- 20 Marks

Question

a) The following information relates to the activities of Chemu Ltd:

Statement of Financial Position as at 31 December

| Account | 2021 (GHȼ’000) | 2020 (GHȼ’000) |

|---|---|---|

| Assets | ||

| Non-current assets | 1,295 | 810 |

| Current assets | ||

| Inventory | 1,500 | 500 |

| Receivables | 2,680 | 890 |

| Bank | – | 740 |

| Total assets | 5,475 | 2,940 |

| Equity and liabilities | ||

| Equity | ||

| Share capital | 600 | 400 |

| Retained earnings | 1,625 | 600 |

| Total equity | 2,225 | 1,000 |

| Non-current liabilities | ||

| 10% Debentures | 160 | 360 |

| Current liabilities | ||

| Bank overdraft | 1,810 | – |

| Payables | 1,000 | 680 |

| Taxation | 280 | 900 |

| Total liabilities | 3,250 | 1,940 |

| Total equity and liabilities | 5,475 | 2,940 |

Additional information:

i) The Statement of Profit or Loss for the year ended 31 December 2021 shows the following:

| Account | Amount (GHȼ’000) |

|---|---|

| Operating profit | 1,531 |

| Interest payable | (26) |

| Profit before taxation | 1,505 |

| Taxation | (480) |

| Profit for the period | 1,025 |

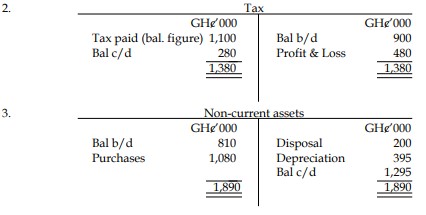

ii) Payables consist of trade payables and accrued interest. The accrued interest as at 31 December 2021 was GHȼ45,000 and as at 2020 was GHȼ80,000.

iii) Profit before taxation had been arrived at after charging GHȼ395,000 for depreciation on non-current assets.

iv) During the year, non-current assets with a carrying amount of GHȼ200,000 were sold for GHȼ190,000.

Required:

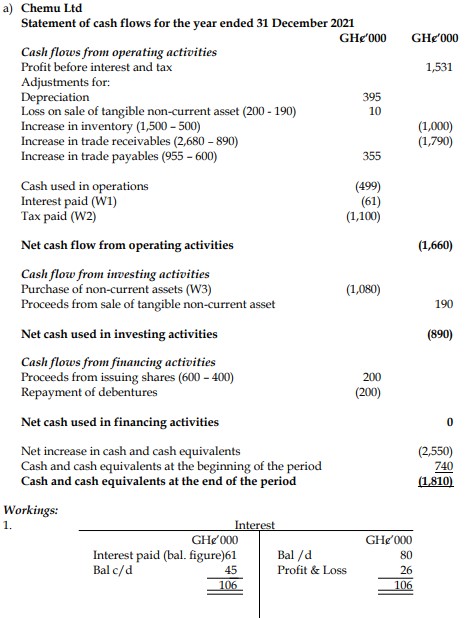

Prepare a Statement of Cash Flows for Chemu Ltd for the year ended 31 December 2021, in accordance with IAS 7: Statement of Cash Flows.

(16 marks)

b) Identify FOUR (4) benefits Chemu Ltd may derive from preparing a Statement of Cash Flows.

(4 marks)

Answer

b)

Benefits of Preparing a Statement of Cash Flows:

- Assessment of Liquidity:

Helps in assessing the company’s ability to generate cash from operations, meet its short-term obligations, and manage its liquidity effectively. - Performance Analysis:

Provides insight into how well the company’s operations are generating cash, which is crucial for evaluating overall business performance. - Investment and Financing Decisions:

Assists in determining how much cash is being used for investments in non-current assets and how financing activities are being managed, supporting better decision-making. - Transparency and Compliance:

Ensures that the company complies with IAS 7, providing a clear, standardized view of cash flows that is useful to investors, creditors, and other stakeholders.

(4 marks evenly spread)

- Uploader: Theophilus