- 7 Marks

Question

On 1 April 2018, Mariam Plc granted 500 share appreciation rights (SARs) to its 300 employees. All of the rights vested on 31 March 2020 and can be exercised from 1 April 2020 up to 31 March 2022. At the grant date, the value of each SAR was GH¢10, and it was estimated that 5% of the employees would leave during the vesting period. The fair value of the SARs is as follows:

| Date | Fair Value of SAR (GH¢) |

|---|---|

| 31 March 2019 | 9 |

| 31 March 2020 | 11 |

| 31 March 2021 | 12 |

All the employees who were expected to leave the employment did leave the company as expected before 31 March 2020. On 31 March 2021, 60 employees exercised their options when the intrinsic value of the right was GH¢10.50 and were paid in cash. Mariam Plc is, however, confused as to whether to account for the SARs under IFRS 2: Share-based Payment or IFRS 13: Fair Value Measurement and would like to be advised as to how the SARs should have been accounted for from the grant date to 31 March 2021.

Required:

Advise Mariam Plc on how the above transactions should be accounted for in its financial statements with reference to relevant International Financial Reporting Standards (IFRS).

Answer

Mariam Limited will account for this transaction under the provisions of IFRS 2: Share-based Payments. IFRS 13 applies when another IFRS requires or permits fair value measurements or disclosures about fair value measurements (and measurements, such as fair value less costs to sell, based on fair value or disclosures about those measurements). IFRS 13 specifically excludes transactions covered by certain other standards, including share-based payment transactions within the scope of IFRS 2: Share-based Payment and leasing transactions within the scope of IFRS 16: Leases.

Thus, share-based payment transactions are outside the scope of IFRS 13. For cash-settled share-based payment transactions, the fair value of the liability is measured in accordance with IFRS 2 initially, at each reporting date, and at the date of settlement using an option pricing model. Unlike equity-settled transactions, the measurement reflects all conditions and outcomes on a weighted average basis. Any changes in fair value are recognised in profit or loss in the period.

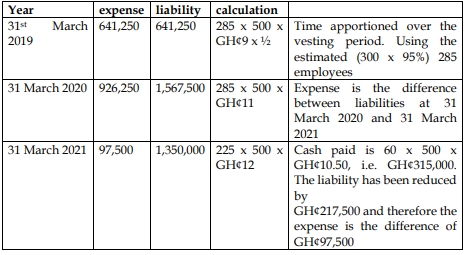

Therefore, the SARs would be accounted for as follows:

Statement of Profit or Loss for the year ended (Extracts):

| Year | Staff Costs (GH¢) |

|---|---|

| 2019 | 641,250 |

| 2020 | 926,250 |

| 2021 | 97,500 |

Statement of Financial Position Extract as at (Extracts):

| Year | SARs Liabilities (GH¢) |

|---|---|

| 2019 | 641,250 |

| 2020 | 1,567,500 |

| 2021 | 1,350,000 |

- Topic: IFRS 13 Fair value measurement, IFRS 2: Share-Based Payments

- Series: NOV 2021

- Uploader: Theophilus