- 20 Marks

Question

a) Edziban Foods Ltd has just signed a contract to sell food items worth GH¢120,000 per month to the School Feeding Secretariat on credit. With the average collection period expected to be 45 days, the company will increase its working capital requirement by GH¢177,534. The company’s managers are considering three options for financing the additional working capital requirement:

- Option 1 – Trade credit: The company buys about GH¢72,000 of food items per month on terms of “2.5/20, net 60.” Going forward, the company may choose to forgo the discount.

- Option 2 – Factoring: The company enters a non-recourse factoring contract, under which the factor takes up the receivables to be created from the credit sales under the contract (i.e., GH¢120,000 per month) for a fee of 2% of the credit sales. The average collection period for the credit sales will remain at 45 days. The factor will advance up to 80% of the face value of the average receivables at an annual interest rate of 16%. It has been estimated that the factor’s services will save the company GH¢1,500 per month in debt collection costs.

- Option 3 – Bank loan: The company takes a loan of GH¢197,260 at 15% from its bankers. A 10% compensating balance will be required.

Required:

i) Recommend the best financing option to the managers of the company based on annualized percentage cost.

(11 marks)

ii) Distinguish between “without recourse” factoring agreement and “with recourse” factoring agreement.

(4 marks)

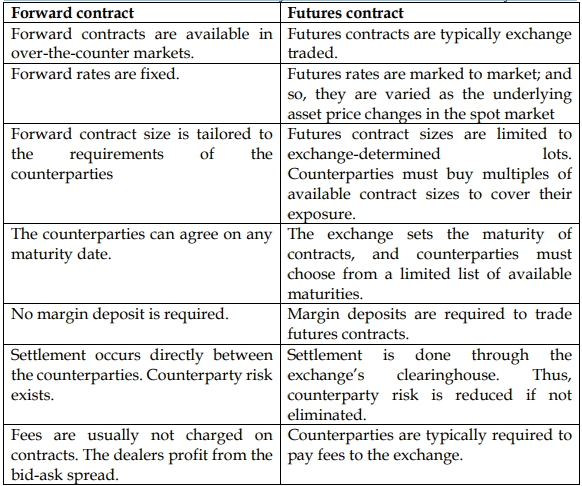

b) Explain THREE (3) differences between a forward currency contract and a futures currency contract.

(5 marks)

Answer

a)

i) The best financing option based on annualized percentage cost.

Trade credit:

The discount is not taken, it will cost the company 23.4% per annum to use the

supplier’s credit:

Annualized cost of credit =![]()

Factoring:

Factoring fees = 2% × (GH¢120,000 × 12) = 2% × GH¢1,440,000 = GH¢28,800

Interest on advance = 16% × (0.8 × GH¢177,534) = GH¢22,724.35

Savings on debt collection = GH¢1,500 × 12 = GH¢18,000

Net cost![]()

Annual Net cost![]()

Bank loan:

Annual cost =![]()

Annual cost =![]()

Recommendation:

The company should use the bank loan to finance the additional working capital

requirements as it presents the lowest cost.

ii) Distinction between a without recourse factoring agreement and a with a

recourse factoring agreement:

A “without recourse” factoring contract implies that the company selling the

receivables to the factor would not be liable for any receivables that become

uncollectible whereas a “with recourse” factoring contract implies that the

company selling the receivables remains liable for any uncollectible accounts and

the factor will only use its best efforts to collect the receivables.

Thus, the company selling the receivables bears bad debt losses when the factoring

agreement is with recourse, but the factor bears bad debt losses when the factoring

agreement is without recourse.

b) Differences between a forward currency contract and a futures currency contract.

- Tags: Bank Loan, Factoring, Forward Contracts, Futures Contracts, Trade Credit, Working Capital

- Level: Level 2

- Topic: Working Capital Management

- Series: MAR 2024

- Uploader: Joseph