- 20 Marks

Question

a) Identify, and briefly explain, the basic accounting principle which requires prepayments to be included in final accounts. (3 marks)

b) Briefly explain the purpose of depreciation charge in the statement of profit or loss. (2 marks)

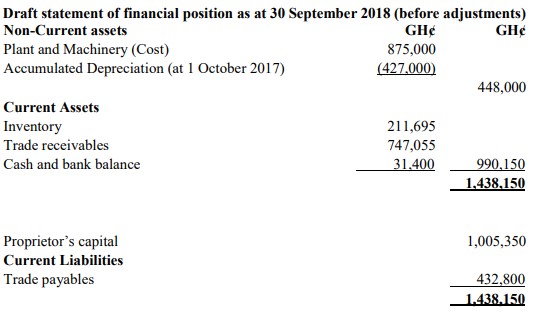

c) A newly qualified accountant has prepared draft accounts for a client for the year ended September 2018, but has not dealt with the adjustments for accrued expenses, prepaid expenses, irrecoverable debts, allowance for receivables, and depreciation.

Below is the statement of financial position prepared by the newly qualified accountant.

The newly qualified accountant has given the following information about the remaining adjustments:

- The last fixed bill paid for electricity covered three months period to 31 July 2018. The bill was GH¢34,350.

- Rent of GH¢142,500 for six months to December 2018 was paid in March 2018.

- The trade receivables figure of GH¢747,055 in the draft account is stated after deducting allowance for doubtful debts of GH¢39,500 from the total receivable balance of GH¢786,555.

- The trade receivable balance of GH¢786,555 includes a balance of GH¢3,300 which has been outstanding for 10 months. The client has decided to write this balance off his books.

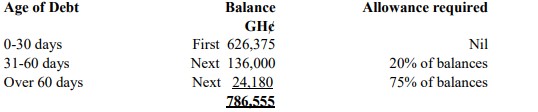

- The policy of the client is to allow for receivables on the basis of the length of time the debt has been outstanding. The aged analysis of trade receivables as at 30 September 2018 is as follows:

Required:

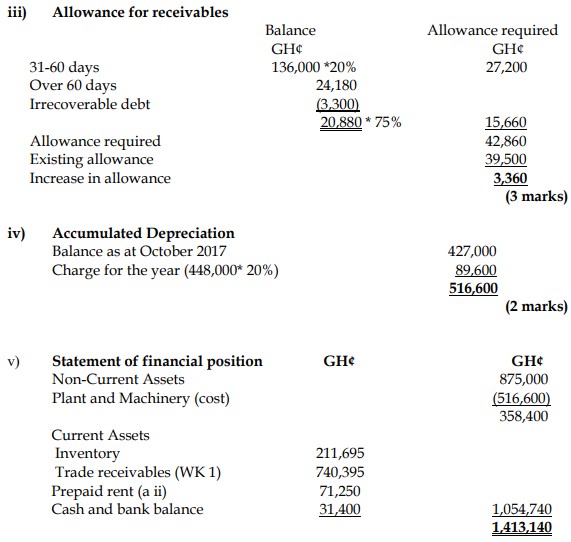

i) Calculate the accrued electricity expense and the prepayment for rent, and update the financial statements. (4 marks)

ii) Calculate the new allowance for receivables and update the financial statements. (3 marks)

iii) Calculate the depreciation charge and update the financial statements. (2 marks)

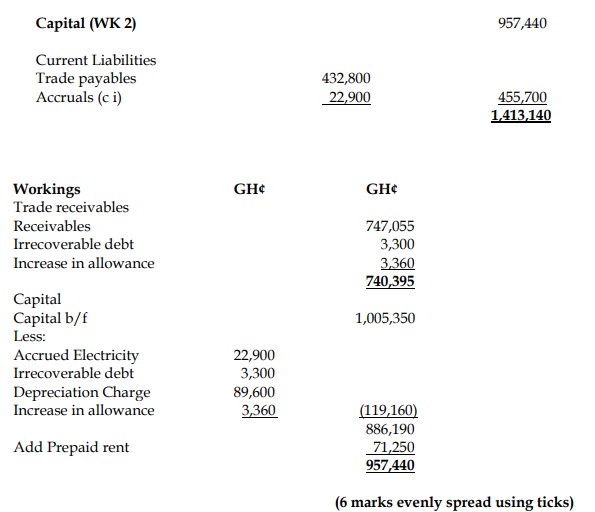

iv) Prepare the updated Statement of Financial Position after accounting for the above adjustments. (6 marks)

Answer

a) Accruals Concept

The accruals or matching concept requires that the revenue earned in a period is matched with the expenses incurred in earning that profit. Therefore, if a payment includes a prepayment for the following period, this must be excluded from expenses in the statement of profit or loss. Costs are recognized on the basis of the period covered by those costs, not by the timing of the payment. (3 marks)

b) Purpose of Depreciation Charge

Depreciation is a way of charging for the use of an asset in earning the current period’s profits. It spreads the cost of a non-current asset over its useful life. This is an example of the accrual or matching concept. (2 marks)

c) Adjustments to Financial Statements

i) Accrued Expenses and Prepayment Calculation

- Accrued Electricity Expense:

Electricity (2/3 * 34,350) = GH¢22,900 (2 marks) - Prepayment for Rent:

Rent (3/6 * 142,500) = GH¢71,250 (2 marks)

ii) Allowance for Receivables Calculation

- Tags: Accruals, Adjustments, Depreciation, Financial Statements, Prepayments

- Level: Level 1

- Topic: Accruals and prepayments, Non-current assets and depreciation

- Series: MAY 2019

- Uploader: Theophilus