- 20 Marks

Question

Breakable Limited is preparing for the last half of the year and you, as the cost accountant, have been requested to prepare the cash budget for the third quarter of the year. The following information were available:

- Sales – 20% of monthly sales are in cash, while the balance is on credit.

a. Collections from receivables are as follows:

i. 60% in the first month after sales.

ii. 20% in the second month; and

iii. The balance after considering 1% bad debt and 5% discount on the outstanding balance in the third month after sales. - Purchases are usually 60% of the month’s Sales and are paid for 70% in the same month and 30% in the following month less 2% discount on the total purchase price.

- Loan of N500,000 is expected to be approved by the bank on the first day of August, payable equally over twelve months with one month moratorium and 1% interest on the outstanding.

- Salary deductions are paid on the preceding month’s basis.

- The sum of N951,550 being a fixed deposit will mature in the month of July; N500,000 will be reinvested the same month with 0.5% interest credited the following month.

- Cash and cash equivalent balance as at end of June is N1,050,706.

- Bank Charges are 1% of total outflow from the bank payment for the month.

- Additional information:

| Month | Sales | Net Salaries | Expenses | Salary Deductions |

|---|---|---|---|---|

| April | 850,000 | 430,000 | 210,700 | 39,400 |

| May | 900,000 | 500,000 | 221,500 | 48,400 |

| June | 1,250,000 | 650,000 | 297,500 | 49,480 |

| July | 1,520,000 | 720,000 | 277,200 | 58,700 |

| August | 1,650,000 | 740,000 | 287,500 | 52,750 |

| September | 1,800,000 | 770,000 | 292,700 | 57,650 |

| October | 1,400,000 | 770,000 | 292,700 | 57,650 |

Answer

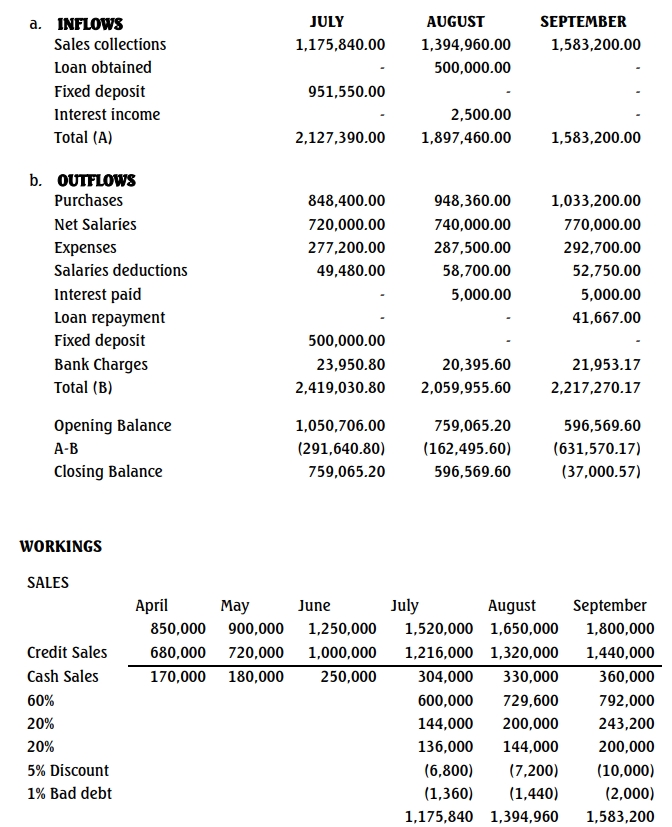

To prepare the monthly cash budget for the third quarter, the cash inflows and outflows for July, August, and September must be calculated based on the data provided. The breakdown includes sales collections, purchases, salary payments, loan repayments, and other outflows such as bank charges.

Explanation:

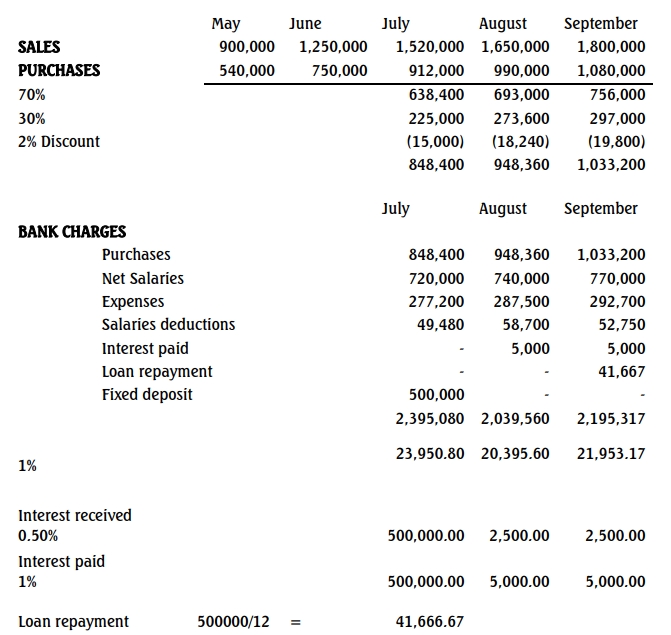

- Sales Collections: Sales are split into cash (20%) and credit (80%). The credit collections are split into three months: 60% in the first month, 20% in the second month, and the remainder (minus bad debt and discounts) in the third month.

- Purchases: 60% of sales value is allocated for purchases, with payments split into 70% for the same month and 30% for the next month (with a 2% discount on the total).

- Loan Repayment: The N500,000 loan will start accruing 1% interest in August, and repayments are spread over 12 months.

- Salaries: Salary payments and deductions are accounted for in each month.

- Bank Charges: Calculated at 1% of total cash outflows for each month.

The full cash budget would detail these figures month by month, showing the net inflows and outflows to arrive at the closing cash balance each month.

- Tags: Cash Budget, Loan Repayment, Purchases, Receivables

- Level: Level 1

- Uploader: Dotse