- 20 Marks

Question

a) IASB Conceptual Framework underpins what IFRS say and why they identify a particular accounting treatment. Another important aspect of the conceptual framework is an attempt to define “high quality” information or in other words, what makes financial information useful.

Required:

Explain in accordance with the IASB’s Conceptual Framework the enhancing qualitative characteristics of useful financial accounting information.

(10 marks)

b) On 1 January 2021, Koo Nimo, a trader, had the following entries in his ledger:

| Account | Amount (GHȼ) |

|---|---|

| Commission received (owing) | 900 |

| Stationery (owing) | 400 |

| Rates (prepaid) | 600 |

The following information relates to the financial year ended 31 December 2021. All transactions were by cheque.

i) Commission received was as follows:

| Date | Amount (GHȼ) |

|---|---|

| 14 January | 850 |

| 16 November | 3,200 |

On 31 December 2021 GHȼ800 was still owing in commission to Koo Nimo for the 2021 financial year.

ii) Stationery was paid as follows:

| Date | Amount (GHȼ) |

|---|---|

| 19 January | 800 |

| 13 November | 4,200 |

On 1 January 2021 there was no stock of stationery, while at 31 December 2021 stock of stationery was GHȼ200. There were no outstanding invoices for stationery at 31 December 2021.

iii) Rates were paid as follows:

| Date | Amount (GHȼ) |

|---|---|

| 9 April | 2,600 |

| 24 November | 2,800 |

A refund for rates of GHȼ800 was received on 15 December 2021. At 31 December 2021 rates were overpaid by GHȼ250.

Required:

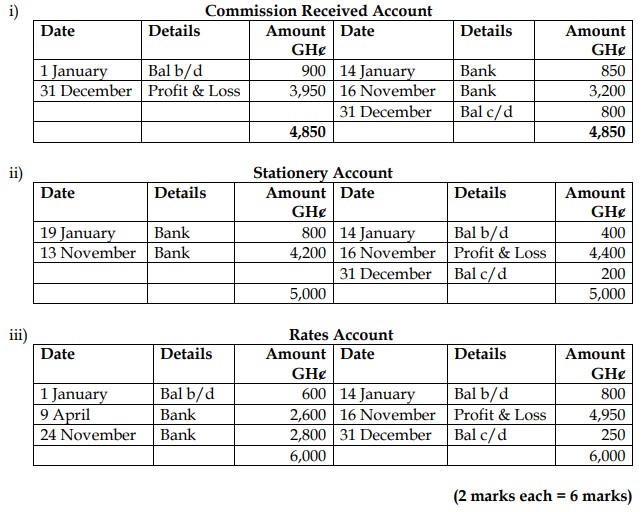

Prepare the commission received, stationery and rates ledger accounts, including in each case the transfer to the Statement of Profit and Loss, for the year ended 31 December 2021, and the balance carried down to the next financial year.

(6 marks)

c) Explain TWO (2) reasons why a business entity will make adjustments for accruals and prepayments in the final accounts.

(4 marks)

Answer

a)

Enhancing Qualitative Characteristics:

- Comparability:

Comparability allows users to identify similarities and differences between two sets of economic phenomena. Information is more useful if it can be compared with similar information about other entities or the same entity over different periods. Consistency in application helps in achieving comparability. - Verifiability:

Verifiability ensures that different knowledgeable and independent observers could reach consensus that a particular depiction is a faithful representation. It helps to assure users that information faithfully represents the economic phenomena it purports to represent. - Timeliness:

Timeliness means having information available to decision-makers in time to be capable of influencing their decisions. Information that is available after the decision-making process is less useful. - Understandability:

Information is understandable if it is classified, characterized, and presented clearly and concisely. Financial reports should be prepared for users who have a reasonable knowledge of business and economic activities.

(4 points @ 2.5 marks each = 10 marks)

b)

c)

Reasons for Adjustments for Accruals and Prepayments:

- Accurate Reflection of Financial Position:

Adjusting for accruals and prepayments ensures that expenses and revenues are matched to the correct accounting period, providing an accurate reflection of the company’s financial position. - Compliance with Accounting Standards:

Making these adjustments ensures compliance with the accruals concept under accounting standards, which mandates that transactions be recorded in the period in which they occur, not when cash is received or paid.

- Topic: Accruals and prepayments, The IASB’s Conceptual Framework

- Series: AUG 2022

- Uploader: Theophilus