- 20 Marks

Question

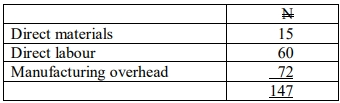

Tripple Company Limited manufactures “MOP Heads” for use in its various offices across the country. The Cost Accountant has the following costs per unit produced:

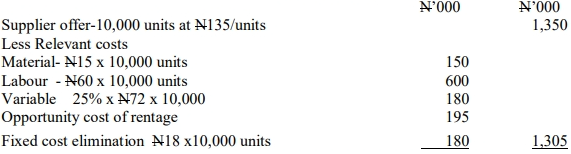

A nearby company, Dusters Nigeria Enterprises, has offered to sell 10,000 units of these MOP Heads to Tripple Company Limited for N135 per unit. If Tripple Company Limited accepts the offer, some of the facilities presently in use to manufacture MOP Heads could be rented out to a third party at an annual rent of N195,000. In addition, N18 per unit of the fixed overhead cost applied to the production of MOP Heads would be totally eliminated. The Cost Accountant has also established that 75% of the overhead is fixed.

You are required to:

a. Advise the Chief Executive Officer of Tripple Company Limited whether the company should accept the offer of Dusters Nigeria Enterprises or not. (15 Marks)

b. State FIVE other qualitative factors that the Chief Executive Officer of Tripple Company Limited should consider in making a decision in (a) above. (5 Marks)

Answer

a)

TRIPPLE COMPANY LIMITED

CALCULATION OF SAVING OR DEFICIT FROM MAKING 10,000 UNITS OF

MOP HEADS

![]()

Conclusion: Tripple Company Limited should continue making the MOP heads in-house.

b. Qualitative Factors to Consider

- Quality control over the production of MOP heads.

- Dependability and reliability of the external supplier.

- Possible long-term pricing changes by Dusters Nigeria Enterprises.

- Flexibility in production and ability to meet demand variations.

- Impact on existing staff and morale if production is outsourced.

- Tags: Costing, Fixed Overheads, Make or buy decisions, Qualitative Factors, Relevant Costing

- Level: Level 1

- Topic: Costing Methods

- Series: MAY 2015

- Uploader: Joseph