- 20 Marks

Question

a) Explain in brief the following features of time series:

i) Trend.

ii) Seasonal variation.

iii) Random variation.

(6 marks)

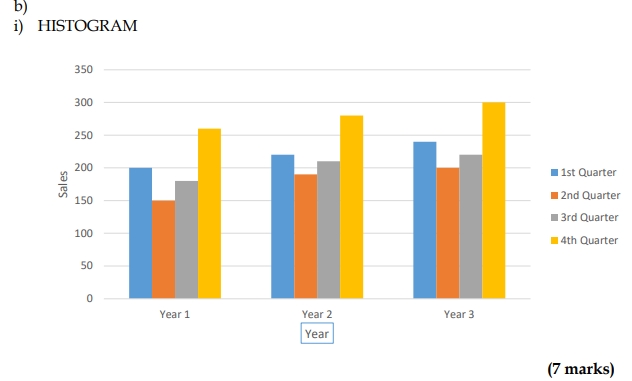

b) The following table relates to sales of Emefa Ltd for a three-year period:

| Year | 1st Quarter (GH¢’000) | 2nd Quarter (GH¢’000) | 3rd Quarter (GH¢’000) | 4th Quarter (GH¢’000) |

|---|---|---|---|---|

| Year 1 | 200 | 150 | 180 | 260 |

| Year 2 | 220 | 190 | 210 | 280 |

| Year 3 | 240 | 200 | 220 | 300 |

Required:

i) Prepare a histogram using the above sales figures. (7 marks)

ii) Describe the trend of performance of the company. (2 marks)

c) Explain the following terminologies as used in accounting for overheads in management accounting:

i) Apportionment

ii) Allocation

iii) Allotment

iv) Absorption

v) Over/(under) absorption

(5 marks)

Answer

a)

i) Trend: This refers to the long-term movement or direction in data over a period of time. It shows whether the data is generally increasing, decreasing, or remaining stable. (2 marks)

ii) Seasonal variation: These are short-term fluctuations in data that occur at regular intervals due to seasonal factors such as weather, holidays, or events. They are predictable and repeatable. (2 marks)

iii) Random variation: These are irregular, unpredictable fluctuations in data caused by unforeseen events like political changes, natural disasters, or unexpected market shifts. They do not follow a pattern. (2 marks)

ii) Sales have generally increased over the 3-year period. In the specific years, sales

for the first quarters are generally higher than the second and third quarters with

last quarter sales being the highest. From the first quarters sales decreases in the

second quarters and start to increase in the second quarters and peaks in the fourth

quarters. So the second quarters sales are the lowest with the fourth quarters being

the highest. (2 marks)

c)

i) Apportionment

The sharing of overheads between and/or among costs centres using fair and

equitable basis. For example, floor area occupied, number of employees, number

stores requisitions, etc

ii) Allocation

This refers to the assignment of overheads in whole to costs centres. That is, the

attribution of overheads in whole to particular costs centres.

iii) Allotment

This refers to the sharing of overheads using defined proportions. For example,

2:3:1, 20%: 30%: 50%.

iv) Absorption

This refers to the charging of overheads to costs units using predetermined

absorption rates.

Example, direct labour hour rate, percentage of material cost, etc.

v) Over/(under) absorption

This refers to the difference between overheads absorbed charged to production

and the actual overheads incurred. Over absorption arises where the overheads

absorbed or charged to exceed the actual overheads incurred. On the other hand,

under absorption occurs where overheads charged to production is lower than the

actual overheads incurred.

(5 marks)

- Tags: Histogram, Overhead Allocation, Trend Analysis

- Level: Level 1

- Topic: Forecasting

- Series: NOV 2020

- Uploader: Joseph