2020 | 17,400 |

| No. 45370 | 31 March 2020 | 36,700 |

Required:

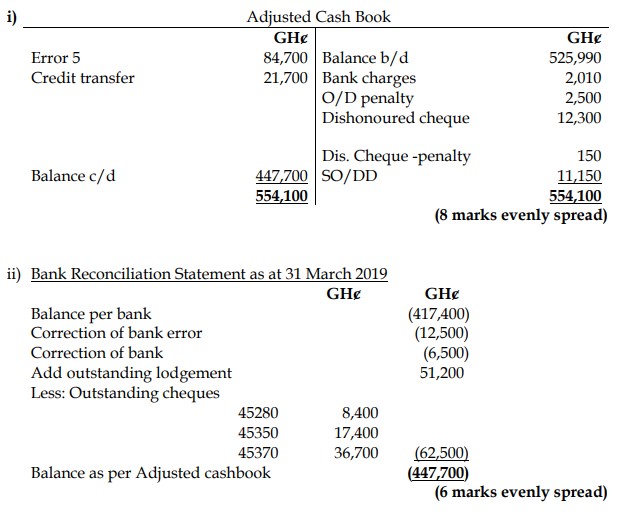

i) Prepare the adjusted cash book for the month of March 2020.

(8 marks)

ii) Prepare a statement on 31 March 2020 reconciling the adjusted cash book with the bank statement balance.

(6 marks)

iii) Explain TWO (2) reasons for preparing bank reconciliation on a regular basis.

(2 marks)

b) A petty cash book is created to facilitate small payments in a business or organization. It is meant to meet the day-to-day expenses and it is entrusted into the hands of the petty cashier.

Required:

Prepare a brief note to Kofi Ntam explaining how the petty cash book operates.

(4 marks)

Answer

iii) Reasons for Preparing Bank Reconciliation Regularly:

- Identification of Errors:

Regular bank reconciliation helps in identifying any discrepancies between the bank statement and the company’s cash book. Errors may have been made by either the bank or the company, such as incorrect postings, and these need to be rectified to ensure accurate financial records. - Detection of Unauthorized Transactions:

Regular reconciliation helps in detecting any unauthorized transactions, such as fraud or bank errors, which may not have been immediately apparent. This ensures the integrity of the company’s financial records.

(2 points @ 1 mark each = 2 marks)

b)

Note to Kofi Ntam: Operation of Petty Cash Book

- The petty cash system operates by setting aside a small amount of cash, known as the float, which is used to make small, day-to-day payments within the business, such as purchasing office supplies or covering minor staff expenses.

- A responsible person, usually the petty cashier, manages this cash. Every time cash is disbursed, a petty cash voucher is completed, documenting the reason for the payment and the amount. The voucher is signed by the person receiving the cash and then retained as evidence.

- The petty cash book records all transactions and ensures that at any given time, the remaining cash plus the total of all petty cash vouchers equals the original float.

- At the end of a set period, typically monthly, the total of the vouchers is used to replenish the petty cash to its original float amount through a reimbursement from the main cash book, ensuring accurate tracking of all expenditures.

(4 marks)

- Tags: Adjusted Cash Book, Bank Reconciliation, Cash Book, Petty Cash

- Level: Level 1

- Topic: Bank reconciliations

- Uploader: Theophilus