- 15 Marks

Question

Phil Company is considering replacing its existing machine on the introduction of a new product. The existing machine would be sold for GH¢2 million and replaced with a new machine at the beginning of the year at the cost of GH¢16 million. This new machine would be sold at the end of year 4 for GH¢1 million.

A market research recently carried out at a cost of GH¢1.5 million indicates a unit selling price of GH¢300 in year 1, rising by 10% per annum. Sales volume for the four-year life of the project has been estimated as follows:

| Year | Units |

|---|---|

| 1 | 60,000 |

| 2 | 85,000 |

| 3 | 85,000 |

| 4 | 80,000 |

Possible unit variable costs are as follows:

| Probability | GH¢ |

|---|---|

| 0.4 | 240 |

| 0.6 | 260 |

Incremental fixed cost as a result of the project is GH¢15 per unit plus GH¢1,000,000 per annum staff cost.

The introduction of the new product is expected to reduce the market demand for an existing product by 5,000 units per annum. The existing product has a unit contribution of GH¢75.

Other annual fixed costs associated with the new product include the following:

- Amortization of goodwill: GH¢50,000

- Depreciation: GH¢250,000

Phil Company’s cost of capital is 12%.

Required:

Evaluate the acceptability of the project.

Answer

a)

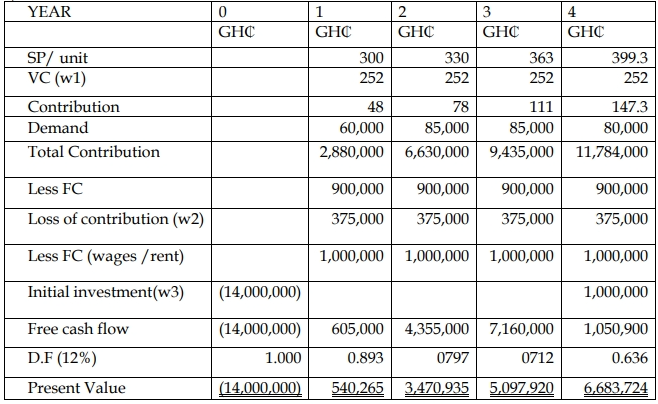

NPV = 1,792,844

Recommendation: The project is acceptable in view of positive NPV

Working 1. Expected variable cost per unit = (GH¢240 x 0.4) + (260 x0.6) = GH¢252

Working 2. Loss contribution 5,000 x GH¢75 = GH¢375,000

Working 3. Initial cost – disposal (16,000,000- 2,000,000) = GH¢14,000,000

- Tags: Cash Flows, Cost of Capital, Net Present Value, Project evaluation

- Level: Level 2

- Topic: Discounted cash flow

- Series: APR 2023

- Uploader: Joseph