- 20 Marks

Question

a) Distinguish between Capital Expenditure and Revenue Expenditure. (5 marks)

(b) The following Trial Balance was extracted from the books of Danfo Enterprise, a second-hand bags dealer, as at 31st December 2014:

| Description | DR (GH¢) | CR (GH¢) |

|---|---|---|

| Stock in Trade | 120,000 | |

| Vehicle (Cost) | 150,000 | |

| Trade Receivables | 80,000 | |

| Accumulated Depreciation: Vehicle | 30,000 | |

| Accumulated Depreciation: Furniture & Fittings | 10,120 | |

| Trade Payables | 100,000 | |

| Drawings | 120,000 | |

| General Expenses | 65,000 | |

| Provision for Doubtful Debts | 2,500 | |

| Rate & Rent | 14,000 | |

| Insurance | 5,000 | |

| Bad Debt | 7,000 | |

| Discount Received | 25,150 | |

| Discount Allowed | 15,160 | |

| Bank Balance | 165,240 | |

| Wages & Salaries | 250,000 | |

| Sundry Expenses | 6,150 | |

| Vehicle Running Expenses | 15,650 | |

| Furniture & Fittings | 50,600 | |

| Repairs to the Shop | 6,500 | |

| Purchases | 650,120 | |

| Sales | 1,079,130 | |

| Capital | 473,520 | |

| Total | 1,720,420 | 1,720,420 |

Additional Information:

i. Provision for doubtful debts is to be reduced by 10%.

ii. Rate and Rent has been paid in advance by two (2) months. Note that Danfo Enterprise pays GH¢1,000 each month.

iii. Stock in trade as at 31st December, 2014 GH¢80,150.

iv. A bill of GH¢6,150 for vehicle running was outstanding as at 31st December, 2014.

v. The Enterprise provides depreciation as follows:

- Vehicle: 20% per annum on straight line basis.

- Furniture and Fittings: 20% per annum on straight line basis.

You are required to:

i. Prepare Income statement for the year ending 31st December 2014. (8 marks)

ii. Prepare Statement of Financial Position as at 31st December 2014. (7 marks)

Answer

(a) Capital Expenditure:

- Capital expenditure results in the acquisition of fixed assets or an improvement in their earning capacity.

- It is not charged as an expense in the income statement in one go; instead, a depreciation or amortization charge is usually made to write off the capital expenditure gradually over time.

- Capital expenditure on fixed assets is the recognition of a fixed asset (e.g., vehicles, land, and buildings) in the statement of financial position of the business.

Revenue Expenditure:

- Revenue expenditure is incurred for the purpose of trade/service of the business, including selling & distribution expenses, administration expenses, and finance charges.

- It is also for maintaining the existing earning capacity of fixed assets, such as repair expenses.

- It ensures the smooth running of the day-to-day activities of the company/business.

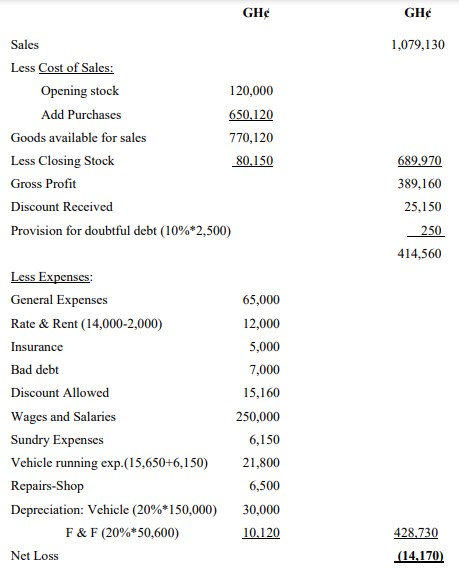

(b) i. Danfo Enterprise Income Statement for the year ended 31st December, 2014

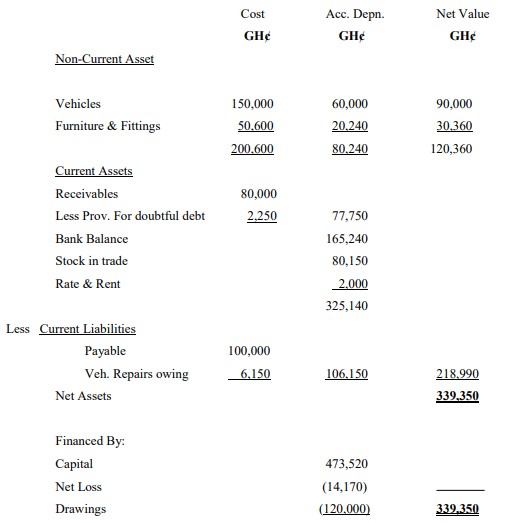

ii. Danfo Enterprise Statement of Financial Position as at 31st December 2014

- Topic: Capital structure and finance costs

- Series: NOV 2015

- Uploader: Theophilus