- 15 Marks

Question

a) Johnson & Co is a medium sized company that is engaged in delivery services. As a result

of the recent increase in the demand for services, the Managing Director (MD) is planning

for the future business performance. The MD plans to acquire a delivery van at the cost of

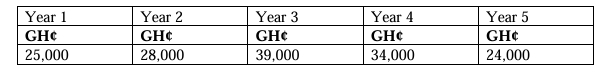

GH¢85,000. The expected net cash flow per year are as follows:

The Sales Manager has indicated to the MD that he will recoup his investment in less than four years and for that reason, it’s a good investment.

The Management Accountant has however drawn his attention to the fact that the manager has not factored time value of money and the cost of capital in his analysis. He could not however suggest the cost of capital since financial institutions are charging different interest rates.

Required:

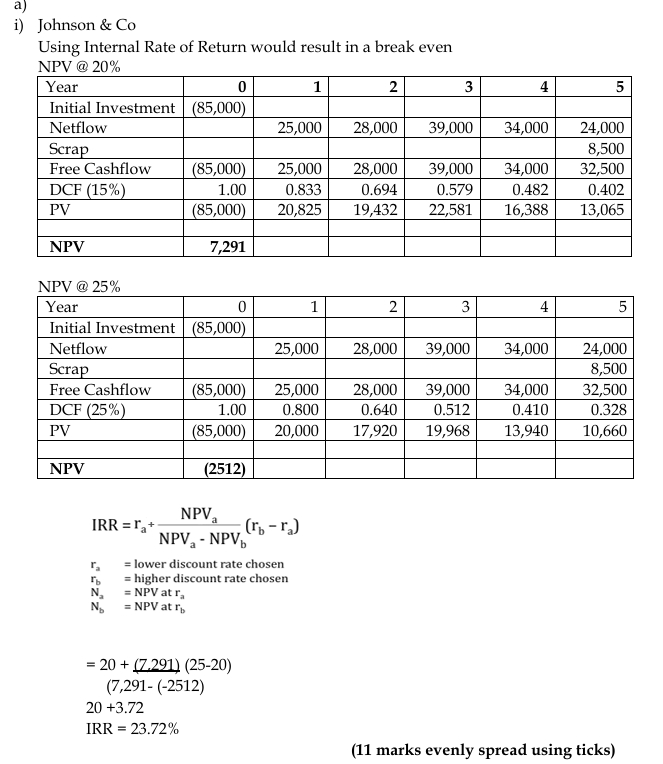

i) Calculate the cost of capital when used would result in a break-even, when the useful life of the van is five years with residual value of GH¢8,500. (11 marks)

ii) Using TWO (2) points each, compare and contrast the payback method of investment appraisal and the discounted cash flow method.

(4 marks)

Answer

ii) Contrasting payback and discounted cash flow:

- The payback period is the number of years necessary to recover funds invested in a project. When calculating the payback period, we don’t take time value of money into account. Discounted cash flow takes into account time value of money.

- For a conventional project, payback period is always lower than discounted payback period. It’s because the calculation of the discounted payback period takes into account the present value of future cash inflows. So, based on this criterion, it’s going to take longer before the original investment is recovered.

Comparing payback and discounted cash flow

- Both payback period and discounted payback period ignore cash flows occurring after recovering the original investment.

- The payback period and the discounted payback period are measures that allow us to assess in how many years the original investment will pay back.

- We prefer investment A to investment B if (discounted) payback period for investment A is lower than (discounted) payback period for investment B.

- Topic: Discounted cash flow

- Series: JULY 2023

- Uploader: Dotse