- 20 Marks

Question

a) The Conceptual Framework for Financial Reporting is a set of principles which underpin the foundation of financial accounting. The Conceptual Framework sets out the going concern concept as one of the important underlying assumptions for the preparation of financial statements.

Required:

Explain what is meant by ‘the assumption that an entity is operating under the going concern concept’. Support your answer with a suitable example. (3 marks)

b) A trader who trades in Machines commences business on 1 Jan 2021 and buys 200 machines, each costing GH¢50,000. During the year, he sells 150 machines at GH¢60,000 each.

Required:

How should the remaining machines be valued at the end of the year if:

i) He is forced to close down his business at the end of the year and the remaining machines will realise only GH¢30,000 each in a forced sale. (2 marks)

ii) He intends to continue the business into the next year. (2 marks)

c) One of the fundamental qualitative characteristics of useful financial information in the Conceptual Framework for Financial Reporting is ‘faithful representation’.

Required:

Explain what is meant by ‘faithful representation’. (3 marks)

d) Davidco is a trader who commenced business on January 1, 2021. He introduced capital of GH¢50,000. He bought Vehicle worth GH¢30,000 out of the capital introduced. The following transaction took place in the month of January (Jan) 2021:

- Jan 5: Davidco bought goods on credit from the following:

- Tradco: GH¢2,500, Trade Discount 10%

- Vamco: GH¢8,000, Trade Discount 10%

- Jan 8: Davidco Sold goods on credit to the following:

- Markcom: GH¢5,000, Trade Discount 20%

- Kathrine: GH¢2,000, Trade Discount 5%

- Jan 12: Davidco returned defective goods worth GH¢200 to Tradco.

- Jan 15: Davidco paid all amounts outstanding to Tradco and Vamco less cash discount of 5%.

- Jan 22: Kathrine returned spoiled goods worth GH¢300.

- Jan 24: Davidco received payment from Markcom and Kathrine of all outstanding debt less cash discount of 5%.

Required:

Prepare the following:

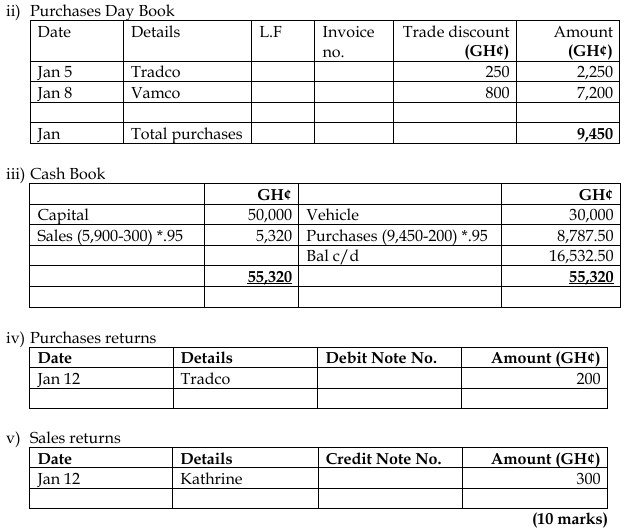

i) Sales day book

ii) Purchase day book

iii) Cash book

iv) Purchase returns

v) Sales returns

(10 marks)

Answer

a) The financial statements are normally prepared on the assumption that an entity is a going concern and will continue in operation for the foreseeable future. Hence, it is assumed that the entity has neither the intention nor the need to liquidate or curtail materially the scale of its operations. Example: inventory is valued at the lower of cost or net realizable value.

(3 marks)

b) Machines:

| Quantity | Price (GH¢) | Value (GH¢) |

|---|---|---|

| Purchase | 200 | 10,000,000 |

| Sales | 150 | 9,000,000 |

| Closing Inventory | 50 |

i) If the business is forced to close down, the machines will be valued at:

| Quantity | Price (GH¢) | Value (GH¢) |

|---|---|---|

| 50 | 30,000 | 1,500,000 |

(2 marks)

ii) If the business continues, the machines will be valued at:

| Quantity | Price (GH¢) | Value (GH¢) |

|---|---|---|

| 50 | 50,000 | 2,500,000 |

(2 marks)

c) Faithful representation:

- The information gives full details of its effect on the financial statements and is only recognized if its financial effects are certain.

- Financial reports represent economic phenomena in words and numbers. To be useful, financial information must not only represent relevant phenomena but must faithfully represent the phenomena that it purports to represent.

- To be faithful, financial information must be complete, neutral, and free from error. A complete report must include all information necessary for the user to understand, neutral is without bias, and finally, free from error means there should be no errors or omissions in the report.

(3 marks)

d)

i) Sales Day Book

| Date | Customer | Invoice No. | Gross Amount (GH¢) | Trade Discount (GH¢) | Net Amount (GH¢) |

|---|---|---|---|---|---|

| Jan 8 | Markcom | 5,000 | 1,000 | 4,000 | |

| Jan 8 | Kathrine | 2,000 | 100 | 1,900 |

Total Sales: GH¢5,900

- Tags: Day Books, Faithful Representation, Going Concern, Inventory Valuation

- Level: Level 1

- Topic: Double entry bookkeeping, Inventory, The IASB’s Conceptual Framework

- Series: MAR 2023

- Uploader: Kwame Aikins