- 20 Marks

Question

a) Financial Accounting and Management Accounting are similar with regard to the determination of costs, their assignment to different accounting periods, and allocation of costs to different departments and segments. This implies that the concepts and principles that are used in Financial Accounting may be suitable for Management Accounting.

Required:

i) Explain the purpose and scope of financial accounting. (4 marks)

ii) Explain THREE (3) differences between Financial Accounting and Management Accounting. (6 marks)

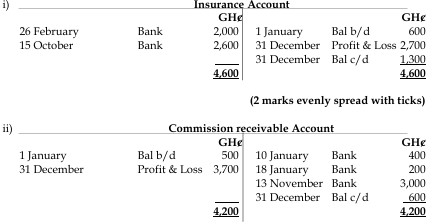

b) On 1 January 2021, Mankessim Traders had the following entries in its ledger accounts:

- Insurance: GHȼ600 owing

- Commission receivable: GHȼ500 owing to Mankessim Traders

- Allowance for receivables: GHȼ1,600 credit balance

The following information is available for the financial year ended 31 December 2021:

- Insurance was paid as follows:

- 26 February 2021 GHȼ2,000

- 15 October 2021 GHȼ2,600

- The payment on 15 October 2021 relates to the period 1 October 2021 to 31 March 2022.

- Commission receivable was as follows:

- 10 January 2021 GHȼ400

- 18 January 2021 GHȼ200

- 13 November 2021 GHȼ3,000

- On 31 December 2021, GHȼ600 was owing in commission to Mankessim Traders.

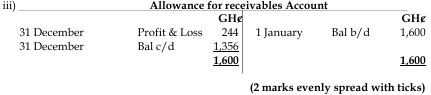

- The trade receivables balance at 31 December 2021 was GHȼ38,400. The allowance for receivables is to be provided as GHȼ600 for a specific debt, plus 2% on the remainder of receivables.

Required:

Prepare the following ledger accounts, including in each case the transfer to the Statement of Profit and Loss, for the year ended 31 December 2021, and the balance carried down to the next financial year.

i) Insurance. (2 marks)

ii) Commission receivable. (2 marks)

iii) Allowance for receivables. (2 marks)

c) Explain why maintaining an allowance for receivables is an application of the prudence concept. (4 marks)

Answer

a)

i) The purpose and scope of financial accounting are as follows:

- Financial Accounting information is prepared by enterprises for external users. It provides information to meet their needs, such as shareholders, potential investors, banks, and suppliers. It is used to inform about the financial performance and position of the company, and it helps in preparing tax accounts.

- Financial Accounting information is normally regulated by law and accounting standards and is often audited. It requires the presentation of financial statements, including a Statement of Comprehensive Income, Statement of Financial Position, Statement of Cash Flows, Statement of Changes in Equity, and the necessary notes. (2 marks)

ii) Differences between Financial Accounting and Management Accounting:

- Financial statements from Financial Accounting are intended mainly for external users, while Management Accounting information is for internal use by management.

- Financial accounts describe the performance of a business over a specific period, whereas Management Accounting helps management record, plan, and control activities and assists in decision-making.

- Financial Accounting deals mainly with historical data, while Management Accounting can include future information, such as budgets. (6 marks)

b) i) Insurance Account

c) The prudence concept states that profits should be understated rather than overstated, and assets should be understated rather than overstated. Creating an allowance for receivables increases the expenses and reduces the profit, which is a prudent approach. It also reduces the assets, as the allowance is subtracted from receivables, making this an application of the prudence concept.

(4 marks)

- Tags: Financial Accounting, Ledger Accounts, Management Accounting, Prudence Concept

- Level: Level 1

- Uploader: Theophilus