- 20 Marks

Question

The Income Statement of Unity Trading Enterprise (UTE) for the year ended 31 December 2016 as prepared by an Accounts Assistant indicated a net profit of GH¢49,360,000. However, the cash book on 31 December 2016 showed a balance at bank to be GH¢6,440,000. Your attention is however drawn to the following:

i) Cheques from customers totaling GH¢4,980,000 which were recorded in the cash book on 20 December 2016 were actually not credited by the bank until 2 January 2017.

ii) Cheques issued on 13 December 2016 totaling GH¢7,420,000 in favour of suppliers were actually not paid by the bank until after the end of the year (that is after 31 December 2016).

iii) On 22 November 2016, the bank paid an amount of GH¢3,600,000 with respect to a standing order from UTE for rent of business premises for the three months to 31 January 2017 but unfortunately, no entry for this payment had been made in the cash book. Additionally, no provision of this outstanding rent had been made in the income statement for the period.

iv) On 31 December 2016, a customer known as Mr. Abuusu had paid GH¢2,340,000 into UTE bank account through a standing order to his bankers in full settlement of a debit balance of GH¢2,400,000 in UTE sale ledger, but no entry had been made in the books.

v) On 30 December 2016, a cheque for GH¢480,000 was received from a customer in settlement of sales invoice for the same amount. The cheques were lodged into UTE bank account. Both sale of goods and the cheque were entered in UTE’s books. However, on 31 December 2016, the customer returned the goods and also instructed her bankers not to pay the cheque (This instruction was carried out the same day) but no entries in respect of these latter developments have been made in UTE’s books. The cost of these goods amounting to GH¢320,000 were not actually included in the closing inventories.

vi) A cheque for GH¢840,000 from an insurance company in settlement of claim for fire damage to inventory had been paid into the bank and credited by the bank on 21 December 2016, but an estimated amount of GH¢800,000 had been entered in UTE’s income statement.

Required:

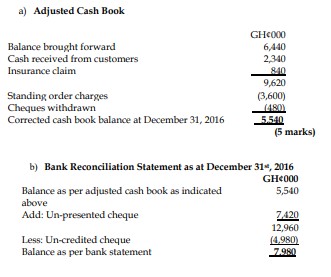

a) Prepare a statement on 31 December 2016, indicating clearly the cash book balance. (5 marks)

b) Prepare the bank reconciliation statement for UTE. (5 marks)

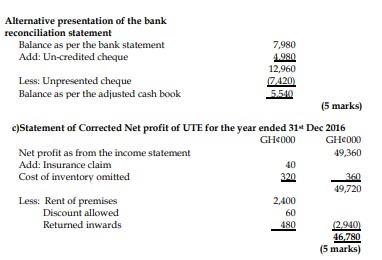

c) Prepare a statement of corrected net profit of UTE on 31 December 2016. (5 marks)

d) Explain TWO reasons for carrying out bank reconciliation. (2 marks)

e) Explain why the bank statement is usually taken as being more accurate than the details that appear in the company’s own records. (2 marks)

f) Indicate how the bank balance will be reported in UTE’s final accounts. (1 mark)

Answer

d) Reasons for carrying out bank reconciliation:

- Accuracy Check: To confirm the accuracy of entries in the cash book and bank statement.

- Error Detection: To uncover any errors or discrepancies between the company’s records and the bank’s records.

(2 marks)

e) Accuracy of Bank Statement:

The bank statement is considered more accurate as it is prepared by the bank, which is an independent entity and less prone to internal errors or manipulation compared to the company’s internal records.

(2 marks)

f) Reporting Bank Balance in Final Accounts:

The bank balance will be reported as a current asset if it is positive or as a current liability if it is negative in the statement of financial position.

(1 mark)

- Tags: Bank Reconciliation, Cash Book, Financial Statements

- Level: Level 1

- Uploader: Theophilus