- 20 Marks

Question

(a) Explain what is meant by the following terms as per IAS 7:

i. Statement of Cash flow (3 marks)

ii. Cash (1 mark)

iii. Cash equivalents (1½ marks)

iv. Operating activities (1½ marks)

v. Investing activities (1½ marks)

vi. Financing activities (1½ marks)

(b)

(i) Yaa Baby Company Ltd. has the following items in its Statement of Financial Position as at 31st December, 2014:

| Item | GH¢ |

|---|---|

| Inventories | 130,000 |

| Trade Receivables | 60,500 |

| Cash in hand | 3,453 |

| Trade Payables | 96,750 |

The company belongs to a Trade Association that has recently published industry averages for key financial ratios based upon a survey of its members. The industry averages for current and quick ratios applicable to the business of Yaa Baby Co. Ltd are:

- Current ratio = 1.55: 1

- Quick ratio = 0.95: 1

Required:

Calculate Current and Quick ratios of Yaa Baby Co. Ltd. and briefly comment on the result with reference to the industry averages. (5 marks)

(ii) Financial Ratios can be grouped under three (3) broad categories i.e. Profitability, Liquidity/Working capital, and Debt and Gearing/Leverage ratios. List all the ratios under Liquidity or Working capital ratios. (5 marks)

Answer

(a)

i. Statement of Cash flow is a statement which provides users of Financial Statement with the ability of an entity to generate cash and cash equivalents, as well as indicating the cash needs of the entity. In simple terms, it is the Statement of how cash and cash equivalents have been generated and used by an organization.

ii. Cash comprises cash on hand (physical cash) and demand deposits.

iii. Cash Equivalents are short-term, highly liquid investments that are readily convertible to known amounts of cash and which are subject to an insignificant risk of changes in values.

iv. Operating Activities are the principal revenue-producing activities of the enterprise and other activities that are not investing or financing activities.

v. Investing Activities are the acquisition and disposal of non-current assets and other investments not included in cash equivalents.

vi. Financing Activities are activities that result in changes in the size and composition of the equity capital and borrowing of the entity.

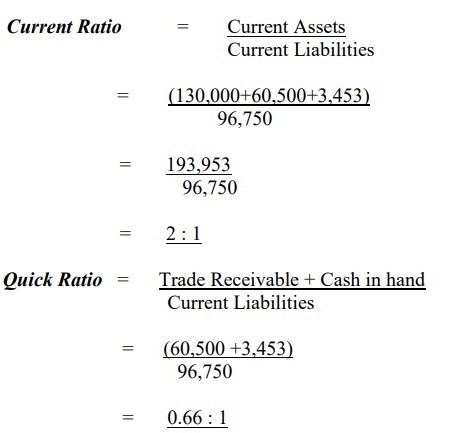

(b) (i) Calculation of Ratios

Comments: The company’s Current ratio of 2:1 is higher than the industry average of 1.55:1, while the Quick ratio of 0.66:1 is below the industry average of 0.95:1.

(ii) Liquidity/Working Capital Ratios:

- Current ratio

- Quick ratio

- Receivables collection period

- Payable payment period

- Inventory turnover period

- Tags: Cash Flow Statement, Financial Reporting, Liquidity Ratios, Ratios

- Level: Level 1

- Uploader: Theophilus